Reviving Chinese unicorns: Challenges and strategies

The recent changes in Chinese unicorns reflect challenges faced by China's technological innovation

Hello! Over the next month, I will be very busy, so there may not be many updates to this newsletter. You might have noticed that I recently launched another newsletter platform, tentatively called Beijing Scroll. This collaborative newsletter is created with some of my friends and colleagues. Recently, more people have been approaching me to collaborate on newsletters, but I often don't have the time to write them. However, many are eager to learn newsletter creation methods, so I created this collaborative platform. It mainly focuses on Chinese politics and social affairs. If you're interested, please feel free to subscribe.

Today's newsletter is about Chinese unicorns. On May 23, Chinese President Xi Jinping chaired a symposium with entrepreneurs and experts in Jinan, Shandong Province, where he posed a crucial question: "What's the main reason for the declining number of new tech unicorns from us?" This underscores his concern about the issue.

To explore further, I want to share an article titled "中国独角兽断崖式下跌,这个问题更值得警惕 The Decline of Chinese Unicorns: A More Worrisome Issue" by Wang Mingyuan, a researcher with the Beijing Reform and Development Commission. The article was published on June 14, from the WeChat blog "Digital Society Development Research Center 数字社会发展与研究," which features insights from Chinese experts and scholars on the development of China's digital technology and its impacts on economy, society and culture.

In today's piece, we have translated and condensed the original article to focus on the key points about the decline in the growth and competitiveness of Chinese unicorns, the factors behind this trend, and potential revival strategies.

The Decline of Chinese Unicorns: A More Worrisome Issue

In 2013, Aileen Lee, a Chinese-American investor, noticing changes in the tech startup industry, coined the term "unicorn" to describe startups valued at over 1 billion U.S. dollars. At that time, there were only 91 unicorns worldwide. However, starting in 2017, the figure grew rapidly reaching over 1,300 by 2022. This far surpassed the number of NASDAQ-listed enterprises with a market capitalization above 1 billion U.S. dollars at the turn of the century.

Unicorns emerged due to accelerating technological innovation, and the combined acceleration of global capital and technology globalization. Unicorns can only appear at the highest stage of globalization humans have witnessed so far. The years leading up to COVID-19 undoubtedly marked the peak of globalization after the end of the Cold War, and also a period when global unicorns increased the fastest.

First, let's look at the geographic distribution of unicorns. If we plot a coordinate graph with the GDP share of each country in the global economy on the X-axis and their share of global unicorns on the Y-axis, we can identify countries where the share of unicorns exceeds their share of GDP. Only seven countries would meet this criterion: the United States, China, India, the United Kingdom, Israel, Singapore, and Vietnam.

Among the top 15 economies in the world, Japan, Russia, Mexico, Italy, and Spain have a much lower share of unicorns relative to their GDP. Particularly noteworthy is Russia, which only saw its first unicorn in 2024. Additionally, large economies with significant populations such as Saudi Arabia, Poland, Bangladesh, Iran, and Pakistan also do not have any unicorns.

Now, let's look at the distribution of unicorns across cities. The cities with the most unicorns are San Francisco, New York, Beijing, Shanghai, London, Shenzhen, Bangalore, Guangzhou, Hangzhou, Boston, Tel Aviv, and Singapore. Except for Sao Paulo, the largest city in Brazil and one of the largest cities in South America, cities with more than 10 unicorn companies are largely located in East Asia, South Asia, the United States, and Europe.

Based on the analysis above, we can see that unicorn companies invariably arise in regions characterized by:

High openness and deep engagement in globalization (especially close exchanges with the global tech hub of the United States in terms of talent, technology, and finance)

Active financial capital (since unicorn startups require substantial initial funding, supported by a well-developed venture capital system)

A relaxed business environment (many innovations face new legal and ethical challenges or may disrupt existing interest structures, so a lenient regulatory environment is necessary to provide ample growth opportunities)

In summary, the number of unicorns reflects a country's depth of participation in globalization and the level of market freedom. Countries with few or no unicorns often have serious problems in at least one of these aspects. For example, Russia lacks economic and technological exchanges with other parts of the world; Japan and Europe do not have developed tech startup markets despite a solid foundation for traditional industries, as they lag far behind the U.S. in financial markets and have more stringent regulations than the U.S.

Current Challenges Facing Chinese Unicorns

Over the past two decades, China has been a key player in globalization, engaging in extensive technological and financial exchanges with the U.S. China has also been an integral part of the global economic and technological landscape shaped by the U.S. post-Cold War. Currently, the Chinese government has been actively embracing globalization, vigorously promoting the development of emerging industries within this global context.

Leveraging its vast market and benefiting from both domestic and international opportunities, China once led the global unicorn boom. From 2015 to 2020, China became the world's most vibrant startup market, with its unicorns growing in number and influence, even surpassing those in the U.S. This underscored China's crucial role in the U.S.-led global technological and economic order, positioning it as a significant beneficiary.

However, since Trump took office in 2017, global economic and technological capitalism has begun to decline. The situation worsened after 2020 as China-U.S. tensions escalated into trade and financial wars. The U.S. implemented strategies to shift supply chains, heightened restrictions on investments and key technology exports to China, and imposed stringent barriers for Chinese enterprises listing on U.S. stock exchanges. Chinese tech startups, once the darling of the world, suddenly found themselves in an awkward position. Globally, the environment deteriorated dramatically; domestically, there were subtle shifts in attitudes toward business internalization and innovation. Consequently, China's unicorns began a downward trajectory.

1. Significant Slowdown in Growth

Chinese unicorns enjoyed peak growth between 2017 and 2022. For example, according to the Global Unicorn Index issued by the Hurun Research Institute, China minted 502 unicorns during this period, averaging over 83 per year. However, in 2023, the number of new unicorn companies in China dropped significantly to only 44, from a high of 120 in 2021. Between 2021 and 2023, the U.S. added over 450 unicorns, widening the gap between the two countries. Although China still holds the second-largest number of unicorns, its total is now less than half that of the U.S.

The global distribution of unicorns is shifting from being evenly distributed between China and the U.S. to being more concentrated in the U.S. Furthermore, economies benefiting from the U.S. supply chain shift policies, such as India, Indonesia, Vietnam, and Singapore, are seeing a rapid increase in the number of unicorns.

2.Significant Decline in Competitiveness

In 2023, among the 10 companies with the largest decrease in valuation, five were based in China while only two in the U.S.; among the 10 companies with the fastest-growing valuations, five were from the U.S., while only two were from China. Notably, the valuations of OpenAI and SpaceX alone jumped over 900 billion yuan (about 124 billion U.S. dollars), almost surpassing the total valuation growth of all other unicorns globally. The rapid decline in valuations has also significantly affected Chinese unicorns' market capitalization at the time of their IPOs. In 2021, the average market capitalization of unicorns on the first trading day stood at 110 billion yuan, but the figure plunged by more than 80 percent, to 24.7 billion yuan in 2022.

Recently, an article published by the WeChat blog "IT桔子 IT Juzi" went viral. The article pointed out that both China and the U.S. saw huge falls in the number of new unicorns. Admittedly, the global tech startup markets are shrinking, as the article claimed, amid rising global conservatism. However, the problems in China's tech starup market are more severe than in other countries. Although the growth of unicorns in the U.S. has also significantly slowed in the past year, the U.S. tech startup market remains a bright spot, with major breakthroughs in key areas further strengthening the U.S.'s technological advantage. More importantly, the U.S. tech startup market is grappling with local and temporary difficulties. In contrast, Chinese tech enterprises are navigating a comprehensive and highly uncertain external environment, putting them under far greater pressure than their American counterparts.

3.Significant Lag in Soft Technology Development (in terms of industrial structure)

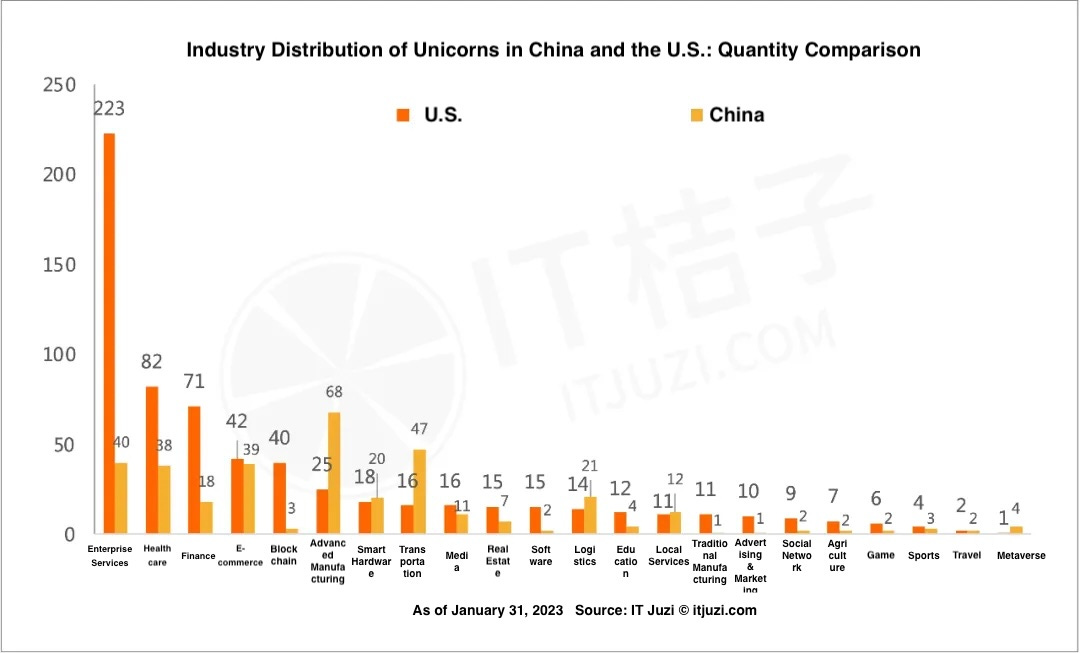

In recent years, it has been suggested that China underperforms in hard technology, while its soft technology is overly abundant, leading to "overcapacity" and excessive occupation of social resources, which disrupts the normal economic order. However, a comparative analysis of the industry distribution of unicorn companies in China and the U.S. offers a different perspective. American unicorns are predominantly concentrated in four sectors: enterprise tech with a focus on AI and big data, financial technology, blockchain, and biological medicine, all associated with soft technology. Contrastingly, China has an edge in hard technology, boasting a strong presence in advanced manufacturing, automobile technology, and intelligent hardware.

In the advanced manufacturing sector, for example, the U.S. had 25 unicorns by the end of January 2023 while China had 68, accounting for nearly 40 percent of the global unicorns in this field. In enterprise tech focused on AI and big data, China only had 40 unicorns, compared with 443 in the U.S. On the whole, Chinese unicorns are weak in soft technology yet strong in hard technology.

The differences can be attributed to the distinct development realities and industrial policies of each country. Practically speaking, China, currently in the stage of industrialization and urbanization, naturally excels in manufacturing and consumer goods. This is common in the industry distribution of unicorns in developing countries. The concentration of unicorns in these industries has also been boosted by the country's industrial policies over recent years.

Last year, China's semiconductor, chemicals, machinery, and automobile sectors garnered investments worth more than 400 billion yuan, accounting for about 70 percent of the total in the equity investment market. This brought the total investments in hard technology to over 500 billion yuan. In stark contrast, investments in digital technology, AI, and the internet sectors were merely 85 billion yuan, not to mention that the financial technology sector received 6.7 billion yuan in investments — a record low. If the investment market was overly concentrated in the "soft technology" field before 2020, it now seems to have swung to the opposite extreme.

How to Revive Chinese Unicorns

The recent changes in unicorns over the past two to three years reflect challenges faced by China's technological innovation. These challenges are unprecedented, testing our ability to cope with evolving global dynamics. In response, the following measures are crucial for maintaining entrepreneurs' confidence and ensuring a favorable environment for business growth.

1.Properly Balancing National Interests and Participation in Globalization

Chinese enterprises currently face unfair treatment in the global market, leading to calls for retreat from globalization and a return to self-reliance. Nonetheless, it is crucial to recognize that all emerging tech sectors are highly internationalized. Without prompt information and talent exchanges, a company would be isolated from the global mainstream system in R&D and production, struggling to keep up in just two to three years. Without market globalization, a company would find it challenging to grow into a global industry leader. Given the complex international landscape, the challenge is to safeguard national interests and counter international bullying while fostering a favorable external environment for Chinese businesses and industries.

2.Properly Balancing the Healthy Growth of Capital with Addressing Market Irregularities

In recent years, the capital market witnessed a misallocation of resources in a desperate bid for short-term profits. We must understand that a mature and robust capital market is essential for the development of the tech startup market. Over the past three years, however, the capital market has seen a significant contraction, with venture capital (VC) and private equity (PE) investments plummeting from approximately 1.4 trillion yuan in 2021 to 692.8 billion yuan in 2023, a decrease of over 50 percent. This has lead to a lack of essential funding for innovation projects. Therefore, while rectifying market chaos, it is crucial to prevent the capital market from shrinking. Moving forward, China should continue to proactively encourage the development of VC and PE, especially fostering patient capital critical to the long-term success of startups.

3.Balancing Sound Regulatory Frameworks with Stable Business Confidence

A sound regulatory framework is necessary for an industry to achieve sustainable development. In creating a new regulatory framework, it is essential to avoid drastic and unpredictable policy shifts to help businesses develop market expectations and build market confidence. As Professor Lu Ming, a member of the 14th National Committee of the Chinese People's Political Consultative Conference (CPPCC), emphasized at the "two sessions" this year, negative and restrictive policies should be cautiously introduced to avoid irreversible damage to industrial development, especially under economic downturn and intensifying China-U.S. competition.

4.Balancing "Soft" and "Hard" Technology Fields

In many "hard technology" sectors, China faces constraints imposed by the U.S. and must overcome these bottlenecks to avoid long-term dependency. At the same time, China must not neglect the “soft technology” fields. Future industrial competition will be increasingly determined by emerging industries based on AI, blockchain, data analysis, and fintech—soft tech sectors. The swift rise of OpenAI serves as a compelling example, and recent breakthroughs in large language models in the U.S. reveals the growing disparity in emerging sectors between the two countries.

China has made some achievements in the developing soft tech sectors in the past few years, producing several world-class internet companies, but it does not imply an overabundance of development in soft tech. Quite the contrary, China still trails the U.S. in this area. Moreover, developed soft tech is a prerequisite for advancing hard tech. For example, China's burgeoning new energy vehicle sector has thrived partly due to the sophisticated digital infrastructure laid down over the years. Looking forward, China should enhance its support for soft tech innovation while focusing on hard tech development, instead of favoring the latter and neglecting the former.

In conclusion, China should continue to cultivate more unicorns as the future of the world lies in the hands of young, outstanding entrepreneurs and their emerging businesses. If economic development stalls for too long, a steep downturn is likely to follow. The same holds true for innovation. Therefore, reviving unicorns is an urgent priority.

Russia is doing just fine without unicorns. She leads or is one of the world leaders in space tech and military tech, which are at the cutting edge. Many game-changing innovations have their roots in military investments. Soft tech unicorn is overrated. Most are easily replicated. Ok, so you’re the first Netflix. The US has/had a lead in content streaming because of it. So, what? You’re the first blockchain. So what? A lead in hard tech is much more valuable. Battery technology, material designs, propulsion systems, manufacturing tools, etc. Even the more valuable soft tech are those that interface and interact with the real world, such as computer vision and robotics. Hard tech is really the “harder” field, compared to soft tech — it actually deals with physical constraints. What would happen to the real economy if Facebook didn’t exist? What would happen if CATL or BYD didn’t exist? Until we are all plugged in and live in the metaverse 24/7, hard tech is what really matters. Also, an abundance of unicorns could mean rampant speculation and severe misallocation of funds.