Critical window of opportunities for China's smaller cities

China has reached a moment to have another Third Front project

To deepen the understanding of China, smaller cities are not to miss because no matter how shiny tier-one cities are, most Chinese people live in smaller places. A previous GRR’s post about county towns depicts the economy, politics, and society of large swathes of land between China's rural countryside and metropolises, and today's post is about the future of these places.

This piece is from 宁南山 Ningnanshan, a popular Chinese blogger, and GRR has brought you his post on predictions for China in 2030 before. This time, Ningnanshan combined lower-tier cities with emerging industries such as semiconductors and new energy vehicles and offered a strategic plan so that China's industry distribution would be more balanced than today, and there would be larger room for the development of both regions and individuals if they grasp the opportunities.

In 2022, China's middle- and high-end industries are still highly concentrated in the tier-one cities and the surrounding areas. It is intriguing that each of the four Tier one cities in China has at least one strong industrial city in close proximity.

Shenzhen's industrial added value accounted for 33.8 percent of the city's economy in 2021, the highest among all tier-one cities, but in Dongguan, a manufacturing powerhouse adjacent to Shenzhen, a staggering 46.1 percent of the GDP came from industrial added value, even higher than that of Shenzhen.

Shanghai's industrial added value accounted for 24.8 percent of the city's GDP, but the industrial added value made up 42.2 percent of the economy in Suzhou, a manufacturing city bordering Shanghai;

Guangzhou's industrial added value accounted for 18.1 percent of the GDP, while in Foshan, a manufacturing city near Guangzhou, the industrial added value comprised 47.4 percent of the GDP;

Beijing ranked bottom among the four tier-one cities, with only 14.1 percent of the GDP from industrial added value, but that of Tianjin reached 33.3 percent. Tianjin is also a manufacturing city near Beijing.

Those tier-one cities' neighbors are also big cities. If we rank China's cities according to their industrial added value in 2021, Suzhou, Foshan, Tianjin, and Dongguan will rank among the top 12 in China. In other words, four tier-one cities and four of their neighbors will take eight seats in the top 12. And Suzhou even ranked the third, second only to Shanghai and Shenzhen.

Each of the four neighbors had higher industrial added value than Chengdu (ranked 13th), Wuhan (ranked 15th), Nanjing, Changsha, and other metropolises. The ranking shows that China's middle- and high-end industries are still highly concentrated in tier-one cities and their surroundings.

As the map of China shows, except for tier-one cities and their environs, middle- and high-end industries are only distributed in Chengdu, Chongqing, Wuhan, Nanjing and several cities in a sporadic way. The Chengdu-Chongqing economic circle is a large area, but except for Chongqing, the new tier-one cities (Chengdu, Chongqing, Wuhan, and Nanjing) did not make it to the top 12. Even some of the tier-one cities' neighbors, like Tianjin, have lagged behind in recent years. Tianjin must make efforts to catch up.

To reverse this situation and develop China's tier-two cities and below, the rise of new industries such as semiconductors and new energy vehicles (NEV) is an excellent opportunity. Each time new industries rise, regions reshuffle. Because emerging high-tech industries will bring in far more benefits than traditional industries. This gap can be staggering. Today is the golden era for developing semiconductors and new energy vehicles, and a great opportunity for lower-tier cities in China. To put it bluntly, the future of China's cities depends on how much investment they get in this wave.

If you observe carefully, you will see that the top ten power battery manufacturers, the top ten semiconductor manufacturers, and the top ten new energy vehicle companies are investing heavily to scale up production. I talked to someone from the industries mentioned above. He works in a second-tier battery company (not CATL or BYD). I am surprised that they plan to build so many new factories nationwide. But it's reasonable, considering the top tier enterprises are rushing to scale up production, others would naturally follow suit to survive.

In the automobile industry, the penetration rate of NEVs reached 28.3 percent in the August of 2022 (according to the data from China Passenger Car Association (CPCA)), while Chinese brands made up 48.4 percent of the total NEVs sold. There still exists much room for NEVs, which will drive the need of batteries to surge. Moreover, as for the localization of the industrial chain, electric vehicles are much better than fuel vehicles. China needs to import a considerable number of fuel vehicles and parts every year. However, as electric vehicles expand, China will import fewer vehicles and auto parts, which means the value now produced overseas will be transferred to China.

In the first seven months of 2022, China's automobile exports increased, and the production of automobile went up 0.8 percent, but the value of China's auto part imports declined by double digits. The import value reached 20.59 billion U.S. Dollars from January to July, down 16.7 percent year on year. In the main categories of auto parts, the import value of four major categories of automotive components declined to varying degrees compared with the same period last year, notably for engines. (The four major categories include: engines; auto parts, accessories and car body; tires of car and motorcycle; other automotive-related products).

Moreover, China's automobiles were mainly sold domestically in the past. Now, there is a huge overseas market. Building Original Equipment Manufacturers (OEMs) overseas this year also greatly promoted China's exports of automotive parts. In August, China exported 308,000 automobiles, up 6.2 percent month on month and 65 percent year on year. And the single month export exceeded 300,000 automobiles for the first time in history. And 83,000 of the exported cars were new energy vehicles, up 53.6 percent month on month and 82.3 percent year on year, showing a strong momentum of growth.

Therefore, China's lower-tier cities should fully recognize the significance of opportunities brought by the rise of new industries. Problems of all aspects will turn up if a region is underdeveloped in the long term, and the influence goes far beyond the lack of high-paying jobs.

[Some paragraphs were omitted here, mainly about using regional marriage situation as an example to explain the importance of the existence of new industries in a region.]

Furthermore, it will be beneficial to China's overall development if lower-tier cities attract new industries. Because even without industry upgrading, the migration of industries and people alone can create significant economic growth, let alone emerging advanced industries. The geographical transfer of industries alone can greatly enhance people's living standards. For example, urbanization is in fact the phenomenon of people moving from rural areas to cities, but the people involved changed from working in the agricultural sectors to the industrial sector. Back home, a farmer earns a few thousand yuan a year, but he earns a few thousand yuan a month in a factory. His income will rise fivefold or even tenfold, and the spending power will also improve greatly.

The reverse is also true. If factories move from coastal areas to inland cities, they will provide jobs for people in the surrounding areas. This industrial movement can greatly improve the living standards of the local workers, because they don't have to travel a long distance to become migrant workers, their children will not become left-behind children, whose inadequate education and companionship cause a host of social problems. At the same time, working near hometown can also save them travel expenses and time spent travelling.

In my view, China's industrial distribution experienced two different stages. Before the reform and opening up, industrial distribution mainly followed the will of the government, and the government decided the distribution according to strategic needs. In the early days of the People's Republic of China, the light industry was the dominant one, and the heavy industry was weak. As a result, China channeled resources into heavy industry, especially in coal, steel and military systems. Investment thus centered around northeast China, north China, northwest China's Shaanxi Province and other northern regions, because these places are the main producing areas of coal, iron, ore, etc. Later on, to cope with the Soviet Union's threat, China carried out the Third Front project, and relocated a large number of factories to the central and western regions. [Read another GRR post on the Third Front project. ]

The relocation of heavy industry led by the government has both pros and cons. On the bright side, it balanced the distribution of industry nationwide, so that China's industry was no longer highly concentrated in several major provinces. And for cities in the Third Front projects, the living standards of the locals were greatly improved. On the downside, the construction and investment were inefficient, and factories were built in rural regions, so various costs like that of transportation were high. Moreover, it was difficult to attract talents. As a result, development went slowly.

After the reform and opening up, foreign capital played a key role in the distribution of China's industry. The success of Pearl River Delta and Yangtze River Delta today have a lot to do with foreign capitals. However, the market-oriented industrial distribution was all about efficiency rather than distribution. Therefore, China's industry is highly concentrated in regions like the Pearl River Delta and Yangtze River Delta. The situation can hardly be changed by the market forces alone.

Thus, I think that China has reached a moment to have another Third Front project.

The development of the semiconductor and new energy vehicles industries nationwide is the best opportunity, because we will need factories in both the upstream and the downstream. If the government guides the distribution of new factories, if the industries can be redistributed nationwide, and become an engine for the economically disadvantaged area, China will see another wave of long-term growth. Here are some examples I have been following these days:

1.In August, Tianjin announced that SMIC would invest 7.5 billion U.S. dollars for a chip production line.

This line will produce 100,000 pieces of 12-inch wafers per month. And the plant will be built in Tianjin's Xiqing Economic-Technological Development Area. As I remember, Tianjin has not seen large emerging high-tech projects like this one for a long time. Congratulations to Tianjin for seizing the opportunity, because every high-tech project creates high-end jobs, which attract well-educated talents, and talents are the most crucial factor in modernization.

2.BYD and xFusion in central China's Henan Province

In 2010, a significant portion of Foxconn's production capacity was relocated from Shenzhen to Henan. It created 200,000 to 300,000 jobs, making it probably the most successful investment in Henan. In the past two years, Henan has brought in another two projects from Shenzhen:

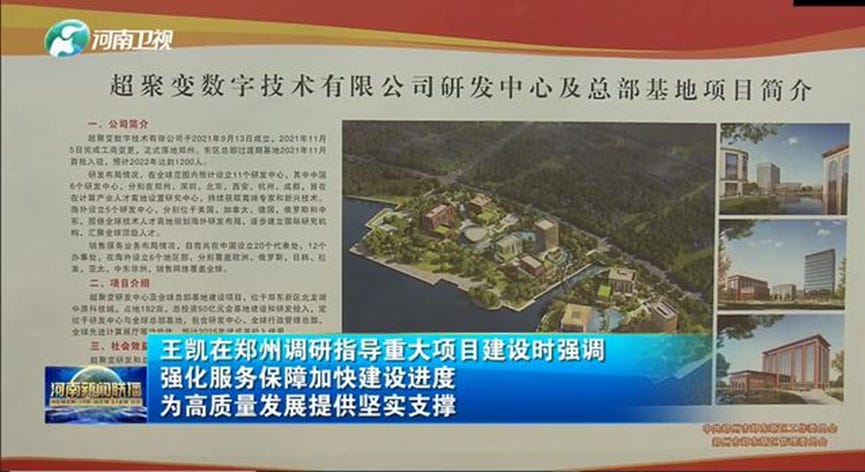

The first is Huawei's server division, which was separated from the company in 2021. Henan saw the opportunity. xFusion, born out of Huawei's former server business, finally settled in Zhengzhou, the capital of Henan Province in November 2021. At present, the company has 1,200 staff. In July, xFusion invested 5 billion yuan to build the global headquarter (including R&D center) in Zhengzhou. About 4000 technicians will work here by 2025, when the project is done. Though xFusion is merely a company worth ten or twenty billion yuan. However, since xFusion is a company related to Huawei, employees have higher income than the average level of the industry. And the company will keep growing, bringing thousands of well-paid jobs to Zhengzhou, which is of great significance.

The second is the BYD's project, which was even bigger. The first phase of Zhengzhou BYD OEM manufacturing base is under construction, and the base is expected to be completed and start operation in the first half of 2023, with a production capacity of 400,000 vehicles. The construction of the second phase started on July 6, and will yield 600,000 vehicles. Together, the total production will reach one million vehicles, with an investment of 16 billion yuan.

BYD invested another 12 billion yuan to build a battery base in Zhengzhou with an annual capacity of 30 GWh. Covering an area of 2,500 Mu (about 167.5 hectares), the plant is scheduled to be completed in September 2023, and will create 10,000 jobs. If BYD's project goes smoothly, Foxconn and BYD will become two manufacturing giants in Zhengzhou.

In addition to Tianjin and Zhengzhou, other cities such as Yibin in southwest China's Sichuan Province and Yichun in southeast China's Jiangxi Province, have received huge investment in the boom of new energy vehicles. BYD has invested heavily in many places in this round [of scaling up]. On the morning of June 30, 2022, BYD's Hefei base held a ceremony in Xiatang Town, Changfeng County to celebrate the first vehicle made there. These factories will allow the host provinces to have a bigger say in the automotive industry.

Shenzhen Faurecia (a joint venture by BYD and Faurecia) has also set up a branch in Fuzhou of southeast China's Jiangxi Province. It produced 15,000 sets of auto seats from April to July. So Jiangxi Province also strives to get a slice of the pie in the auto industry.

Another example is SERES [an electric vehicle and component manufacturer] and Huawei cooperated in the production of AITO vehicles in Chongqing. The municipality will benefit from their cooperation as the sales keep climbing.

SERES has two factories in Chongqing, the SERES Liangjiang Factory, and the Fenghuang factory. the SERES Fenghuang Factory has just recently been put into use.

In August, the company started building the third plant, named "SE Project of Liangjiang New Area". The new factory is expected to be completed by the end of July 2023.

SERES transfers Huawei's capacity to Chongqing through its cooperation with Huawei. As we see on the website of SERES:

"Huawei offers AITO comprehensive support in fields including product design, industry chain management, quality management, software ecosystem, user management, brand marketing, and sales channels, etc."

New factories and new organizational process is undoubtedly a boon for the development of Chongqing's automobile industry, and also creates more jobs. As we know, Chongqing is more of a province than a city, and a large number of locals work as migrant workers every year. So the municipality's development will help retain the workforce.

Moreover, Yibin in Sichuan province introduced the CATL project to manufacture batteries. In September 2019, CATL invested in the establishment of a battery plant in Yibin in September, a total production of 225GWh will be reached 10 phases. The first phase of 15GWh was put into production in June 2021. After the completion of the whole project, the base will become the world's largest battery manufacturing base, according to the company.

As an inland city along the river, Yibin has neither geographical advantage nor mineral resources.

As an official from the New Materials Office of the Investment Promotion Bureau in Yibin's Lingang New District told Caijing reporter

"Many cities invited CATL to build factories at the time. Yibin was not the most competitive one, because Chengdu and Suining held more advantages than Yibin."

"Back then, leaders of the government went to CATL themselves. They were refused at first. It was not until after Yibin made some achievements that CATL executives came to evaluate Yibin."

"Some achievements" refer to Tianyi Lithium Industry 天宜锂业. The company was established at the end of 2011 and put into trial production in August 2020. Tianyi Lithium produces lithium hydroxide, a material for producing batteries. It made up for Yibin's weakness in upstream lithium industry, and also shows the sincerity and coordination capacity of the Yibin government.

In fact, I don't think that opportunities are available at all times. Strategic opportunities for industrial development last for a few years. If a place takes them, it will enjoy dividends of the business cycle for more than ten years or even decades to come.

At present, the industries of semiconductors and automobiles are striding forward. Enterprises, capitals and talents are all flooding in. Once the window is closed, the amount and will of overall investment will decline. Investment will fuel development for the host provinces or cities. They will also benefit from corporate development, talent agglomeration, global labor division, and dividends from the global market.

Therefore, China's lower-tier cities should firmly seize the opportunity brought by the development of emerging industries. It will lay the groundwork of industrial leadership. In other words, the host region will enjoy dividends from the business cycle for a dozen years or even decades. So top priority should be inviting these industries to settle. Local governments should implement the responsibility system, sending leaders to visit and negotiate with leading enterprises in China.

For lower-tier cities, helping these enterprises to land is also an opportunity for venture capitals. Through appropriate measures and meticulous surveys, it won't be too risky, because the conditions are generally favorable when an emerging industry rises.

If this round of investment boom is missed, it will be difficult to convince enterprises to invest when industries start to fruit.

All regions are fighting over investments. I met an old classmate not long ago. He was sent to Shenzhen from a tier-two inland city to attract investments. And he was not the only one in charge of the job.

His responsibility covers two respects. One is to serve Shenzhen enterprises that have invested in their city before. The other is to negotiate with new enterprises and invite them to invest.

As he told me, they have also teams in other leading cities in addition to Shenzhen. And they adopt a one-on-one approach for targeted enterprises

Investments don't exist at all times. It comes in waves. [Smaller] Cities must seize the opportunity of this wave.

Finally, I think that time is running out for China's rapid development. The timing is critical, not just because emerging industries such as semiconductors and electric vehicles are rising. It might also be the last decade (maybe shorter) for China to grow at middle and high speed.

China's labor force has been shrinking year by year since 2012, and the country is likely to see negative growth in the total population this year, but the elderly population is expanding, which means in the next decade, China's economic growth will also further decline, even without the interference of COVID-19 (the growth of GDP in China amounted to 6.1 percent in 2019). Therefore, we must have a sense of urgency. If lower-tier cities seize the last window for rapid growth, they could catch up with metropolises and get a makeover.

Once China's economic growth slows down, it will be harder and slower for regions to develop. This is the current state for developed countries, where cities remain unchanged for a long time. For China, I think development is far from enough in many regions. We must seize the opportunity to balance the industrial distribution, so as to avoid what happened to Russia, South Korea and Japan. These countries' industries are highly concentrated in Moscow, Seoul, Tokyo, and surrounding areas. We are pursuing that Chinese people can choose from multiple developed regions to work and live with high standards.

This is what we need to do right now.

Very helpful. Many thanks!

One niggle: "but the elderly population is expanding, which means in the next decade, China's economic growth will also further decline”.

Based on current demographics, the labor force problems will not impact China until 2050. Until then, according to the world's leading development practitioner/theorist, Justin Lin Yifu, China can grow its GDP 8% compounded until then, if it so desires. No biggie, in other words.