Beijing vs Shenzhen: Which city is China's No.1 tech hub?

Beijing's innovation is more strategy-oriented, while Shenzhen's is based on market demand and the needs of enterprise competition.

Apologies for the infrequent updates recently as I've been frequently traveling. Time really flies, and half of 2023 is almost over.

I'd like to give you a heads-up about an upcoming event. On June 13th, my friend Yaling will host a Twitter Spaces session with the theme "What do you need to know as a China watcher in 2023 (tips and tools)". Many China watchers, including the CEO of Bigone Lab, Robert Wu, whom I had a podcast episode with three months ago, will participate in sharing their insights. I'll try my best to join in it as well if time allows. This promises to be an exciting event, so feel free to mark it in your calendar if you're interested.

Today's newsletter will focus on technology. For one, tech self-reliance has been one of China's major themes in recent years. Additionally, I've noticed that my previous posts comparing Chinese cities have been quite popular among some readers, so today's issue will present a comparison of the two leading tech hubs in China.

Beijing, the capital and a northern city of China, and Shenzhen, in south China's Guangdong province, are set in a race for the country's most innovative city - yet on very different tracks. Numerous universities and research institutions in Beijing are the cradle of technological breakthroughs, whereas big private enterprises in Shenzhen are wielding their investment powers.

Now perhaps is the time to showcase who's got the upper hand, as the contest heats up with technological wonders such as ChatGPT and Starship. Beijing and Shenzhen will be put on a close justaposition in terms of national strategy, R&D expenditure, and innovation patterns. The author of today's piece, for a start, seems to side with Shenzhen, commending it for being the "the most diverse region in China in terms of new technologies and business models".

The following piece comes from an article on Guominjinglue [国民经略, "state strategies"], a WeChat blog with a particular focus on prefectural and provincial development in China. Check a previous popular article from this account posted by GRR: Top dogs, rat race, leapfrogging -- A look behind provincial GDP figures in China.

Recently, a delegation of the Hong Kong Special Administrative Region government and the Legislative Council comprising of more than a hundred people visited the Pearl River Delta area. It is the first joint visit to the mainland after the full resumption of normal travel between the mainland and Hong Kong, and the largest in scale to date. The delegation was reported to have toured Shenzhen, Guangzhou, Foshan, and Dongguan, and visited technology enterprises such as BYD, Tencent, Huawei, and DJI.

So, what's the implication?

01

Why these cities and enterprises?

As an international financial hub and shipping center, Hong Kong has long relied on finance, trade, professional services and tourism.

Hong Kong's high-end service industry has a global competitive edge. However, the secondary industry in Hong Kong has almost reduced to non-existence, with the share of manufacturing in GDP dropping to about 1 percent from a peak of over 20 percent; information technology industries such as the internet are practically nil.

The world today is going through profound changes unseen in a century. Faced with changes in the geopolitical, international and globalization landscapes, Hong Kong is pushing for "Re-industrialization" to stimulate new growth.

Due to the decline of manufacturing, the "Re-industrialization" has aligned itself with "technology innovation", targeting high-tech industries and technological innovation instead of traditional industries.

"Re-industrialization" has its practical basis. Hong Kong has five of the world's top 100 universities and numerous research institutions, such as the Hong Kong University of Science and Technology, in addition to open access to the international market and finance.

But without the support of advanced manufacturing clusters and large technology enterprises, "Re-industrialization" will always be a castle in the air.

The four major cities that have come under the focus of the Hong Kong delegation are precisely the key members of the Guangzhou-Shenzhen-Hong Kong and Guangzhou-Zhuhai-Macau science and technology innovation corridors, which, together with the U.S. Highway 101 and Route 128, form the most important innovation belts in the world.

The Guangzhou-Shenzhen-Hong Kong and Guangzhou-Zhuhai-Macau innovation and technology corridors Source: Guangdong Province Territorial Spatial Planning 2020-2035

Shenzhen, which is just across the river, happens to be the most complementary sister city to Hong Kong.

Shenzhen is not only the newly promoted No. 1 industrial city, having surpassed Shanghai for the first time to rank first in China in terms of industrial added value (IAV), but also the No. 3 city in the digital economy after Beijing and Shanghai.

In a nutshell, Shenzhen is one of the few comprehensive cities that integrates hard and soft technologies, and is in the lead in the two mainstream tracks of advanced manufacturing and digital economy.

The destinations of the Hong Kong delegation -- BYD, Tencent, Huawei, DJI, etc. -- are all leaders in their fields and significant influencing powers inside and outside the industry.

"BYD is a model of real economy and Tencent is a pioneer of digital economy, both of which are also the current focus of Hong Kong's economy", said Sun Dong, Secretary for Innovation, Technology and Industry of the Hong Kong SAR Government.

The weak point, though, is that as a national innovative city, Shenzhen's higher education is seriously mismatched with its economic strength. Only one university in the fourth most populous city of China is included in the "double world-class project” [an initiative launched in 2015 to develop world-class universities and first-class disciplines, in which selected universities enjoy increased financial and other resources]; and the number of university students is only about 1/10 of that in cities such as Beijing, Shanghai and Guangzhou.

Because of this, the burden of innovation in Shenzhen falls almost entirely on enterprises, especially large technology enterprises.

According to PATENTSCOPE, the World Intellectual Property Organization (WIPO) database of International Patent Cooperation Treaty (PCT) applications, 12 Chinese enterprises rank among the TOP 50 global patent assignees, among which Shenzhen alone accounts for seven, including Huawei, Tencent, DJI and other enterprises visited by the Hong Kong delegation.

The 2022 rankings of R&D funding of private enterprises by the All-China Federation of Industry and Commerce (ACFIC) also placed Huawei and Tencent, both Shenzhen-based, in first and third place respectively. This goes to show the city's overwhelming power of innovation.

In this regard, there is much space where Shenzhen and Hong Kong can complement each other to facilitate the Greater Bay Area as a national or even global highland for science and innovation.

02

Which city is the most innovative one in China?

Behind the interaction between Hong Kong and Shenzhen is the implication that the Guangdong-Hong Kong-Macao Greater Bay Area is becoming one of the most popular science and technology innovation highlands in the country and even the world.

How innovative a region is boils down to two parameters: 1) national strategy and international ranking; 2) the intensity of innovation.

The concept of "national principal cities" is widely-known in China. Sitting on top of the pyramid of the national urban system, these cities assume the important role of the "outpost of national strategy, executor of national mission, leader of regional development, partaker of international competition, and representative of national image".

Accordingly, comprehensive national science centers and international centers for science and technology innovation are at the top of the pyramid of China's technology system. They represent China's core competitiveness in the global science and technology arena, the former focusing on basic science and the latter on science and technology innovation.

As of today, China has designated five comprehensive national science centers, three international centers for science and technology with global influence, and three science and technology innovation centers with national influence.

Only Beijing, Shanghai and the Greater Bay Area are awarded with two titles, becoming genuine "dual centers" of national and international influence.

Hefei, in contrast, is only a comprehensive national science centre; Wuhan and the Chengdu-Chongqing economic circle have only the title of "science and technology innovation center with national influence".

Although Xi'an is in a sense a "dual center", its "national influence" title is inferior to the "international" hierarchy occupied by Beijing and Shanghai.

Of course, titles are not everything. Whether these cities can actually live up to their names depends on real innovative powers, which is measured in part by R&D expenses and intensity.

China's R&D expenses have maintained double-digit growth for seven consecutive years. The frontrunners are, invariably, major city clusters such as the Beijing-Tianjin-Hebei region, the Greater Bay Area and the Yangtze River Delta.

Judging by R&D expenses, the top 10 cities with the highest R&D expenditure in China are Beijing, Shanghai, Shenzhen, Suzhou, Guangzhou, Hangzhou, Chengdu, Wuhan, Chongqing and Nanjing.

But the expenses measure only the sheer scale of innovation. R&D intensity (R&D investment/GDP), on the other hand, is a better indicator of innovation intensity, industrial transformation, and overall research capability.

In terms of R&D intensity, the top 10 rankings are somewhat different: Beijing, Shenzhen, Xi'an, Shanghai, Suzhou, Hangzhou, Tianjin, Nanjing, Hefei and Wuhan.

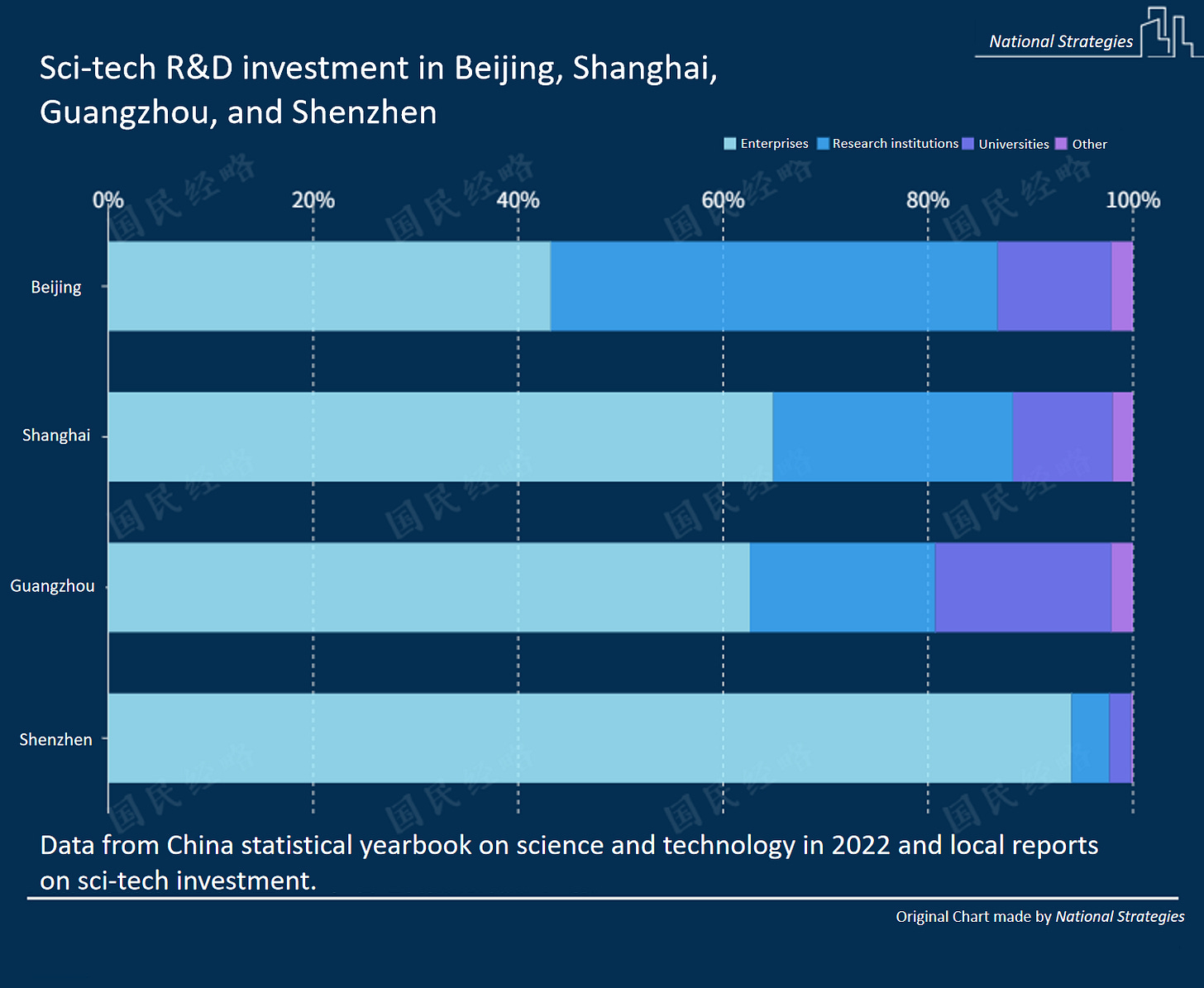

Of course, different cities have different resources, and thus different forces of innovation. Some come from enterprises, some from research institutions, and some from universities.

03

In the field of science and innovation in China, two cities are hard to ignore: Beijing and Shenzhen.

Whether considering innovation intensity, national science, and innovation systems, or the international technology matrix, the "Beijing-Shanghai-the Greater Bay Area" region is the leading force in science and innovation, with Beijing and Shenzhen serving as pioneers, bearing the responsibility of driving innovation in their respective regions and even the entire nation.

However, as Beijing is a city known for education and scientific research, while Shenzhen is a hub for technology companies, their fundamental differences determine that there are some disparities in their innovation models, but they also complement each other in certain aspects.

The first difference is that research and development (R&D) investment in Beijing mainly comes from universities and research institutes, while in Shenzhen, it almost entirely comes from enterprises, with other cities falling somewhere in between.

According to statistics on science and technology funding, out of Beijing's 260 billion R&D expenditure, the proportion coming from research institutions and universities is as high as 55 percent, which is the highest in the country, while the proportion coming from enterprises is 43 percent.

In contrast, over 94 percent of Shenzhen's R&D budget of over 170 billion yuan comes from enterprises, and the investment in R&D by enterprises has ranked first in the country for several consecutive years.

Furthermore, there is a saying in Shenzhen called the "Four 90 percent"

[Over 90 percent of R&D personnel are concentrated in enterprises, over 90 percent of R&D funding comes from enterprises, over 90 percent of R&D institutions are established in enterprises, and over 90 percent of job-related invention patents come from enterprises.]

According to the article "Why is Tencent's Growth So Steep?" published by South Reviews, a biweekly politics and economics magazine based in Guangzhou, China, Tencent has applied for over 62,000 patents since its establishment, ranking second among global internet companies, only behind Google.

It is worth noting that Tencent's innovation curve has a striking similarity to the innovation curve of Shenzhen city.

This illustrates how enterprises and cities grow together. The innovation of numerous technology companies enriches the entire city's innovation matrix, while the city's technology, industry, and talent environment, in turn, drive the explosion of enterprise innovation.

Tencent, together with many other technology companies such as Huawei, BYD, and Ping An in Shenzhen, have created a legend of enterprise innovation in Shenzhen.

04

The second difference is that Beijing's innovation is more strategy-oriented, while Shenzhen's is based on market demand and the needs of enterprise competition.

Beijing, with approximately one quarter of the country's first-class universities, one quarter of the national key laboratories, one fifth of the national engineering research centers, and more than half of the academicians in China, has an abundance of scientific and technological innovation resources and unparalleled advantages.

Precisely because of this, Beijing must shoulder the responsibility of basic science and technological innovation in critical areas, making it the main venue for the country's new system of tackling key core technology challenges.

In contrast, Shenzhen has relatively few top-tier universities or research institutions. Its innovation relies on more than 20,000 high-tech enterprises and dozens of private companies listed in the top 500 of China.

Innovation in enterprises is funded internally and therefore must be subject to market rules. Any innovative results must face market validation.

In other words, enterprise innovation cannot be trapped in a patent bubble. It must be guided by problems and based on the market. The key is how to transform and implement the technological innovation results and produce stronger shared innovation effects.

Who could have imagined that the artificial cochlear implant and Tencent Meeting are both products of the same technological innovation - AI noise reduction?

Similarly, it is hard to imagine that unmanned mining trucks, which have freed drivers from this high-risk industry in Ordos, the largest coal-producing city in China, are also based on “Immersive Convergence”, an innovative model that integrates the digital economy and the real world.

This technological breakthrough from Tencent can be applied to both games and the metaverse, as well as providing strong support for industrial transformation and upgrading.

This is the most "magical" aspect of enterprise innovation, which economist Fan Gang calls "shared innovation".

05

The third difference is that the emphasis of innovation of Beijing and Shenzhen is different, but they are not mutually exclusive.

One focuses on fundamental and original innovation (from zero to one), while the other focuses on technological innovation (from one to ten) and industrial innovation (from ten to infinite), but the distinction is not always clear-cut.

The stage from zero to one is the most difficult, as it involves tackling the toughest technological challenges with self-reliance. Clearly, it is not something that can be shouldered by just one enterprise or a few research institutions, which makes a new national innovation system necessary.

In fact, as a city with the most abundant scientific and technological resources, Beijing also has the highest investment in basic research.

Data shows that in 2021, Beijing's basic research funding exceeded 40 billion yuan (about 5.6 billion U.S. dollars), accounting for nearly a quarter of the national total.

In comparison, the existence of a large number of technology companies in Shenzhen has made it the most diverse region in China in terms of new technologies and business models.

However, as industries deepen and technology companies grow and become more competitive internationally, innovation has become more profound and abundant, including fundamental and technological innovation.

Huawei's numerous patents in the 5G field and Tencent's solid reserves in AI and VR/AR have already touched the most fundamental core of innovation and established an innovation chain from theory to technology and finally to application.

Today, basic research funding in Shenzhen is also maintaining high growth rates.

Data shows that in 2021, basic research funding in Shenzhen reached 12.2 billion yuan, a year-on-year increase of 67.4 percent, ranking third after Beijing and Shanghai for two consecutive years.

According to Guangdong Province's plan for the comprehensive national scientific center in the Greater Bay Area, Shenzhen will be the main base, with Guangming Science City, Songshan Lake Science City, Nansha Science City, and other areas as the main carriers.

Clearly, Shenzhen is not only a highland of industrial innovation, but also a significant source of original innovation in the future.

06

Recently, two technological products have become popular globally, one is ChatGPT, and the other is Starship.

These two products represent the highest levels of artificial intelligence and carrier rockets, respectively, and together they have refreshed people's understanding of the new round of technological revolution.

Interestingly, the creators of these two products are both from the private sector, highlighting the importance of enterprises in technological innovation.

In fact, in China's scientific research and development, enterprises are the main force.

Data shows that in the R&D expenditure of around 3 trillion yuan nationwide, the contribution from enterprises accounts for 76.9 percent, while that from government-affiliated research institutions and universities is 13.3 percent and 7.8 percent, respectively.

Of course, in some core areas involving key technologies, universities and research institutions still play a major role, but the role of enterprises is becoming increasingly important.

The first meeting of the Central Commission for Comprehensively Deepening Reform under the 20th the Communist Party of China (CPC) Central Committee recently focused on technological innovation, emphasizing the principal role of enterprises in innovation, and actively encouraging and effectively guiding private enterprises to participate in major national innovation initiatives.

It is evident that there is a great deal of room for technological enterprises in terms of encouraging innovation.

The whole society is pleased to see the emergence of more and more private enterprises in the tide of technological self-reliance and self-strengthening.

To help make Ginger River Review sustainable, please consider buy me a coffee or pay me via Paypal. The university students who offered to contribute to today’s newsletter will receive your reward from me. Thank you for your support!