Highlights of annual reports on China, EU’s business environment by CCPIT

Germany, the Netherlands and Luxembourg stood as top recipients of Chinese direct investment flows in the EU.

Today's newsletter consists of two parts. The first part highlights the key points from the annual report on China's business environment (2022) released by the China Council for the Promotion of International Trade (CCPIT) on April 18th.

The second part summarizes the highlights from the report on the European Union's business environment (2022/2023) released by the CCPIT Academy in March. The report includes the trade relations between China and the EU, the challenges faced by Chinese companies in developing their business in the EU, and recommendations made by the organization regarding the EU's business environment policies.

The two reports combined exceed 330 pages, and this piece aims to save you time by providing a concise summary. However, if you are interested in reading the original reports, you can download them here:

China’s Business Environment Annual Report (2022) by CCPIT Academy (Chinese: P1-P66, English: P67-165)

Business Environment of the European Union 2022/2023 by CCPIT Academy (English)

Founded in 1952, China Council for the Promotion of International Trade (CCPIT) is a national foreign trade and investment promotion agency. The aims of the CCPIT include promoting foreign trade, carrying out Sino-foreign economic and technological co-operation activities, promoting economic and trade relations between China and other countries worldwide etc.

The CCPIT Academy is a research institute directly affiliated to the CCPIT. The CCPIT Academy has a host of renowned Chinese experts in domestic and international trade, as well as a high-level research team on international trade, outbound investment, e-commerce and market circulation.

Part 1: Highlights of China’s Business Environment Annual Report (2022)

Overall Evaluation Of China's Business Environment

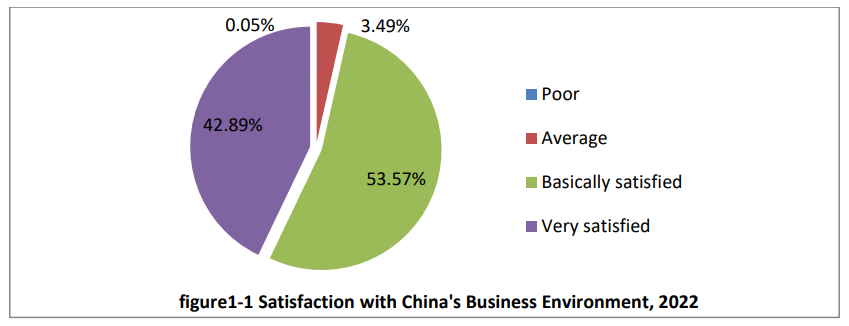

The surveyed enterprises are generally satisfied with China's business environment, with 42.89% being "very satisfied" and 53.57% being "basically satisfied"; those who rated “merely fair” account for 3.49%; and only 0.05% think that China's business environment is "bad".

30.81% of the enterprises surveyed believe that China's business environment has "improved significantly" in the past three years; 33.19% believe that it has "somewhat improved"; 9.59% see no change; 26.4% feel that it has worsened (including "seriously worsened" and "somewhat worsened"), and this proportion is higher than that in 2021 (6.2%).

China's business environment scores 4.38 in 2022, the same as in 2021, reaching a good level. Among the indexes, social credit gains the highest score of 4.53, while fiscal and tax service environment (4.52) and rule by law environment (4.50) are also at an excellent level. Human resources environment is rated the worst with 4.06 points, followed by financial service environment with 4.11 points.

By region, the central region has gained the highest rating of the business environment (4.47 points), the western region is in the middle (4.32 points), and the eastern region is at the bottom (4.31 points).

In terms of ownership, Sino-foreign joint ventures and cooperative enterprises have given the highest score of 4.51 on China's business environment, while private enterprises have given the lowest score of 4.32. The ratings of wholly foreign-owned enterprises, enterprises of other ownership and state-owned enterprises are in the middle, being 4.47, 4.41 and 4.36 points respectively.

Among the industries, the resource industry has the highest rating on China's business environment, with a score of 4.53, followed by the construction industry, with a score of 4.46; the high-tech industry and other industries both have the lowest, 4.32 points; the ratings of traditional manufacturing and service industries are 4.36 points, which is in the middle level.

Operation and Investment Status of Enterprises

Nearly 90% of the surveyed enterprises were negatively affected by the COVID-19 epidemic to varying degrees, among which those "greatly affected" account for 42.7%, which is the highest proportion, while those "less affected" and "seriously affected" account for 31.4% and 14.7%, respectively. In addition, 6.0% of the enterprises reflected that they had been positively affected, while 5.3% stated that they were not affected.

Of all the surveyed enterprises, 47.0% reflected that their supply chain was most affected by the epidemic; 40.4% and 36.8% stated that production and operation and export were significantly affected; 34.9%, 31.7% and 27.3% reported that their capital chain, domestic sales and resumption of work were affected; and 6.1% gave feedback that their after-sales service was affected.

The optimism of the surveyed enterprises towards the development prospects in the post-epidemic period has declined. Compared with 2021, the proportion of enterprises holding an "optimistic" attitude has decreased by 4.7%, and that of "pessimistic" enterprises has increased by 2.1%.

In order to minimize the impact of the epidemic, over 60% of enterprises expect the government to provide epidemic subsidies (66.5%) and increase tax relief (63.8%); 44.0% expect financial support; over 30% expect the government to provide support in logistics (30.1%) and build an online matchmaking platform between enterprises (19.7%); and about 10% need regular guidance on epidemic prevention and control (11.9%) and epidemic prevention supplies (8.3%).

More than half of the surveyed enterprises have taken or may take measures to reduce unnecessary expenses.

In 2022, 76.2% of the surveyed enterprises had average revenue or above, down 13.2 % from 2021, and 35.7% maintained their revenue at the good level or above, down 3.8 % from 2021.

Nearly 50% of the surveyed enterprises in the central region have maintained their ROI at the good level or above, while less than 30% have achieved such result in the eastern region.

The percentage of enterprises with positive ROI growth (average and above) is 76.2% in 2022, down 6.8 % from 83.0% in 2021.

Among different industries, the resources industry contributes 55.4% of the enterprises with good ROI or above, followed by the high-tech industry (46.8%), while the service industry ranks last (29.5%).

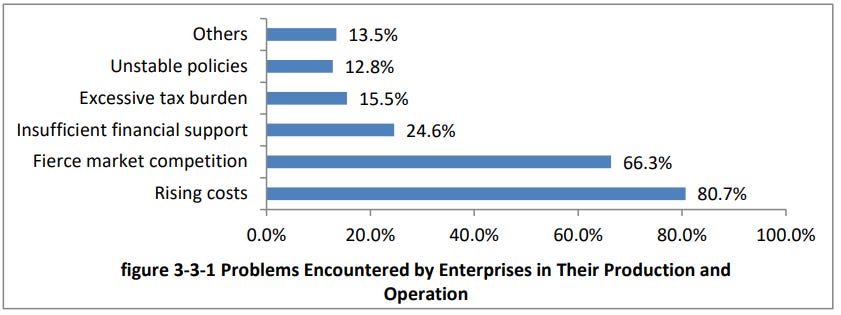

Enterprises reflected that in their production and operation, rising costs and fierce market competition are the most obvious problems, accounting for 80.7% and 66.3% respectively. In addition, insufficient financial support (24.6%), excessive tax burden (14.9%), and unstable policies (12.8%) are also prominent problems.

The policy and government administration environment is the major concern of the surveyed enterprises.

Part 2: Highlights of the report of Business Environment of the European Union 2022/2023

China and the EU have maintained stability and progress in their economic and trade relations

In 2022, the bilateral trade in goods between China and the EU continued to grow and the trade volume increased steadily. China was the second largest trading partner of the EU, its largest source of import and second largest market for export; the EU was China’s second largest trading partner, the second largest export market and the second largest source of import. In 2022, the total bilateral

trade in goods between China and EU was valued at RMB 5,646.798 billion (about 821.24 billion U.S. dollars) , up 5.6% year-on-year.

In breakdown, China exported RMB 3,743.441 billion of goods to the EU, up 11.9% year-on-year; China imported RMB 1,903.357 billion of goods from the EU, down 4.9% year-on-year.

Chinese enterprises’ direct investment stocks in the EU remained the highest among developed economies.

In 2021, Chinese enterprises’ direct investment flowed to the EU amounted to USD 7.86 billion, down 22.2% year-on-year, with the EU ranking third in terms of China’s ODI flows in 2021. In the same year, the stock of Chinese enterprises’ direct investment in the EU was USD95.9 billion, accounting for 33.5% of the stock of Chinese investment in developed economies, making the EU the largest FDI recipient of Chinese investment stock. As of the end of 2021, China had established over 2,700 direct investment enterprises in the EU, covering all 27 EU member states and employing nearly 270,000 foreign workers.

By country, Germany, the Netherlands and Luxembourg stood as top recipients of Chinese direct investment flows. In 2021, Chinese enterprises’ direct investment flow to Germany reached USD2.71 billion, up 97.1% from the previous year, accounting for 34.5% of total Chinese investment flows to the EU, mainly in manufacturing, electricity/heat/gas and water production and supply, wholesale and retail, and finance. The Netherlands was next with USD1.7 billion, down 65.5% from the previous year, accounting for 21.7% of the Chinese investment flows to the EU, mainly in information transmission/ software and information technology services, mining, wholesale and retail trade, etc.; Luxembourg ranked third with USD1.5 billion direct investment flows from Chinese enterprises, up 113.9% from the previous year, accounting for 19.1%, mainly in residential services/repair and other services, manufacturing, leasing and business services.

By industry, the main target sectors for Chinese direct investment in the EU in 2021 were manufacturing, finance and information transmission/software and IT services, with investment amounts accounting for 47%, 14.3% and 13.7% respectively.

General Issues of the Business Environment of the EU

Trade protection and over-intervention have made the EU business environment worse. More than 30% of the surveyed enterprises believe that the business environment in the EU has deteriorated.

The three most prominent problems with the EU’s business environment as perceived by Chinese enterprises in Europe are the rising production costs, the Russian-Ukrainian conflict affecting normal operations, and the continuous increase in market access barriers, accounting for 54.36%, 51.01% and 33.56% respectively.

How enterprises evaluate the business environment of each EU Member State differs greatly. According to the survey, 76.99% of the respondents believe Germany is the EU Member State with the best business environment. France comes next with 58.41%. Italy, the Netherlands and Spain rank third to fifth, accounting for 46.02%, 38.05% and 34.51% respectively

The survey shows that Lithuania receives the lowest evaluation from the respondents (51.96%) for its business environment, followed by Latvia (33.33%), Bulgaria (23.53%), Estonia (22.55%) and Cyprus (21.57%) respectively.

The EU’s “policy toolbox” has raised market access barriers across the board

1. Strengthened foreign investment review has raised market access thresholds.

2. Chinese enterprises have suffered from unfair treatment in the foreign investment review process.

3. Foreign subsidy review has made it more difficult for Chinese enterprises to invest in the EU.

4. New offensive protection tools in the field of public procurement have been added.

Generalization of the national security concept has hindered the free flow of production factors

1. The Regulation for Export Controls of Dual-Use Items has increased barriers to technology exchange.

2. Completed acquisitions by Chinese enterprises have been annulled on national security grounds.

3. Visa processing in the EU and its member states has become more difficult and less convenient.