How pandemic changes lifestyles, travel habits of China's middle class

Local outdoor activities were seized by travel agencies as a "life-saving" straw in the pandemic, a move that may change the future of tourism even after COVID-19 walks away.

China's annual Central Economic Work Conference held in Beijing from Thursday to Friday noted that China's economic performance in 2023 is expected to witness an overall recovery and improvement. The meeting stressed better coordinating epidemic prevention and control with economic and social development, urging efforts to optimize epidemic response based on time.

Among many tasks, expanding domestic demand was highlighted as a priority in order for it to play a larger role in driving economic growth, and forming new consumption scenes was mentioned as one of the main work to fully tap the potential of the domestic market.

Over the last three years, the pandemic has changed some Chinese consumer habits, particularly in the tourism industry, which has been hit hard by COVID. As China optimized its COVID response, seizing the opportunities presented by the new consumer demands and the new consumption scenes appears to be essential for both new players and established ones who have recently survived the storm.

Camping, cycling, surf skating ... This year has seen the rise of outdoor activities. While the pandemic restricted long-distance trips to some extent, excursions to suburbs are booming due to the restrictions.

The increase in outdoor lifestyles has also boosted outdoor sports brands and outdoor outfits. In the past month, users posted 118,000 notes about outdoor activities on Xiaohongshu, a social media platform in China.

Who is enthusiastic about outdoor activities? What kind of outdoor activities does the new middle class like exactly? Why are they attracted to the outdoor lifestyle?

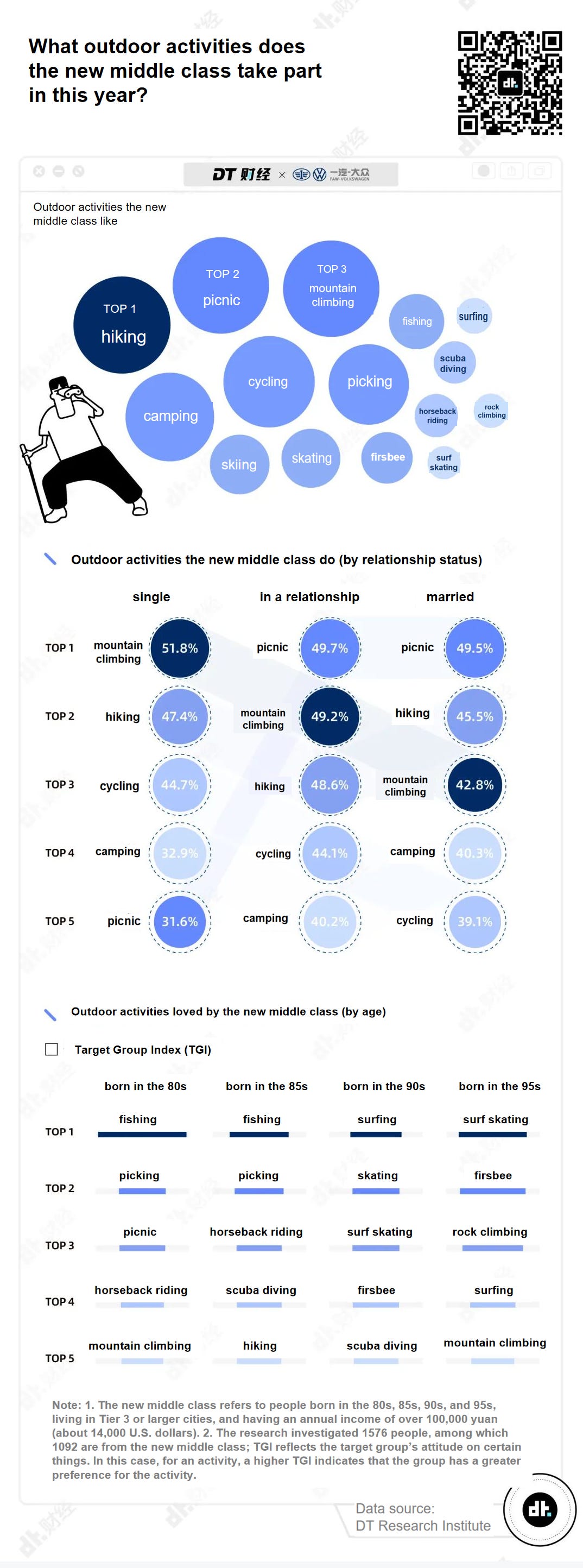

According to a survey by DT Caijing, a data analysis platform in China, the new middle class now dominates outdoor activities. The group has the ability to spend, and they have relatively more free time. As for the sub-categories of activities, hiking, picnicking, and mountain climbing are the most popular, followed by cycling, camping, and picking fruits and vegetables on farms.

[The new middle class in the research refers to people born in the 80s, 85s, 90s, and 95s, living in Tier 3 or larger cities, and having an annual income of over 100,000 yuan (about 14,000 U.S. dollars). The research collected 1,576 effective samples, and 70 percent of them are classified as the new middle class.]

Moreover, people of the new middle class have varied preferences for outdoor activities when they are at different stages of their lives. Single people like mountain climbing the best, while those with a partner prefer going on picnics.

Ninety percent of the new middle class fond of outdoor activities would pay for them, and nearly half would spend as much as 500 yuan each month.

Other than sportswear and outdoor equipment sellers, travel agencies have also sniffed an opportunity in the rising business. For the past three years, these agencies have been struggling. Now, as the government rolled out a set of new COVID control policies right before New Year's Day and the Spring Festival, the tourism industry finally saw the light at the end of the tunnel.

On the afternoon of Dec. 9, the Ministry of Culture and Tourism updated the epidemic prevention and control guidelines. With the new measures, travelers are no longer required to take PCR tests upon arrival, and people no longer need to provide negative test results or health codes at tourist attractions and entertainment facilities.

In the second week of December, searches related to traveling soared more than 900 percent compared with the same time last year on online travel platforms Trip.com Group 携程 and LY.com 同程, according to Shanghai Securities News. The Newspaper also found that on the morning of Dec. 8, two hours after the government released New Year's Day holiday arrangements, searches for flight tickets and hotel rooms on Trip.com Group surged six and seven times, respectively, compared with the same time a day ago.

"On Dec. 8, the orders for traveling during the New Year's Day jumped tenfold year on year," said Zhou Weihong 周卫红, head of Shanghai Chunqiu International Travel Agency (Group) 春秋集团, and deputy general manager of Spring Tour 春秋旅游. But she added that the surge mainly resulted from last year's dismal situation.

Even though the ice is thawing, the travel agency is determined to pivot, considering the shift in consumer habits during the pandemic. How did the agency survive? How did the agency find its "life-saving" straw, local outdoor activities? All can be found in Zhou's narration in the following part. It was first published on China News Weekly's official WeChat account on Dec. 13 :

When COVID-19 broke out at the beginning of 2020, it happened to be the busiest time for the agency.

On Jan. 24, 2020, all tourism activities across China ground to a halt in response to policies released by the Ministry of Culture and Tourism. Days ago, China's authorities confirmed that the virus could spread from person to person and put the city of Wuhan under lockdown. The whole industry was caught off guard. Spring Tour made refunds and canceled group tours immediately as required by the policy. They even called back tour groups already on their way to the airport.

By March 2020, refunds totaled 400 million yuan (around 57 million U.S. dollars). The finance department rushed to solve the financial problem. At that time, the company got an emergency bank loan of approximately one billion yuan. Everyone thought the pandemic would be over when spring came, but the struggle turned out to last for three years.

Losses from refunds doubled quickly, and the operational losses were even more dramatic. Even for a healthy company like Spring Tour, it takes three to five years to recover the losses from the pandemic. In January 2020, senior executives, shareholders, and most managers of our company voluntarily applied for zero salary to lower the cost. This way, we made sure that employees could get a basic salary starting in March or April.

Another key personnel group is tour guides, and the pandemic has driven many of them out of business. Over 40 percent of the company's employees were born in the 80s and 85s, which means many of them need to take care of both the elderly and kids. Moreover, leaving for Shanghai from their hometown, many don't have much savings. Under the pressure of house and car mortgages, they had to do part-time jobs such as food and package delivery or even changed fields altogether. They were desperate moves in desperate times.

Despite the difficulties, Spring Tour made the strategic decision to maintain the regular income of the more than sixty employees in the IT department. Their work did not get delayed because of the pandemic. Quite the contrary, they accelerated the company's product informatization process. We believe that customization is the future of group tours, so Spring Tour launched the quality check system during the pandemic, laying the underlying technological foundation for building a high-quality service system in the future.

Striving to help young staff survive

We tried our best to seize the opportunity of each "window period" and keep tourism going. In this way, the young staff get to keep their jobs and have incomes.

Since long travel was not available, we then turned to local trips. How to develop local trips in Shanghai? In March 2020, I started "reading" with a bunch of colleagues. We did some research on 64 roads that will never be widened in Shanghai. Later, we launched Spring Micro Travel 春秋微游 to satisfy tourists' curiosity and spiritual needs.

To encourage the tourists to repurchase our product and make tourism part of their daily life, we priced the micro travel product at only 49 yuan per person per time. All the revenues of the project went to the tour guides. We encouraged people to go on the streets and into the alleys and to "read" the architecture. Through our introduction, we brought customers a city not often seen in books.

So far, Spring Micro Travel has been upgraded to the eighth generation, "Dig into History of Haipai city." [Haipai, literally Shanghai style, refers to an avant-garde culture that originated in the early 20th century. The style combines the indigenous culture and the western culture.] We encouraged tourists to experience, explore, and share. In the end, some tourists willingly offered us many suggestions and resources on city exploration. Moreover, young couples took their kids with them on local trips, and many have bought our micro trip products over ten times.

Before the pandemic, tour guides led tour groups to different places. Now, some of our top guides have become local tour guides. In August, the company started live streaming. Many tour guides even built their own fan base and kept good long-term relationships with customers. These customers may join the local micro trips today, but they are also potential customers for cross-provincial and outbound trips in the future.

From a business point of view, these methods were great ways of bringing in customers. Advertising in a traditional way would cost 100 to 200 yuan to attract one customer, but we approached potential customers at a much lower cost. With quality services and products, we expanded the business in a customer-friendly way and increased the company's reputation. Almost every customer in the program gave us a thumbs up.

In the spring of 2022, we dived into another new project, camping tourism. Camping tourism started to become a thing during the pandemic. It's a new lifestyle loved by youngsters. To extend the product life cycle, we developed a "camping plus" model, such as selling agricultural products. When the pandemic wanes, even if the number of campers drops, our customers can still buy agricultural products online.

The company has already launched a new camping brand, and we have built over 30 campsites in more than 20 cities in China. Admittedly, COVID-19 resurgences have caused troubles. Even our campsite with the best performance earned a revenue below one million yuan with a gross margin below double digits. But the revenue is still enough to keep the camping team afloat. We believe that the revenue will grow steadily if we stick to it.

More importantly, through camping, the company managed to extend the target customer age group to young customers. The managers of the camps are also young people. We helped a bunch of Gen Z employees to grow in this new program. In the future, camping is likely to become a highlight in long-distance tours, such as camping on the grassland and in the Gobi Desert [a Large desert in East Asia, part of it is in north China's inner Mongolia]. With the experience of suburb camping, our product managers will have a deeper understanding of new tourism products and resources. Like micro trip products, camping will also become a good way to attract customers.

On July 1, 2022, Shanghai was the only place with high-risk areas in China. We rebooted our programs to Gannan immediately. [Ganan is a Tibetan prefecture in north China's Gansu Province, also a popular tourist attraction.] The program was open for only a few days. When the information was released, tickets were sold out in minutes.

Focusing on cross-provincial tours, the domestic department of the company accidentally became one of the few profitable departments during the pandemic. The other two were the MICE tourism (meetings, incentives, conferences, and exhibitions) department and the theme travel department. But given the operational cost and overall losses of other functional departments, the profit was just too meager.

Following market trends to spur tourism consumption

There's a view in the industry. It says that we can expect a travel boom after the pandemic, but that may have little to do with travel agencies as consumer habits and travel modes have changed.

Travel agencies are good at integration, but we don't own any of the resources from tourist attractions, hotels, to vehicles. Even tour guides may not be the agency's employees. The pandemic has fueled livestreaming, and it also connects consumers and suppliers, allowing the transaction to take place without "intermediaries," perhaps at better prices. Travel modes have also changed, with "hotel as destination" travel becoming the new trend. If consumers don't go to tourist attractions, the original room for travel agencies to operate will disappear.

A shift in demand and supply may bring disruptive changes to the traditional tourism industry. Travel is no longer the movement of people. Instead, traveling will be a lifestyle of which consuming, feeling, and experiencing would be the core definition. Under the new circumstances, how can travel agencies provide new value-added services and help drive consumption? We're still searching for the answer.

As the Spring Festival approaches, "Spring Festival Reunion Dinner + Accommodation" has become another hot product. Chinese people are fond of family reunions. However, after COVID-19 broke out, to ensure the kids could go back to school safely after the festival, many nuclear families choose not to go back to their hometowns to reunite with the elderly and other relatives. However, spending the holiday alone is too lonely, so some families gather together to celebrate the holiday.

[Nuclear family, a family type that includes only the mother, the father, and the kids, as opposed to the extended family.]

The reasons they get together may be different, from the friendship between parents to the friendship between kids. Some youngsters spend the holiday together because their pets are close to each other. Whatever the reasons are, a Chinese New Year's Eve dinner for ten, as usual, is no longer suitable. Therefore, we put forward a dinner plan for six. Several friends come together, drinking, chatting, and living in the hotel after dinner.

We also offered consumers different choices about the hotels. In some hotels, customers get a bird's eye view of Huangpu River at night, while others are old brands in Shanghai, such as Sunrise on the Bund Hotel 上海外滩浦华大酒店, Shanghai Baixia Pagoda Hotel 上海白厦Pagoda君亭设计酒店, and Songjiang New Century Grand Hotel 上海松江开元名都大酒店. These places are almost fully booked despite the high price per customer.

After the release of "Ten Measures," cross-provincial trips are back in the game. Consumers are no longer satisfied with going to 26 hotels in Shanghai. Given the risks of long-distance travel, we launched the Yangtze River Delta hotel plan, including 15 hotels in Jiangsu Province and 21 in Zhejiang Province as destinations.

To boost consumption, travel agencies must keep tabs on the market trend. The Beijing 2022 Winter Olympics has ignited Chinese people's enthusiasm for winter sports. Currently, Spring Airlines 春秋航空 has two full flights each day from Shanghai to the Changbai Mountains in northeast China. Basically, the planes send more than 300 tourists to the ski resort every day. It reflects a boom in demand for winter tourism, especially ice-snow tourism.

At the same time, we are also doing more research, hoping to offer advice for the industry's recovery. One problem is that as many businesses resume, many medium- and small-sized travel agencies are still reluctant to restart. Because they need to start paying taxes immediately, which means doing business may cause greater losses for a period of time.

Many favorable tax policies will expire by the end of this year. Will the government extend the policies for some time and help the industry tide over difficulties? I mean, tax can take diverse forms. Given the grim employment situation in recent years, the tourism industry, a big contributor to new jobs in pre-COVID days, has barely recruited new employees. One solution is to allow travel agencies to use new hiring to offset their taxes. In this way, travel agencies can help improve the employment situation while bringing in new blood. Enditem