Top dogs, rat race, leapfrogging -- A look behind provincial GDP figures in China

Economic development has become the foremost priority in China, from the state to local regions, from the government to society, and from enterprises to individuals.

China's optimization on its COVID response has set free the vigor, resilience, and yearning for economic growth long suppressed by stringent pandemic measures. Eager to kickstart production and dislodge the hanging gloom over consumer confidence, city and provincial administrations are now launching every means of stimulation, whether it targets consumption, foreign trade, or foreign investments.

The following article was published on Jan. 29 on Guominjinglue [国民经略, "state strategies"], a WeChat blog with a particular focus on prefectural and provincial development in China. Based on the 2022 province GDP numbers, it offers a window into how several aspects of China's economic development have performed over the previous year, which could provide them an advantage in the post-pandemic recovery.

Here are some highlights:

South China’s Guangdong Province and east China’s Jiangsu Province still led the way, remaining as the only two major economic powerhouses with their gross domestic product (GDP) exceeding 10 trillion yuan (about 1.47 trillion U.S. dollars). Guangdong has ranked first for 34 consecutive years, while Jiangsu has come second for 30 years in a row.

Among the top five, east China’s Shandong Province, ranking third, attained the fastest GDP growth in real terms, giving it a bigger advantage over east China’s Zhejiang Province, which fell right behind.

East China’s Shanghai and northeast China’s Jilin Province had negative growth for the first time since reform and opening-up

Shanghai, however, managed to turn the corner with great resilience. Its economy saw a strong rebound in the second half of 2022. That not only kept Shanghai at the top among the best-performing cities, but also gave it a bigger edge over Beijing.

Anhui surpassed Shanghai and made to the top ten for the first time.

The biggest change in China's economic landscape in 2022 was a further narrowing of the gap between south China and north China.

Driven by the once-in-a-century pandemic, geopolitical conflicts and global inflation, the prices of coal, petroleum and other commodities skyrocketed. As a result, major energy provinces that had long been plagued by outdated capacity became a hot spot in the new era.

Another trend in regional landscape in the past few years was that southwestern regions were catching up with northeastern regions.

All eyes on economy as 2023 unfolds.

This follows years of reshuffles in regional development when the once-in-a-century pandemic, geopolitical conflicts, and trade disputes held sway over the economy.

Now, which regions will thrive in the post-pandemic era?

01 Who led the way?

Which provincial-level regions took the economic lead in 2022?

South China’s Guangdong Province and east China’s Jiangsu Province still led the way, remaining as the only two major economic powerhouses with their gross domestic product (GDP) exceeding 10 trillion yuan (about 1.47 trillion U.S. dollars). Guangdong has ranked first for 34 consecutive years, while Jiangsu has come second for 30 years in a row.

[GRR's note: Both provinces now have their eyes on the international market, with Guangdong pledging 100 “Guangdong Trade Global” overseas exhibitions and Jiangsu announcing support for enterprises in attending 206 offline fairs and exhibitions overseas. Jiangsu ranked first in the actual use of foreign capital in 2022, and is determined to keep up the momentum by leveraging its overseas economic representative offices and inviting representatives from multinational companies and foreign business associations to visit Jiangsu. Guangzhou, the capital city of Guangdong, also unveiled targeted preferential policies with up to 100 million yuan as a reward for paid-on foreign investments.]

Among the top five, east China’s Shandong Province, ranking third, attained the fastest GDP growth in real terms, giving it a bigger advantage over east China’s Zhejiang Province, which fell right behind.

[GRR's note: Shandong has released on Feb. 2 ten measures to stimulate consumption and protect consumers' rights.]

The gap between central China’s Henan Province and Shandong and Zhejiang also widened.

[GRR's note: The commerce department of Zhejiang sent a Chinese-English bilingual letter to foreign investors on the first working day after the week-long Spring Festival holiday that started on Jan. 21, demonstrating its “strong resolve, extraordinary measures, and diligent efforts” to attract global investment and cooperation. The first investment promotion group after the Spring Festival holiday is also due to leave in early February.]

Despite remaining as the top two performers, Guangdong and Jiangsu saw the lowest yearly GDP growth rate in real terms among the top ten for the first time, mirroring what huge shocks the pandemic has wrecked.

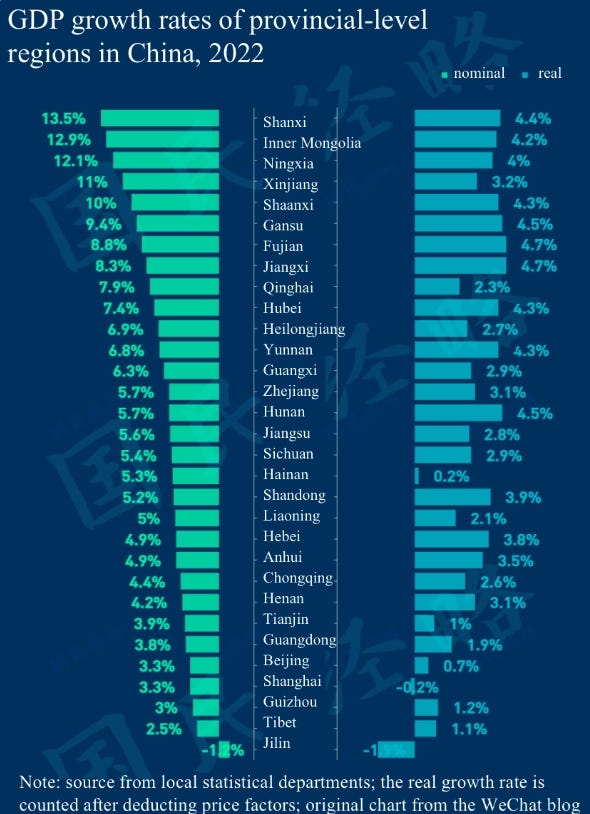

A similar impact was also felt in the year-on-year GDP growth rate (in real terms) of other provincial-level regions. East China’s Shanghai and northeast China’s Jilin Province had negative growth for the first time since reform and opening-up; south China’s Hainan Province recorded a close to zero growth rate; Beijing saw its growth rate fall below 1 percent; the figure dropped to 1 percent or so in southwest China's Guizhou Province and the Tibet Autonomous Region that had always posted high growth rates.

Shanghai, however, managed to turn the corner with great resilience. Its economy saw a strong rebound in the second half of 2022. That not only kept Shanghai at the top among the best-performing cities, but also gave it a bigger edge over Beijing.

It is worth noting that although Shanghai managed an overall triumph at the city level, at the provincial level, it was surpassed by east China’s Anhui Province, which got into the top ten for the first time.

Among the top ten, southwest China’s Sichuan Province, central China’s Hubei Province and east China’s Fujian Province were locked in an increasingly tight competition as their GDP passed the 5 trillion yuan mark.

A robust recovery in the post-pandemic era got the GDP of Hubei back into the top seven.

[GRR's note: In January, 2023, Hubei launched pilot programs for implementing export tax rebates upon departure of goods, the first of its kind in China. Exporters across the province can apply for getting the tax rebates in advance, without going through the regular procedures such as preparing relevant documents, thus speeding up fund turnover.]

But Fujian, after being overtaken by Hubei in 2021, took up the pace in 2022 and narrowed their gap to less than 100 billion yuan. It is also catching up with Sichuan.

Who will be the next front runner is now a question of not only economic fundamentals, but also the will to press ahead.

02 A reshuffle in the top 10 provinces

Anhui surpassed Shanghai and made to the top ten for the first time.

In the past decade, Guangdong, Jiangsu and Shandong have stayed at the forefront of the economic race. But there have been changes in other names on the top 10 list. Liaoning Province and Heilongjiang Province in northeast China, Hebei Province in north China and Shanghai dropped out of the list over the years, while Fujian, Hunan and Anhui rose to prominence. [Shanghai is a province-level city in China]

How did Anhui surpass Shanghai in 2022?

Leaving aside the fallout of the pandemic, the outperformance was a result of both policy support and hard work.

These years, Hefei, capital city of Anhui, came to fame for the big bets and venture investments it made.

For the past dozen years or so, the city and the entire Anhui Province have wagered on high-tech sectors including new display, integrated circuit, and new energy vehicles, in an effort that finally completed an upgrade from traditional to emerging industries. [GRR's note: Chinese electric vehicle maker Nio has two factories in Hefei.]

Apart from that, national policy also played a contributing role.

There have been three important milestones in Anhui's development, all accompanied with major policy decisions. In 2006, China implemented the “Rise of Central China plan”. In 2016, China set out a mid-to-long term plan (2016-2030) for expanding its high-speed rail network (to eight rail lines north to south, and eight lines east to west). In 2019, China issued an outline of the integrated regional development of the Yangtze River Delta that encompasses Jiangsu, Zhejiang, Anhui and Shanghai. This completely reversed the disadvantageous situation Anhui faced for its geographical location in the hinterland.

The first and the third decisions, in particular, paid huge dividends for Anhui from two adjoining economic zones.

The second policy on expanding the high-speed railway network raised Anhui from the edge of the normal train network and transformed it into a new transportation hub. Anhui's high-speed railway mileage, in the meantime, has made it to the national top.

Data showed that Anhui’s high-speed railway mileage reached 2,400 kilometers by the end of 2022, second only to Guangdong.

Of course, national policy just added to its success, which ultimately came down to its own efforts.

03 South-north gap narrowed again

The biggest change in China's economic landscape in 2022 was a further narrowing of the gap between south China and north China.

Data showed that in 2022, the combined GDP of 16 provinces in southern China reached 77.77 trillion yuan while the figure was 42.62 trillion yuan for the 15 provinces in northern China.

Southern regions saw their contribution to national GDP fall to 64.58 percent, while northern regions witnessed their share in GDP rise to 35.42 percent. The change narrowed the south-north gap to 29.2 percentage points, the reverse of what had been happening in the past decade and more.

Does this mean the economic center of gravity no longer shifts southward?

Afraid not. There was a time when north China was able to rival south China. In the beginning of reform and opening-up, for instance, the share of north China GDP accounted for up to 46.2 percent of China’s economy . By 2020, however, the figure had dropped to a record low of 35.2 percent. Despite the slight increase to 35.4 percent, it still has a long way to go before being able to actually reverse the current trend.

In fact, economic growth in north China in the past few years relied heavily on major energy-producing provinces, yet the golden age for traditional energy would vanish at any second.

Driven by the once-in-a-century pandemic, geopolitical conflicts and global inflation, the prices of coal, petroleum and other commodities skyrocketed. As a result, major energy provinces that had long been plagued by outdated capacity became a hot spot in the new era.

It can be seen that in 2022, the nominal GDP growth rates exceeded 10 percent in northwestern provinces including Shanxi, Inner Mongolia Autonomous Region, Shaanxi Province, Xinjiang Uygur Autonomous Region and Ningxia Hui Autonomous Region.

In Shanxi, the largest coal producer in China, GDP jumped 45.26 percent in nominal terms from 1.77 trillion yuan in 2020 to 2.56 trillion yuan in 2022, sending the province back into the top 20.

Previously, such growth momentum was only seen in coastal provinces turning to foreign trade after China joined the world trade organization (WTO).

However, neither the pandemic nor the energy spree will last long. How the energy-endowed provinces can continue the glory in the post-pandemic era is definitely worth attention.

04 Southwest China overtaking northeast China?

Another trend in regional landscape in the past few years was that southwestern regions were catching up with northeastern regions.

The three northeastern provinces used to be China’s economic powerhouses around the time of reform and opening-up. They were not only way ahead of other provinces in terms of overall strength, but also laid the industrial foundation for western China through the Third Front Construction [For more details, check GRR's previous post How China prepared for potential invasion from Soviet Union with mankind’s largest doomsday project]

But times have changed. The Western Development Strategy launched in 2000 and the policy of moving industries westward in the past few years have given a huge boost to economic development in southwestern regions.

According to the latest data, the total GDP of western leader Sichuan amounted to as high as 5.67 trillion yuan, while that of its northeastern counterpart Liaoning was 2.89 trillion yuan, only half as much.

In fact, Liaoning was even overtaken by Chongqing, and its gap with Yunnan was narrowed to about 2 billion yuan, with the latter’s GDP being 2.985 trillion yuan in 2022.

At the same time, south China’s Guangxi Zhuang Autonomous Region and Guizhou got a bigger advantage over Heilongjiang and Jilin while narrowing its gap with Liaoning.

Once the late movers catch up, southwestern regions outpacing northeastern regions will become reality. [Note: Liaoning has released some new moves to grab export orders. For enterprises that attend key overseas trade fairs and exhibitions, the provincial government will cover 100 percent of the booth fee for the first six standard trade show booths (ranked from high to low) and no more than 50 percent of the booth fee for the remaining booths. Private enterprises will get a subsidy worth 100 percent of the booth fee in key overseas fairs and exhibitions.]

05 Economy is the first priority

Time waits for no one in the economic race.

On Jan. 28, the first working day after the week-long Spring Festival holiday, the Guangdong government held a conference on high-quality development. Attended by more than 25,000 people, the meeting was reported to be the largest-scale meeting held by the Guangdong government in recent years.

At the meeting, government officials called for concerted efforts to shoulder responsibility with courage and insight, the capability to promote development across the province, and a good start to the new year.

The same emphasis on economic development was seen at the first meeting of other regions like Shanghai, Jiangsu, Shandong, and Zhejiang.

Although the pandemic has not come to a complete end, it is no longer the biggest drag on the economy and Chinese people are no longer living with “health codes” after the country passed the first wave of infection.

Economic development has become the foremost priority in China, from the state to local regions, from the government to society, and from enterprises to individuals.

I really appreciate the thoroughness of your writing!

ok, so how do we profit from this? is there a native anhui play?? like a like 9988.hk baba?

All I see is that shipping/trucking costs in past 2-3 years have gone astro, almost parity to USA now

Also the SE-ASIA high-speed rails are complete,

Are there really enough customers in the world to absorb all this activity?

Will people just sell to themselves, or this this all just 'bank of china' ( rockefeller ) chinese dollars getting re-cycled in the same pocket pants or running around the same vehicle playing chinese fire drill?

Again, does anybody profit from anhui? buy local real-estate or REITS?

Having traveled widely the past 40 years all over China, I agree its the most exciting and advanced place on earth;