A quick review of Xi Jinping's speech on the development of China's financial sector

The path for financial development with Chinese characteristics is different in nature from the mode of Western financial development.

Good evening. Towards the end of one year and the start of another, China typically holds many significant meetings. In today's piece, I will focus on Xi Jinping's speech on the development of China's financial sector, delivered at the opening ceremony of a study session attended by provincial and ministerial-level officials on Tuesday.

The study session was opened at the Party School of the Communist Party of China (CPC) Central Committee (the National Academy of Governance). The Party school organizes a number of study sessions every year, of which attended by principal officials at the provincial and ministerial levels is the highest-level class at the school. The first time the Central Committee of the CPC held a study session dates back to 1999, which focused on analyzing the causes and lessons of the financial crisis in Southeast Asian countries.

The theme of this year's study session is "boosting high-quality development of the financial sector", marking the first time since 1999 that the theme of finance has been addressed.

Today's piece presents the full-text translation of the readout of Xi's speech, with five quick takeaways added by me.

习近平在省部级主要领导干部推动金融高质量发展专题研讨班开班式上发表重要讲话

Xi makes important speech at study session on promoting high-quality development of financial sector

新华社北京1月16日电 省部级主要领导干部推动金融高质量发展专题研讨班16日上午在中央党校(国家行政学院)开班。中共中央总书记、国家主席、中央军委主席习近平在开班式上发表重要讲话强调,中国特色金融发展之路既遵循现代金融发展的客观规律,更具有适合我国国情的鲜明特色,与西方金融模式有本质区别。我们要坚定自信,在实践中继续探索完善,使这条路越走越宽广。

A study session on promoting high-quality financial development, attended by provincial and ministerial-level officials, was opened at the Party School of the Communist Party of China (CPC) Central Committee (the National Academy of Governance) on the morning of Jan 16. Xi Jinping, general secretary of the CPC Central Committee, Chinese president and chairman of the Central Military Commission (CMC), made an important speech at the opening ceremony. Xi noted that the path for financial development with Chinese characteristics not only follows the way for the development of modern finance, but also has distinctive features that suit China’s national conditions, and thus it is different in nature from the mode of Western financial development. We should have more confidence and continue to explore and improve our work in the financial sector, so that this path will become wider and wider.

1. In addition to differences in ideology with the West, the once-in-a-century international financial crisis in 2008 made decision-makers in China realize the importance of not blindly following the development mode of the financial sector in the West.

In 2017, 韩保江 Han Baojiang, an economic scholar at the Party School of the CPC Central Committee, said in an interview with "瞭望 Liaowang", a news magazine under Xinhua News Agency, that the international financial crisis is a concentrated manifestation of various ailments of the old international pattern and the Western development model. He said that the unprecedented global financial crisis has not only educated the Chinese people but also awakened people around the world.

中共中央政治局常委赵乐际、王沪宁、丁薛祥、李希,国家副主席韩正出席开班式,中共中央政治局常委蔡奇主持开班式。

Zhao Leji, Wang Huning, Ding Xuexiang, and Li Xi, members of the Standing Committee of the Political Bureau of the CPC Central Committee as well as Vice-President Han Zheng attended the ceremony. Cai Qi, a member of the Standing Committee of the Political Bureau of the CPC Central Committee, presided over the opening.

习近平指出,党的十八大以来,我们积极探索新时代金融发展规律,不断加深对中国特色社会主义金融本质的认识,不断推进金融实践创新、理论创新、制度创新,积累了宝贵经验,逐步走出一条中国特色金融发展之路,这就是:坚持党中央对金融工作的集中统一领导,坚持以人民为中心的价值取向,坚持把金融服务实体经济作为根本宗旨,坚持把防控风险作为金融工作的永恒主题,坚持在市场化法治化轨道上推进金融创新发展,坚持深化金融供给侧结构性改革,坚持统筹金融开放和安全,坚持稳中求进工作总基调。这几条明确了新时代新征程金融工作怎么看、怎么干,是体现中国特色金融发展之路基本立场、观点、方法的有机整体。

Xi noted that since the 18th CPC National Congress in 2012, we have actively explored the rules governing the development of finance in the new era, kept deepening our understanding of the defining feature of socialist finance with Chinese characteristics, and persistently promoted practical, theoretical and institutional innovation in the sector. In this process, we have accumulated valuable experience and gradually blazed a distinctively Chinese path to developing finance. On this path, the CPC Central Committee’s centralized, unified leadership over financial work must be upheld, people-centered approach must be adhered to as its value orientation, and the fundamental principle that finance serves the real economy must be upheld as well. On this path, risk prevention and control must be regarded as the abiding theme of financial work, market-oriented financial innovation and development under the rule of law must be constantly promoted, and supply-side structural reform in the financial sector must be continued. On this path, financial opening up and security must be well coordinated, and the general principle of pursuing progress while ensuring stability must be followed. These points have clarified how financial work should be perceived and carried out on the new journey in the new era. They form a sound whole that encapsulates the fundamental position, viewpoints and methods for developing finance in a distinctively Chinese way.

2. The eight "must" I highlighted above can be regarded as the core of the "distinctively Chinese path to developing finance", which is supposed to be different from the West mode. Those requirements are exactly the same as those stressed in the Central Financial Work Conference on October 31, 2023. Zichen Wang's Pekingnology has a pretty useful interpretation of the conference.

习近平强调,金融强国应当基于强大的经济基础,具有领先世界的经济实力、科技实力和综合国力,同时具备一系列关键核心金融要素,即:拥有强大的货币、强大的中央银行、强大的金融机构、强大的国际金融中心、强大的金融监管、强大的金融人才队伍。建设金融强国需要长期努力,久久为功。必须加快构建中国特色现代金融体系,建立健全科学稳健的金融调控体系、结构合理的金融市场体系、分工协作的金融机构体系、完备有效的金融监管体系、多样化专业性的金融产品和服务体系、自主可控安全高效的金融基础设施体系。

Xi emphasized that a country with a strong financial sector should have a strong economic foundation, and lead the world in economy, technology and comprehensive national strength. Such a nation should also have a series of key core financial elements, such as a strong currency, a strong central bank, strong financial institutions, strong international financial centers, strong financial supervision, and a high-calibre team of financial talents. Building a strong financial sector requires long-term and persistent effort. It is a must to accelerate the building of a modern financial system with Chinese characteristics, and establish and improve a sound and stable financial regulation system, properly-structured financial markets, a financial institution with clear division of labor and cooperation, a complete and effective financial regulatory system, a diversified and professional system of financial products and services, and a financial infrastructure that is independent, controllable, safe and efficient.

3. The six "strong" I highlighted above may be of interest to many readers. It appears that these goals are essentially the specific objectives emphasized by Xi when building "a country with a strong financial sector". In the context of "a strong currency", the internationalization of the renminbi (RMB) is likely to continue to be a hot topic. Regarding "a strong central bank", the Financial Times has a piece reporting that the central bank was sidelined after the plan on reform of Party and state institutions proposed the formation of a Central Financial Commission. While the establishment of the Central Financial Commission involved adjustments to the organizational structure, I am not sure that the term "sideline" can accurately describe the situation considering that the establishment of "a strong central bank" is one of the six key core financial elements stressed in Tuesday's study session.

习近平指出,要着力防范化解金融风险特别是系统性风险。金融监管要“长牙带刺”、有棱有角,关键在于金融监管部门和行业主管部门要明确责任,加强协作配合。在市场准入、审慎监管、行为监管等各个环节,都要严格执法,实现金融监管横向到边、纵向到底。各地要立足一域谋全局,落实好属地风险处置和维稳责任。风险处置过程中要坚决惩治腐败,严防道德风险。金融监管是系统工程,金融管理部门和宏观调控部门、行业主管部门、司法机关、纪检监察机关等都有相应职责,要加强监管协同,健全权责一致的风险处置责任机制。严厉打击金融犯罪。

Xi pointed out that efforts must be made to prevent and defuse financial risks, especially systemic risks. Financial regulation must be "sharp and tough." Financial regulatory and administrative authorities must clearly define their responsibilities and strengthen cooperation and coordination between them. It is imperative to strictly enforce the law in such areas as market access, prudential supervision and behavioral supervision, so that financial supervision both horizontally and vertically is administered to the letter. Local governments should not just do their financial work well, but also focus on the big picture, and manage well financial risks under their jurisdiction and perform their duties well in maintaining stability. In the process of risk management, corruption must be resolutely cracked down on, corrupt elements must be punished and moral hazard must be prevented. Financial regulation is a systematic project, and financial management departments, macro-control departments, industry authorities, judicial departments, and discipline inspection and supervision organs all have corresponding responsibilities. They should strengthen coordination in supervision, and optimize the risk management mechanism, under which anyone in charge must be held accountable for risk control. We should also crack down on financial crimes.

习近平强调,要通过扩大对外开放,提高我国金融资源配置效率和能力,增强国际竞争力和规则影响力,稳慎把握好节奏和力度。要以制度型开放为重点推进金融高水平对外开放,落实准入前国民待遇加负面清单管理制度,对标国际高标准经贸协议中金融领域相关规则,精简限制性措施,增强开放政策的透明度、稳定性和可预期性,规范境外投融资行为,完善对共建“一带一路”的金融支持。要加强境内外金融市场互联互通,提升跨境投融资便利化水平,积极参与国际金融监管改革。要守住开放条件下的金融安全底线。

Xi stressed that it is necessary to improve our country's efficiency and capacity in the allocation of financial resources through expanding opening up, and boost our financial sector's international competitiveness and its influence on international rules. Prudence should be exercised when it comes to the pace and intensity of endeavors in this regard. It is imperative to promote high-level financial opening up with a focus on institutional opening up, and implement the management system of pre-establishment national treatment plus negative lists. It is essential to benchmark against relevant rules in the financial sector from high-standard international economic and trade agreements to streamline restrictive measures, improve the transparency, stability and predictability of opening-up policies, standardize outward investment and financing, and improve financial support for Belt and Road cooperation. It is also essential to boost the inter-connectivity between the domestic and overseas financial markets, further promote the facilitation of cross-border investment and financing, and take an active part in the global reform on financial regulation. The red line for financial security must never be crossed under the conditions of opening up.

4. Recently GRR published an article in which Zhang Wei, an economic scholar, said at the China Economic Roundtable that institutional opening-up is currently a top priority in the field of opening-up.

I also found a chapter in China's 14th Five-Year Plan (2021-2025) introducing "制度型开放 institutional opening-up" and the part related to financial sector says

稳妥推进银行、证券、保险、基金、期货等金融领域开放,深化境内外资本市场互联互通,健全合格境外投资者制 度。稳慎推进人民币国际化,坚持市场驱动和企业自主选择,营造以人民币自由使用为基础的新型互利合作关系

We will steadily promote the opening of banking, securities, insurance, funds, futures, and other financial sectors, deepen the interconnection of domestic and foreign capital markets, and improve the system of qualified foreign investors. We will steadily promote the internationalization of RMB in a prudent manner, adhere to market-driven operation and independent choice of enterprises, and create a new type of mutually beneficial cooperative relationship based on the free use of RMB.

Note that the internationalization of RMB is classified as a category of institutionalized openness. It explicitly states that the Chinese government's attitude towards promoting the internationalization of the RMB is in a prudent manner. I feel that this generally aligns with the development trend since the publication of the plan. Of course, there may have been some impact (positive or negative) on the progress of RMB internationalization due to geopolitical conflicts in recent years. I am not an expert in this field, so I will not delve into it further.

And my understanding of the statement "We must safeguard the financial safety bottom line under open conditions" is that opening up is a prerequisite, and only after that should security be addressed.

习近平指出,推动金融高质量发展、建设金融强国,要坚持法治和德治相结合,积极培育中国特色金融文化,做到:诚实守信,不逾越底线;以义取利,不唯利是图;稳健审慎,不急功近利;守正创新,不脱实向虚;依法合规,不胡作非为。

Xi noted that to promote high-quality development of the financial sector and build China's financial strength, it is imperative to combine rule of law with rule of virtue and foster a financial culture with Chinese characteristics. It is essential to remain committed to honesty and trustworthiness instead of crossing the line, to seek interest without compromising moral principles instead of putting profit before everything, to be prudent and cautious in work instead of seeking instant success and quick profits, to uphold fundamental principles and break new ground instead of diverting funds out of the real economy, and to be compliant with law and regulations instead of conducting illegal activities.

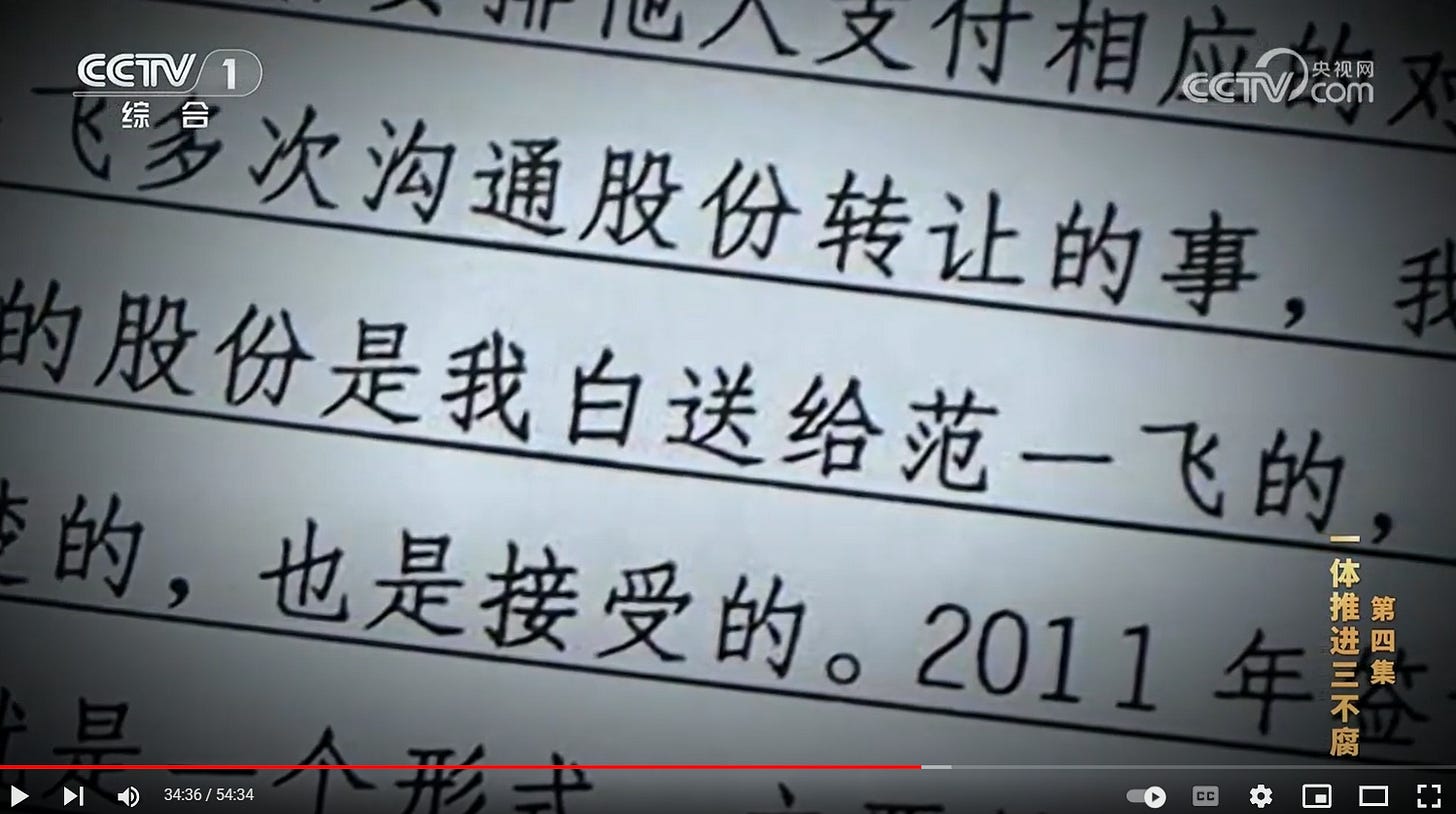

5. The highlighted part are not new and it reminds me of China Media Group's recent anti-corruption documentary series, which particularly emphasized “新型腐败 new type of corruption” and “隐性腐败 quiet corruption” exemplified in the financial sector. In the fourth episode (available on YouTube), it disclosed the case of 范一飞 Fan Yifei, the former deputy governor of China's central bank, and investigation found that he mainly received bribes through an investment company run by his younger brother Fan Kan.

习近平最后强调,各级领导干部要增强金融思维和金融工作能力,坚持经济和金融一盘棋思想,认真落实中央金融工作会议的各项决策部署,统筹推进经济和金融高质量发展,为以中国式现代化全面推进强国建设、民族复兴伟业作出新的更大贡献。

Xi noted at the end of his speech that officials at all levels must strengthen their financial acumen and capability in financial work. They should develop thinking about overall planning of both economic and financial work, faithfully implement the decisions and arrangements made at the central financial work conference, and coordinate efforts towards the high-quality development of both the economic and financial sectors, so as to make new and greater contributions to advancing the building of a strong country and national rejuvenation on all fronts through a Chinese path to modernization.

蔡奇在主持开班式时指出,习近平总书记的重要讲话思想深邃、视野宏阔、论述精辟、内涵丰富,具有很强的政治性、理论性、针对性、指导性,对于全党特别是高级干部正确认识我国金融发展面临的形势任务,深化对金融工作本质规律和发展道路的认识,全面增强金融工作本领和风险应对能力,坚定不移走中国特色金融发展之路,具有十分重要的意义。要深刻理解把握习近平总书记重要讲话的丰富内涵、精髓要义和实践要求,深刻领悟“两个确立”的决定性意义,坚决做到“两个维护”,切实把思想和行动统一到党中央决策部署上来。

While presiding over the opening, Cai Qi highlighted that General Secretary Xi Jinping's speech is insightful, rich in substance, and has a broad vision and penetrating views. It is of political, theoretical, pertinent and guiding importance. This speech is of great significance for the entire Party, particularly senior officials, to have a correct understanding of the current situations and tasks facing China's financial development, further understand the fundamental principles and development path of financial work, substantially strengthen their capability in financial work and risk control, and stay committed to the path of financial development with Chinese characteristics. We should deepen our understanding of the speech's rich substance, core tenets and requirements for practical work, as well as the decisive significance of establishing Comrade Xi Jinping's core position on the Party Central Committee and in the Party as a whole and establishing the guiding role of Xi Jinping Thought on Socialism with Chinese Characteristics for a New Era. We should firmly uphold Comrade Xi Jinping's core position on the Party Central Committee and in the Party as a whole and uphold the Central Committee's authority and its centralized, unified leadership, and align our thoughts and actions with the decisions and plans made by the Central Committee.

中共中央政治局委员、中央书记处书记,全国人大常委会党员副委员长,国务委员,最高人民法院院长,最高人民检察院检察长,全国政协党员副主席以及中央军委委员出席开班式。

Members of the Political Bureau of the CPC Central Committee, members of the Secretariat of the CPC Central Committee, vice chairpersons with CPC membership of the Standing Committee of the National People's Congress, state councilors, president of the Supreme People's Court, procurator-general of the Supreme People's Procuratorate, vice chairpersons with CPC membership of the National Committee of the Chinese People's Political Consultative Conference and members of the CMC attended the opening.

各省区市和新疆生产建设兵团、中央和国家机关有关部门、有关人民团体,中央管理的金融机构、企业、高校,解放军各单位和武警部队主要负责同志参加研讨班。各民主党派中央、全国工商联及有关方面负责同志列席开班式。

Leading officials from all provinces, autonomous regions and municipalities, and Xinjiang Production and Construction Corps, relevant central Party and state departments, relevant people's organizations, centrally-administered financial institutions, enterprises and institutions of higher learning, units of the People's Liberation Army and the People's Armed Police Force participated in the study session. Heads from central committees of other political parties, the All-China Federation of Industry and Commerce and other relevant departments sat in on the opening.

Enditem