Population, Industrial Upgrade and Taiwan: Some predictions for China in 2030 - Part 2

Detailed analysis on how industrial upgrade would shape China's future in 2030

Today's newsletter is the second part of the 对2030年中国的一些预测 Some Predictions About China in 2030, written by a popular Chinese blogger宁南山 Ningnanshan. The first part, which was published a week ago, has become one of GRR's most popular newsletters less than 24 hours after it was released. For another popular story featuring Ningnanshan, see GRR's previous piece on Huawei.

In part 2, the author presented a detailed analysis on how industrial upgrade would shape China's future in 2030. He predicted that the swiftly growing semi-conductor industry would create tens of thousands of new jobs, while the advancement of new energy vehicles could revolutionize not just people's daily travels, but also every aspect of transport-related services. He also elaborated on futuristic lives that cloud computing would help realize, indigenous innovation in building airliners, and prospects for high-speed railways.

When talking about the pharmaceutical industry, the author connected it tightly with the well-being of Chinese people, echoing the population problem mentioned in part 1. Moreover, an exciting section is the one about space exploration. Moon, Mars, Jupiter ... China's scientists are determined to find out what the stary night has in store. Well, sky is definitely not the limit.

Except for the rosy outlook on China's future, the author also kept reminding us of the risks and challenges along the way. He especially put emphasis on the risks of organizational abilities dropping, the adverse effect should China's population shrinks too fast, and lessons learned from the Russia-Ukraine conflict.

***

Now, I’d like to talk about the industries that will bring drastic changes to our society in the future.

The first one is the semiconductor industry. Its market size will quickly expand to 1 trillion U.S. dollars.

According to the statistics published by the Semiconductor Industry Association (SIA), the global market size of the semiconductor industry in 2021 reached a record high of 555.9 billion U.S. dollars, up by 26.2 percent compared with a year ago.

The demand for chips will continue to grow as the internet of things keeps expanding and more devices are connected. Therefore, the scale of this industry will not be limited to the current 500 billion U.S. dollars. Judging from its characteristics, the semiconductor industry is a high-tech industry and most enterprises in it have a pretty good profit margin, which means they would bring abundant high-paying jobs. I believe that the semiconductor industry in China will take the lead in this respect in the next decade, creating tens of thousands of new jobs in China every year.

51job.com, a recruitment website in China, published Q1 2021 “Chip Power” (Integrated Circuits/Semiconductors) Market Demand and Supply Report. [Chinese]

The report showed that the integrated circuit/semiconductor industry has seen a 22.2 percent increase in hiring in the first quarter of 2021 compared to the same quarter of 2019. That is to say, the average annual growth of recruitment from 2019 to 2021 was approximately 10 percent.

At the same time, the jobs in the integrated circuit/semiconductor industry in March 2021 accounted for a record-high 5.5 percent of all jobs available, ranked 4th among all industries. While in the same period of 2019, only 2.6 percent of positions are provided by the semiconductor industry, which placed 12th in 61 industries.

This means, the demand for talents in the semiconductor industry surged from the 12th to the 4th in merely two years.

The salary of graduates entering the semiconductor industry in 2020 rose by 20 percent to 25 percent on average, while the salary of graduates in 55 of 61 industries remained unchanged.

We can also see similar trends from another source.

As shown by China Integrated Circuit Industry Talent White Paper (2019-2020), by the end of 2019, China’s integrated circuit industry has a total of 511,900 employees, a rise of 50,900 (up by 11.04 percent) compared with 2018. In terms of different links on the industrial chain, the number of practitioners engaging in the design, manufacturing and packaging/testing reached 181,200, 171,900 and 158,800, up by 13.22 percent, 19.39 percent and 1.34 percent respectively from the same time last year.

The White Paper estimates that the total demand for talents in the whole industry will reach 744,500 around 2022, including 270,400 for chip design, 264,300 for manufacturing and 209,800 for packaging and testing.

From Q2 of 2019 to Q1 of 2020 , the average gross pay in China’s integrated circuit industry (including design, manufacturing and packaging ) was 12,326 yuan ( about 1,800 U.S. dollars) per month, with a year-on-year growth of 4.75 percent.

The average gross pay of R&D posts was 20,601 yuan per month (about 3,100 U.S. dollars), showing a 9.49 percent year-on-year growth.

The figures above are two years old. In fact, it's quite commonplace for the salary of a senior chip design engineer with over 10 years of experience to surpass 1 million yuan (about 150,000 U.S. dollars). Some famous chip manufacturers in China are offering an annual salary of more than 300,000 yuan to a fresh graduate with a master’s degree. Some in the industry claim that there are bubbles because the real capabilities of chip talents in China are not proportional to their high salaries. In my opinion, however, only by offering high salaries can an industry attract more high-level talents. And talents may create stunning value.

Undoubtedly, the industry will have more than 1 million employees by 2030 and let’s see if this number will exceed 2 million. Please bear in mind that this is an industry with an average monthly salary higher than 10,000 yuan in 2019.

By 2030, China’s semiconductor industry will have more than 30 big enterprises earning over 10 billion yuan (about 1.5 billion U.S. dollars) per year.

I’m not making things up.

According to the data collected by 魏少军 Shaojun Wei (A professor of Tsinghua University and Peking University, fellow of the International Institute of Electrical and Electronics Engineers), the last one of the Top 10 Chip Design Companies in China in 2020 had a revenue of 4.85 billion yuan. In 10 years, it’s actually quite easy for the last of the Top 10 to double in revenue.

The threshold of entering Top 10 Chip Design Companies has already increased to 6.6 billion yuan in 2021, as revealed by Shaojun Wei. It’s almost a certain event that there will be 10 chip design companies earning more than 10 billion yuan by 2030. In fact, there will be more.

In chip manufacturing and packaging industries, the combined sales of 中芯国际SMIC, 安世半导体 Nexperia Semiconductor, 长电科技 JCET and 通富微电 TFME exceeded 10 billion yuan in 2020 while that of HT-Tech surpassed 10 billion in 2021. The total revenue of 华虹半导体 Huahong Semiconductor and 华力微 Huali Microelectronics under 华虹 Huahong Group also passed 10 billion yuan in 2021. 长江存储 Yangtze Memory and 长鑫存储 CXMT didn’t report their data, but it will surely excel 10 billion yuan in the years to come. There are eight companies here already, and there must be more chip manufacturing companies and packaging/testing companies that will cross the revenue threshold of 10 billion yuan.

There will also be several companies with an annual revenue higher than 10 billion yuan in the field of semiconductor materials and equipment. 北方华创 NAURA Technology, a semiconductor equipment manufacturer, will be the first to achieve this goal. In addition, some companies specializing in silicon wafers (the most expensive semiconductor materials) will also join their rank.

Generally speaking, more than 30 semiconductor enterprises in mainland China will have revenue more than 10 billion yuan by 2030.

The second is the new energy vehicles (NEV) industry.

The so-called new energy vehicles, or electric cars, are kind of misleading. Because it makes people overlook the biggest reform in the industry. In fact, the switch from fuel to electricity isn’t the most profound change in the automobile industry.

In the long run, the biggest revolution in the industry is that automobiles will become smarter. In other words, electrification and intellectualization. I believe that the latter is the core and high ground where car-makers widen the technological gaps.

The biggest application and the symbol of electric vehicles’ intellectualization is autonomous driving for now.

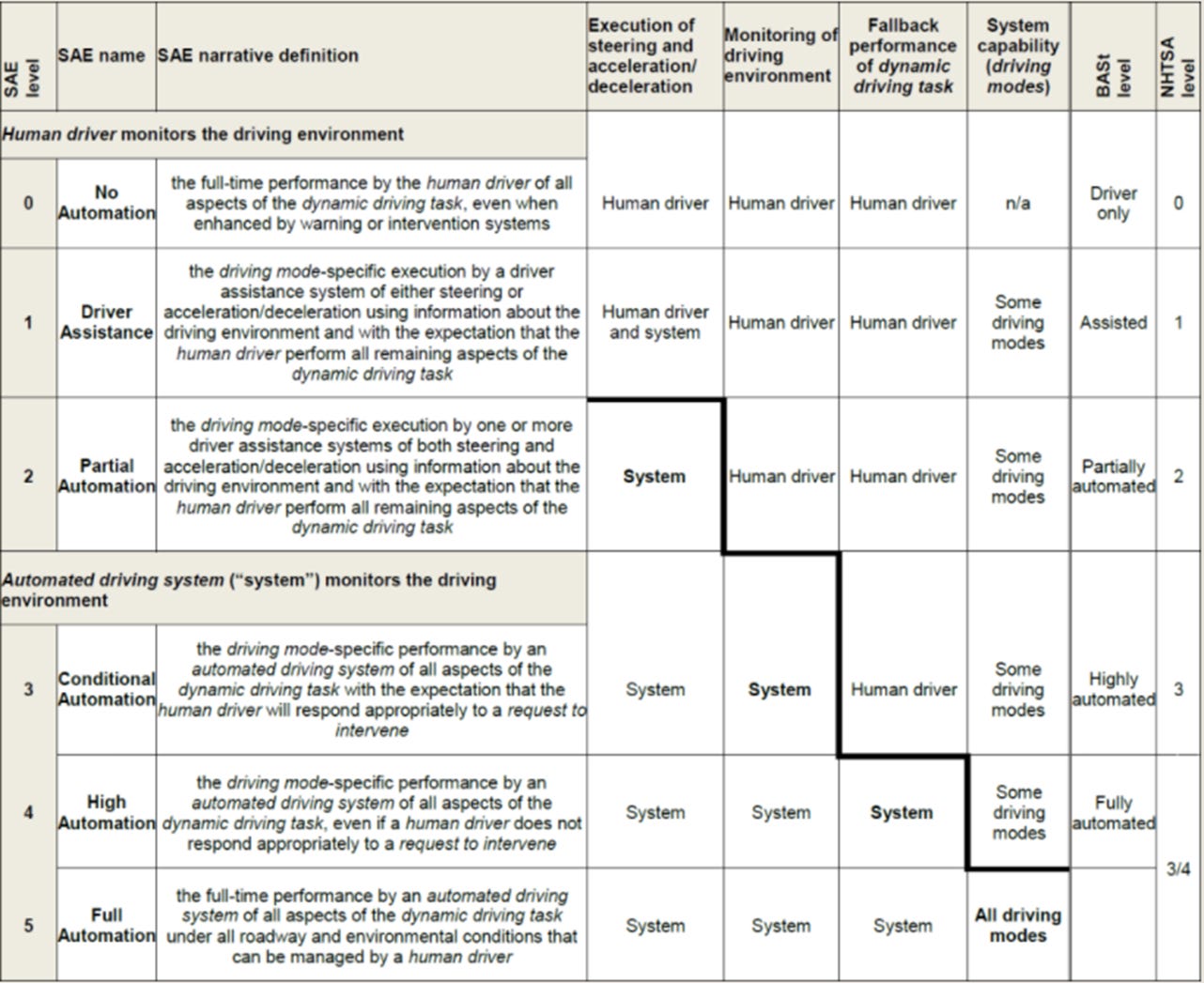

It’s still hard to predict whether Level 5 (Full Driving Automation) self-driving cars can be mass-produced and become commercially available by 2030, but it’s quite clear that the self-driving technology of electric cars will quickly move toward Level 5 in the next decade, and it will become more mature and safer. This change will bring about drastic changes to our lives. Considering that in 2022, the mass-produced electric cars are mainly equipped with Level 2 (Partial Driving Automation) aided driving.

The autonomous driving levels of Level 0 (No Driving Automation) - Level 5 (Full Driving Automation) were introduced by the Society of Automotive Engineers (SAE) of the U.S. It is a grading system widely used throughout the world. But for most laymen, there is no need to understand the differences so clearly.

To put it simply, the mainstream electric cars available fall into the category of Level 2 aided-driving, and they are developing toward Level 3 (Conditional Driving Automation) aided-driving.

Compared with Level 2, Level 3 cars are capable of more automatic operations and are more advanced. Level 3 can be seen as a great leap from Level 2. However, even with Level 3 vehicles, drivers' attention is still required, so Level 3 could provide aided driving only.

Level 4 (High Driving Automation) vehicles are capable of self-driving, but they are confined to certain roads and environments.

Level 5 cars can achieve real self-driving in all environments.

During Shanghai Auto Show in April 2021, 侯福深 Fushen Hou, Deputy Secretary-General of China-SAE and the Executive Director of China-SAE Automotive Innovation and Strategy Institute said that, in 2025, China is expected to make 70 percent of mass-produced cars reaching Level 3 automation and begin the scaled applications of Level 4 autonomous car.

He also said that we’re expected to realize mass production of Level 5 fully autonomous cars by 2030. But notice that these are just expectations instead of certainties.

If you ask me what will bring the biggest change to our daily lives and city appearance in the future, my answer would be self-driving technology. If we could realize Level 5 automation by 2030 and begin its popularization, tens of millions of truck drivers and Didi drivers (those who provide ride-hailing service) will be liberated. With an investment of several hundreds of thousands yuan, then they could rent autonomous cars which will carry passengers and ship cargo on their own. Drivers don't even need to be in the cars.

Since the systems will be way smarter than humans, the death toll of traffic accidents will drop significantly. Currently, traffic accidents kill tens of thousands of people every year and the number is way too large for peaceful times. So the expansion of advanced self-driving technology helps reduce traffic accidents.

Of course, the rosy picture will only become reality when the popularization of Level 5 technology is done, and it will be after 2030.

Although electric cars on the roads today are merely Level 2 vehicles, there has been news about bold drivers handing over the wheel entirely to the cars on highways while lying back on the seats. It made automobile manufacturers tremble with fear.

Imagine that when Level 3 autonomous vehicles are in mass production and commercially available, more drivers will be tempted to give control to the cars. Though technically speaking, Level 3 automation will be just aided driving, it has more functions than Level 2 automation, and electric cars may take over monitoring road environment. So more Level 3 electric cars will be on the road, which means risks will increase as well. As a result, carmakers need to fulfill requirements for the stability and advancement of self-driving technologies.

For an electric vehicle manufacturer to stand out in 2030, it must have advanced self-driving technologies and high-end brands. Given the big trend of electrification of automobiles, the electric vehicles brands won't have much difference in power consumption and range, so the biggest difference will come from the safety and stability of their autonomous driving technologies, as well as premiumization. These two factors complement each other in a sense.

Although intellectualization will be the biggest revolution in the long run, the electrification technology of automobiles remains to be perfected. The most typical problem is that the range and the charging speed of electric cars can’t satisfy consumers’ demands, thus hybrid cars using both electricity and fuel still have a huge market. This is why consumers say that the biggest competitiveness of 理想汽车 Li Auto’s cars is that they can run on fuel, and 比亚迪 BYD's DM-i hybrid power technology is also a big hit.

The third industry chased by industry giants will be cloud computing.

The digital transformation of enterprises will be a major market in the next decade.

What is the digital transformation of enterprises? To put it simply, the core is the Internet of Things and Artificial Intelligence. This wave of digital transformation is also known as intelligent transformation because intellectualization lies at its core.

In factories and companies, all the production equipment and processes, office procedures and the venues are becoming intelligent.

For example, if you drive into any parking lot in the southern Chinese city of Shenzhen, you will find that vehicle license plate recognition is a common thing.

Face recognition has been widely used in office buildings, high-speed rail stations and gated community access control.

Intelligent factories are going unmanned. Sensors will be installed on production equipment. When sensing that the materials are running out, the sensors will notify the transfer robot, and it will automatically fetch the required materials from the warehouse and deliver them to the equipment in the workshop, where the automatic filling robot will put materials into the equipment.

Once produced, parts and components will be inspected by advanced HD cameras and AI machine vision algorithm instead of quality inspector’s eyes. The system will then summarize and upload the inspection data, pictures and videos, during which it will analyze defect data and show the result to the factory’s quality management department.

The production parameters of the machine will be linked with the final product yield rate and defect distribution data, which will be analyzed and judged by artificial intelligence. The AI then will start self-learning and improve the production parameters of the machine to improve the yield rate.

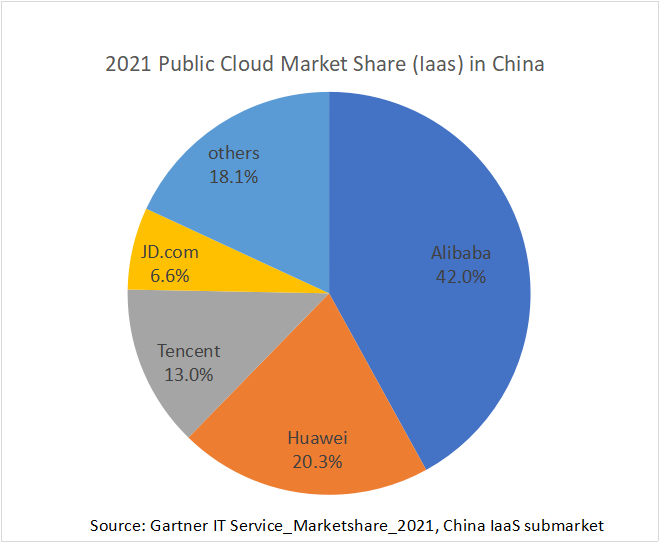

The intelligent transformation will generate mass data, leading to an increase of demand for cloud data centers. However, cloud computing is a highly concentrated market. According to Gartner, Alibaba (42 percent), Huawei (20.3 percent) and Tencent (13.0 percent) occupy the largest share of China’s public cloud IaaS (Infrastructure as a Service).

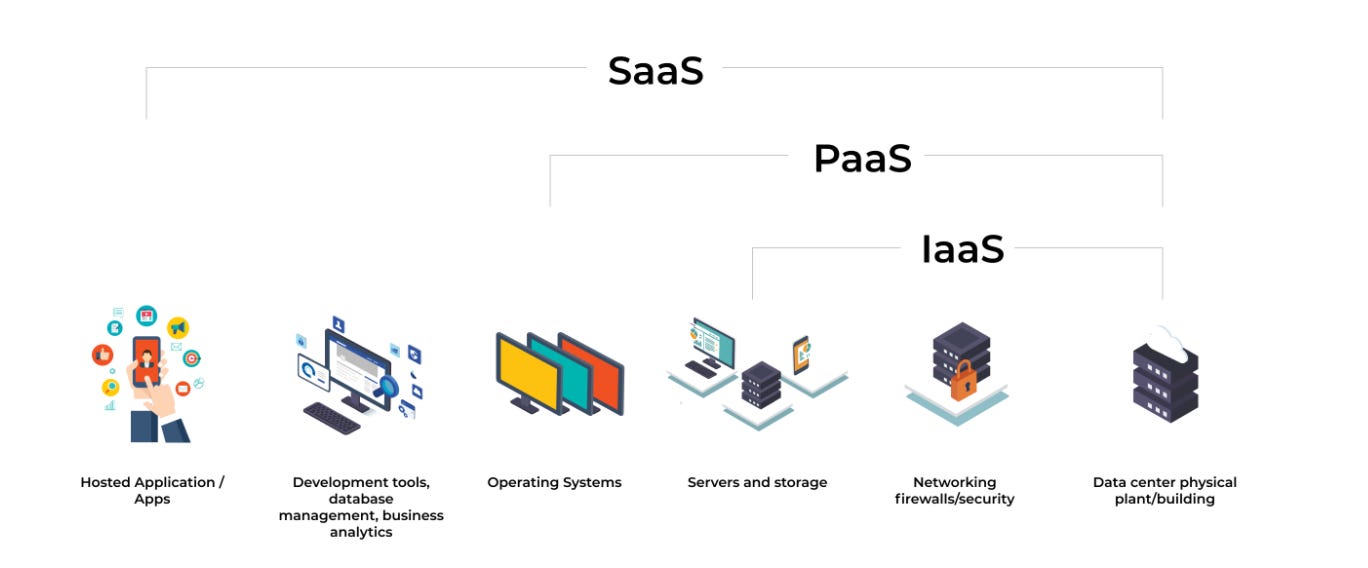

IaaS refers to various hardware infrastructures while PasS (Platform as a Service) refers to platform software, including operating systems, databases and software development tools. PaaS can be seen as software infrastructure. There is also SaaS (Software as a Service), referring to various applications and software like WeChat.

I downloaded the picture below from Microsoft’s Azure cloud website. It explains the relationships of IaaS, PaaS and SaaS very clearly.

The market is essentially dominated by Internet and software companies and its benefit will be under the power of the Matthew Effect eventually. That is to say, several industry giants will eat up most of the market share.

I don’t think the landscape will change much by 2030. Alibaba, Huawei and Tencent will continue to divide the domestic market of cloud computing. And we will wait and see how they perform in overseas markets.

Now let's move the focus to the industry of medical instruments and pharmaceuticals.

This industry will grow under pressure. I’m most concerned with the R&D of innovative medicines and the expansion in overseas markets.

What does it mean to 在矛盾中前行 step forward in contradiction for domestic enterprises of medical instruments and pharmaceuticals?

On the one hand, China's market for generic versions of drugs is huge, which leaves a broad growing room for domestic medical instrument manufacturers and pharmaceutical manufacturers. After all, the market is still dominated by foreign giants.

On the other hand, China's aging population would bring about a rapid increase in medical expenditure for the whole society. The medical insurance system will be under great pressure. So we have to curb the growing speed of medical expenditure in society, which means lowering the drug prices would be one of the main methods.

So for domestic manufacturers of medical instruments and pharmaceuticals, the vast market of domestic substitute drugs could bring sustainable growth while they have to face the pressure of lowering the price. Meanwhile, the R&D on innovative drugs and the expansion in overseas markets could increase their profit.

We must notice that the domestic production of medical instruments and pharmaceuticals is not an option, instead, it’s a must-do task. China has the largest number of elderly people in the world and there will be more. If we don’t replace foreign drugs and medical instruments with domestic generic versions, and if we don't earn profit overseas, the health of all Chinese people will be threatened.

In short, the road ahead for the industry is promising while challenging, but the overall direction is still forward.

The centralized purchasing of the government has become the black swan event for pharmaceutical enterprises in recent years. I believe those who hold shares of pharmaceutical enterprises would have felt it deeply. In the long run, however, our China's policies will be in favor of enterprises committing to innovation, and some of them will become world-class enterprises. By then, we’ll probably understand that centralized purchasing has in a sense created an investment opportunity. You can think about it carefully.

In the field of aerospace:

The cumulative delivery of ARJ21-700 regional airliners will reach 66 by the end of 2021.

More importantly, we were scheduled to deliver the very first C919 airliner at the end of 2021.

But the aviation industry was severely affected by COVID-19, so 中国商飞 COMAC failed to fulfill its goals of delivering 100 ARJ21 aircrafts and the first C919 in 2021.

If the influence of COVID-19 ebbs away in the next year or two, the cumulative delivery quantity of ARJ21 + C919 will reach 500 to 1,000 by 2030.

COMAC will rise to be the top 3 of aircraft manufacturers in the world.

Just 华夏航空China Express Airlines alone planed to purchase 100 ARJ21 and C919 planes, according to an announcement on October 15, 2020. Among these 100 planes, 50 will belong to ARJ21 series, while the remaining 50 will come from C919 series alone or a mix of C919 and other series. These 100 planes are expected to be delivered in 10 years starting from 2020.

CR929 is also underway. If everything goes well, it will be available for airlines by 2030. However, cooperation with Russia always hits many bumps, thus we must manage our expectations.

In the field of space, China will build a basic model of a research station on the south pole of the moon in 2030.

The following is from an interview of 吴伟仁 Wu Weiren, chief designer of China's lunar exploration program, which was conducted by Xinhua in December 2020.

Xinhua: Where is the future direction of the China Lunar Exploration Project now that Chang’e 5 has returned?

Wu Weiren: We aim to land on any part of the lunar surface. And we will build a research station on the moon's south pole. At 89 degrees south of the Moon's south pole, there may be more than 180 consecutive days of light. The rotation period of moon is about 28 days, which means in every period, one side would have 14 consecutive days of light, while the other experiences 14 nights in a row. Without consecutive sunlight, some equipment cannot function continuously.

Wu: A research station on the moon's south pole would allow us to conduct a large, dynamic, all-round and stable observation of Earth. By 2030, we will build a basic model of a research station on the south pole. As the station expands in scale, we can build houses, make bricks, do some 3D printing, and other work. Meanwhile, we can also mine minerals on the moon. These are future directions. Besides, the moon could act like a springboard for us to explore deeper space and farther planets.

In terms of deep space exploration, we plan to launch the Mars sample-retrive mission and explore asteroids and Jupiter in 2030.

Report by Global Times in June 2021:

After the first Mars exploration mission to achieve "orbiting, landing, and roving" in one step, where is the next target of China's deep space exploration aimed at?

China National Space Administration (CNSA) indicated the direction at a press conference on June 12:

By around 2030, we will launch the Mars sample return mission and start our explorations of asteroids and Jupiter.

According to 许洪亮 Xu Hongliang, the Spokesperson of CNSA, CNSA is drafting the “14th Five-Year Plan” for aerospace development. The plan would take international scientific hotspots and China's foundation in engineering technologies into consideration. CNSA has decided to launch a Mars sample return mission, asteroid exploration and Jupiter exploration in around 2030. Besides, it will also implement the Chang’e 6, Chang’e 7 and Chang’e 8 missions, and work with international counterparts, Russians in particular, to determine the feasibility of the international lunar research station.

张荣桥 Zhang Rongqiao, chief designer of China's first Mars exploration mission, introduced the features of these subsequent missions in details.

Zhang said, “Mars will remain the focus of our future explorations. It’s also the focus of international deep space explorations. Because of its close proximity to Earth, Mars has great scientific significance. Besides, we’ll also lay emphasis on asteroid exploration because everyone talks about the harms of an asteroid hitting Earth and asteroids are also rich in resources. Most importantly, despite their small sizes, it’s extremely difficult to explore them and such attempts can push our space technologies to a more refined direction.”

“Here at CNSA, we follow the principle of ‘start early to get an upper hand’. We had begun researching the asteroid sample-return mission when we launched the first Mars exploration mission. We will go with our own pace and reach the goal as early as possible,” Zhang added.

When asked about the reason for Jupiter exploration, Zhang replied, “We know little about the Jupiter system and did quite limited explorations of it. Jupiter hosts abundant opportunities for scientific discoveries. In addition to the scientific significance, Jupiter exploration could also boost the development of technologies for longer-range measurement and control, probes with longer service life, and utilization of new energies because we must rely on new energies to get to Jupiter. Therefore, the exploration of the Jupiter system will develop our space technologies in a profound way.”

As is explained above, asteroid exploration aims at making space technologies more refined because asteroids are small.

In the meantime, the exploration of the Jupiter system, which is even farther than Mars, could enhance the development of technologies for longer-ranger measurement and control, probes with longer service life and new energies.

In addition to the four industries I’ve mentioned above, namely the semiconductor industry, the NEV industry, the medical instruments and pharmaceuticals industry and the aerospace industry, I’d like to add that China will probably start the construction of 400km/h high-speed railway in 2030.

On August 24, 2021, 刘振芳 Liu Zhenfang, head of the National Railway Administration (NRA) said at a press conference that NRA will promote the R&D and application of major technologies, including the 400km/hour high-speed rail.

In conclusion, China has a bright future as long as we maintain our development momentum.

However, we need to stay alert to three risks at all times.

The first is that we should prevent our organizational abilities from weakening, which are the core guarantee of our national development. China’s national rejuvenation is a certain event if we could maintain our organizational abilities. I’m not going to elaborate on this risk here.

The second risk is population plummeting. Because the economic growth rate will slide down before schedule if the population shrinks too quickly.

China's per capita GDP has just exceeded 10,000 U.S. dollars in 2019. Our target is 40,000 U.S. dollars or even 50,000 U.S. dollars in the future, which means in terms of the total economic volume, China’s GDP must grow to two or three times that of the US.

Such an objective requires our economy to grow continuously for decades. However, if the population decreases too fast, the growth of the vast domestic market will be sluggish and the market may even shrink, causing our economic growth to slow down before the gross and per capita GDP reach the required levels for national rejuvenation.

Influenced by the long-advocated family planning policies which see the population as a liability, and the fact that global consumer markets are mainly clustered in Europe and America, possessing 1 billion consumers. For a long time, we produced low-end, labor-intensive products and sold them to developed countries at low prices. Affected by such a trade pattern, we often see ourselves as cheap labor instead of consumers like Europeans, Americans and Japanese. However, through industrialization and continuous industrial upgrading, 1.4 billion Chinese people are gradually transforming from low-end consumers to middle-end and high-end consumers.

Currently, a food deliveryman or a courier makes 5,000 yuan (about 750 U.S. dollars) a month, while their income will increase to 8,000 to 10,000 yuan by 2030. On a global scale, they would be considered as a group with high consumption capabilities.

We must get rid of the backward philosophy and advance with the times. We must realize that China is replacing developed countries as a host of most high-consumption consumers.

If our population shrinks quickly, the momentum of the global consumer market shifting from the West to China will be interrupted. As a result, developed countries with 1 billion high-end consumers would gain predominance.

The third risk is the challenges that we might encounter in the reunification. The reunification would be the coronation of our national rejuvenation. However, foreign powers may interfere. Nonetheless, we have the confidence and the ability to win if we do our things well.

The Russia-Ukraine conflict that broke out in February 2022 serves as a very realistic simulation for us.

Firstly, the West does not dare to wage a war against a major country and they mainly resort to economic sanctions, financial sanctions and providing weapons and intelligence to Ukraine so that it can fight on the frontline. In addition, the weapons the West has provided to Ukraine are all tactical and defensive ones.

Secondly, almost no third-world countries joined the West to sanction Russia even Russia’s national power has declined to such an extent. Developing countries across the world seem to have formed a tacit understanding that developed Western countries have a habit of curbing non-Western developing countries so as to safeguard their superiority forever. This is apparently tinted with hegemony. Therefore, no developing countries in the world followed suit when the West put sanctions on Russia.

However, the Russia-Ukraine conflict also gives us a serious warning. The most shocking of all is that Western countries would freeze all foreign exchange reserves of Russia in their countries. We must think carefully about how to deal with our foreign exchange reserve worth three trillion U.S. dollars.。

We didn’t think it's possible that Americans would ever freeze the offshore foreign exchange reserves of China’s central bank and commercial banks, but we could no longer rule out that possibility. In fact, they have started discussing the possibility and investigating the attitudes of internal stakeholders.

To me, however, it resembles nuclear weapons. Western countries could push the button of confiscating China’s foreign exchange reserves, we could retaliate by doing the same.

Western countries make huge sales revenues in China's market, but such revenues are not merely China’s imports from the West because lots of products and services are produced by Western companies in China. Just think about how many Western brands you saw in China.

These brands also have various assets in China, including lands, factories, equipment and intellectual property.

And every year, we pay a large amount of intellectual fees to Western countries. On June 2, 2019, 王受文 Wang Shouwen, China's vice minister of commerce said that China paid 35.6 billion U.S. dollars of intellectual property fees last year (2018). And we paid 8.64 billion U.S. dollars to the US, accounting for nearly a quarter of the total intellectual property fees .

Of course, the solutions above wouldn’t be enough.

What if the US decides to strike precisely as it did to China's advanced industries?

For example, instead of confiscating all of China’s foreign exchange reserves at once, it swallows 50 billion or 100 billion dollars worth of assets first for some excuses. The US may use the Salami slicing tactics again, as they are doing to Taiwan today.

Therefore, we need more countermeasures.

As I’ve analyzed in this article (see Part 1), the Taiwan independence separatist force is growing rapidly, so mainland enterprises must have adequate preparation to supply chains as soon as possible. Those who rely on Taiwan suppliers must find substitutes and backups. Risk awareness is necessary, in case the situation changes one day and our hands are tied.

The next decade is a critical test. Survive it, the prospects of national rejuvenation, being a developed country and national unity will become reality.

May we pass the test with flying colors.

***

Disclaimer: This newsletter does NOT represent the views of Xinhua, “Chinese media,” or “China.” You’re kindly asked to include something to that effect - and preferably a web link - if GRR is honored to be quoted by you.

To help make GRR sustainable, please consider buy me a coffee or pay me via Paypal. Thank you for your support!