Chinese auto industry expert urges temporary tariff rate hikes on imported cars with large engines

And an article analyzing Biden Administration's Section 301 Tariffs on China by a think tank affiliated with China's Ministry of State Security

Good evening. Today's piece is on tariffs.

First, I want to highlight an exclusive interview released by Global Times. In the interview, Liu Bin, chief expert of China Automotive Technology & Research Center (CATARC) and deputy director of China Automotive Strategy and Policy Research Center, has called for raising the temporary tariff rate on imported cars with large engines. According to Global Times, Liu has participated in drafting policies for China's auto industry.

Liu explained that raising the temporary tariff rate can further accelerate the green transition in China's auto industry. In addition, Global Times added a noted at the very beginning of the interview saying "China's EV industry has also become a target for a U.S.' crackdown campaign against China. The EU has also launched a so-called anti-subsidy investigation into Chinese EVs."

Two days ago, on the evening of Saturday, May 18, Yu Yuan Tan Tian 玉渊谭天, a social media channel with a presence in China’s social media and known to be run by China Media Group, China’s state broadcaster, warned the European Union against further anti-subsidy investigations into Chinese companies by citing anonymous, “informed” sources saying China would retaliate with “a series of measures.” Zichen Wang has covered this in his Pekingnology newsletter that same day.

I suspect many people will connect these two matters, and I cannot definitively say that these two matters are completely unrelated, especially considering that CATARC is an auto research institute affiliated with the Chinese government. However, I prefer not to speculate without sufficient evidence. Nevertheless, I believe these are significant points that stakeholders should be aware of.

Liu noted in the interview that according to WTO rules, China's temporary tariff rate on imported vehicles could be raised to a maximum of 25 percent, and any decision for China to hike the rate is in line with WTO rules, and is fundamentally different from the protectionist moves made by certain countries and regions.

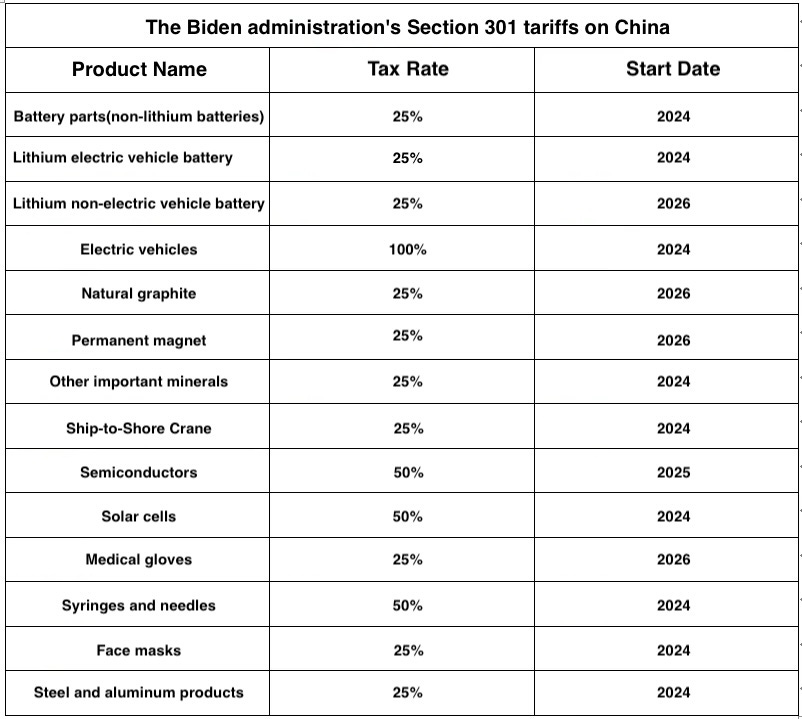

The second part of today's piece is a translation of an article which was first published on the WeChat blog of the China Institue of Contemporary International Relations (CICIR) on Monday, one week after the Biden administration announced expansions to the United States’ Section 301 tariffs on imports from China.

The article published by CICIR, which is regarded as affiliated with the Ministry of State Security (MSS), is entitled "Evaluating the Economic Impact of the Biden Administration's New Round of Section 301 Tariffs on China." Authored by Ma Xue, an associate fellow at the Institute of American Studies within CICIR, the article provides an analysis of the characteristics, short-term impacts, and future outlook of the Biden Administration's latest Section 301 tariffs on China.

Evaluation of the Economic Impact of Biden Administration's New Round of Section 301 Tariffs on China

Ma Xue. Associate Fellow, Institute of American Studies, China Institutes of Contemporary International Relations

On May 14, 2024, the Office of the United States Trade Representative (USTR) announced the decision to maintain tariffs on most Chinese imports following the sunset review of Section 301 tariffs, while significantly increasing tariffs on products such as electric vehicles (EVs), semiconductors, solar products, steel, and aluminum.

The Biden administration conducted a three-year review of tariffs on China under Section 301, announcing the results and increasing tariffs as the 2024 U.S. election approached. This timing clearly serves political purposes to boost election momentum and garner votes. However, this move is not merely an election stunt; it aims to further suppress China's emerging industries, especially in the green energy sector, to outcompete China.

Characteristics of the Biden Administration's Section 301 Tariffs on China

This round of tariff increases by the Biden administration is a review and modification of existing Section 301 measures, but the specific tariffs are significantly different from those of the Trump administration.

On the one hand, the Biden administration's tariffs specifically target China's advanced manufacturing and materials sectors. Unlike Trump's blanket 25 percent tariff on 250 billion U.S. dollars worth of goods and 10 percent on 300 billion U.S. dollars worth of goods, the current tariffs are highly targeted and purpose-driven. The core measures include further tariff increases on specific products such as EVs, semiconductors, lithium batteries, natural graphite, permanent magnets, photovoltaic cells, shore cranes, and medical supplies. The tariffs vary in rate and duration, aimed at undermining China's market power and slowing its technological advancement.

On the other hand, the Biden administration's tariffs aim to balance the economic and security interests of the U.S. supply chain.

Tariffs have been imposed on medical supplies that were previously exempt, such as gloves, masks, syringes, and needles, with rates ranging from 25% to 50%. This decision stems from the U.S. perception that China's control over key production elements during the pandemic posed a risk to American economic security.

The tariffs will be implemented between 2024 and 2026, based on the international competitiveness of Chinese products and the production capabilities of the U.S. and its allies. China has already surpassed the U.S. and Europe in the EV sector, prompting the U.S. to impose tariffs ranging from 25% to 100% on Chinese EVs and battery components, effective immediately. In contrast, tariffs on natural graphite and permanent magnets will be delayed until 2026, allowing the U.S. and its allies time to develop and enhance their own supply chains.

To mitigate significant economic costs for U.S. companies, a more economical and feasible tariff approach is adopted. The USTR has further established exclusion mechanisms for certain production equipment listed in Chapters 84 and 85 of the Harmonized Tariff Schedule (HTS), particularly for solar products, to provide temporary relief.

Short-term impacts

The immediate impact on Chinese EVs is minimal. In 2023, China exported approximately 12,400 EVs to the U.S., valued at around 2.355 billion yuan (about 325 million U.S. dollars). While the tariff increase from 27.5 percent to 102.5 percent is expected to decrease this trade volume, the current low penetration of Chinese EVs in the U.S. market means the short-term impact is negligible. This assessment is corroborated by the stock performance of Chinese EV companies like NIO and Li Auto, which saw increases even on the day the tariff hike was announced. Their stocks listed in the U.S. rose by 6.71 percent and 1.16 percent, respectively, on that day. Similarly, Zeekr, newly listed in the U.S., received a warm response from Wall Street, with its shares steadily climbing during the first two trading days after going public, rising by 2.76 percent.

The short-term impact on Chinese photovoltaic products is slightly more significant. With existing anti-dumping and countervailing duties ranging from 33 percent to 250 percent, and an additional 14 percent Section 201 tarriffs, the new tariffs will increase from 25 percent to 50 percent. Despite various tariff pressures, current exports of Chinese photovoltaic cells and modules to the United States are relatively small, approximately 3.347 million U.S. dollars and 13.147 million U.S. dollars, respectively. Following the imposition of additional tariffs, these export volumes will continue to be under pressure. However, photovoltaic production equipment is included in the exemption list of the USTR, which will mitigate the substantial impact of high tariffs on Chinese photovoltaic products in the short term.

The impact on Chinese shore cranes is substantial. The tariff rate will rise from zero to 25 percent starting in 2024. China currently dominates the global market for shore cranes, with nearly 80 percent of cranes used in U.S. ports originating from China, totaling over 200 units. U.S. lawmakers have consistently underscored concerns about the security of freight cranes manufactured in China. They highlight serious supply chain vulnerabilities in U.S. maritime systems due to software embedded in Chinese-manufactured cranes, potentially exposing ports used by the U.S. military to Chinese surveillance and manipulation. This tariff hike may signify the onset of the U.S.'s expulsion of Chinese-manufactured cranes.

Future outlook

1.The new tariffs signal the U.S.'s commitment to decoupling from China. Initially, Biden's measures were provocative yet measured. The administration refrained from severing ties with China in sectors characterized by lower technological content, higher commoditization levels, and cost efficiency focus. Instead, it advocated for a "small yard, high walls" approach, favoring "trusted suppliers" in technologically sophisticated areas with heightened cybersecurity risks. However, the introduction of new tariffs underscores a renewed commitment to explore supply chain decoupling from China and bolster tariff effectiveness in enhancing the U.S. supply chain. Bipartisan support for tariffs reflects a newfound consensus on trade matters in the U.S. The dominance of the "restrictionist" faction over "centrists" and "cooperators" emphasizes a perception of bilateral relations as a "zero-sum game." With the perceived window of opportunity for U.S. technological dominance closing, there's a growing demand for stronger measures to significantly curtail bilateral technological exchanges and trade.

2. The tariffs will gradually apply pressure to China's vital industrial chains, specifically targeting its leading exports in EVs, lithium batteries, and solar cells, referred to as the "new three pillars." The imposition of a 100 percent tariff on EVs seeks to immediately halt Chinese exports of new energy vehicles (NEVs) to the U.S. Meanwhile, a 25 percent tariff on lithium batteries aims to constrain upstream vehicle production. Similarly, a 25 percent tariff on natural graphite and permanent magnets further restricts materials upstream in the supply chain. Essentially, the U.S. recognizes China's significant cost and technological advantages, along with policy support, especially in EV battery manufacturing and solar energy. This acknowledgment triggers a new geopolitical and economic competition between the two nations. The Biden administration aims to outpace China in the clean energy sector, preventing Chinese dominance in this industry and reshaping the future geopolitical and economic landscape.

3. Potential for more restrictions: Bipartisan competition in U.S. trade policy towards China could escalate Sino-U.S. economic and trade tensions. Potential future measures by the U.S. to "undermine China and drain its resources" may include: first, tightening rules of origin. During a campaign speech in New Jersey, Trump hinted at further escalation by proposing a 200% tariff on cars manufactured by Chinese companies in Mexican factories, aiming to prevent non-signatory countries of the United States-Mexico-Canda Agreement (USMCA) from gaining benefits. Second, cracking down on Chinese transshipment trade. On April 24, the Biden administration initiated anti-dumping and countervailing duty investigations on photovoltaic products from Vietnam, Cambodia, Malaysia, and Thailand. The tariff rates for these four countries could be increased to between 70.35 percent and 271.45 percent, with the objective of blocking China from redirecting its photovoltaic exports to the U.S. through these nations. Last, perpetuating issue hype. The U.S. is likely to persist in highlighting accusations of "forced technology transfer," "overcapacity," and "economic coercion" against China,, coordinating with allies to reconfigure supply chains and industrial arrangements. The Biden administration's new tariff policies pose long-term trends and potential risks that merit caution. Enditem

Interesting, I didn't know that tariffs above 25% were illegal according to the WTO charter. If the Biden administration violates this threshold what will stop other countries from doing the same with industries they want to develop?