What is the future of China's chipmaking after the U.S. chips bill?

Chip is the “atomic bomb” of this era and the high ground that great powers fight over.

The U.S. administration has recently kept making moves in the chip sector. According to Reuters, chip designer Nvidia Corp (NVDA.O) said on Wednesday that U.S. officials told it to stop exporting two top computing chips for artificial intelligence work to China. A day later, China's Ministry of Foreign Affairs responded at a press conference that the US seeks to use its technological prowess as an advantage to hobble and suppress the development of emerging markets and developing countries. On the same day, the Ministry of Commerce also made it clear that the US harms both the legitimate rights and interests of Chinese companies, and that of the U.S. companies.

Earlier this month, Xinhua News Agency released an English commentary arguing the U.S. chip bill is good for no one in response to The Chips and Science Act signed by U.S. President Joe Biden on August 9.

Today's post brings you a piece on the "chip battle" between China and the US. The original article was posted on Aug 16 by 巨潮WAVE, a Wechat blog dedicated in offering investors information. In four parts, the piece shares some ideas about how China's chip industry thrived in the past decade, what role Taiwan plays in the battle, what moves the US has made against China, and where the future lies for China.

The original title is 中美芯片,围剿与反围剿 The battle over chips between China and the US.

The anti-corruption campaign is making huge strides in China's chip industry. Related figures, including the current and former general managers of large foundations, heads of departments, and even many senior executives of Tsinghua Unigroup are under investigation.

Meanwhile, the global chip industry is also going through turbulent days. U.S. President Joe Biden signed the CHIPS and Science Act of 2022, the most important document in this eighty-year-old man's life. According to the act, the U.S. government plans to pour 52.7 billion U.S. dollars in chips.

The US made it clear that it will continue to reinforce its "dominance in science and technology", and it will curb and even halt China’s technological progress. "And that's going to help America win the economic competition of the 21st century ... " said Biden on the same day.

Just a week ago, U.S. House Speaker Nancy Pelosi visited Taiwan, casting a shadow over the region. In her hurried trip, This "No. 3 figure in U.S. politics" arranged a meeting with the chairman of TSMC, underscoring the importance of the world’s largest chip manufacturer.

As you can see, chip is the “atomic bomb” of this era, the high ground that great powers fight over, and the battleground of the tech war.

At present, the international situation is fickle. The U.S. chips bill foreshadows the accelerated decoupling of participants in the global industrial chain, of which the chip industry is an example.

Chinese chip, together with the nation's fate, reaches the crossroads of the times. This is a grand war without smoke.

01

Eight years of thriving

The "Big Fund" (China Integrated Circuit Industry Investment Fund) was established in 2014. After eight years of painstaking efforts, China's chip industry has made huge progress.

The "Big Fund" is the largest industrial fund in China by far. It initially raised 138 billion yuan (about 20 billion U.S. dollars) and was mainly spent on IC design (integrated circuit design) and wafer manufacturing. The second phase of the fund raised over 200 billion yuan in 2019, focusing more on components of the upstream, such as equipment of semiconductors and materials.

Compared with the chip subsidies proposed by the U.S. government, the Big Fund runs under the investment guidance of "market-oriented operation and professional management." Besides supporting many competitive Chinese chip enterprises in sub-segments of the chip industry, the fund also made considerable investment returns.

Not long ago, the Big Fund gradually withdrew from its first-phase projects, and invested in second-phase projects, forming a virtuous circle. This confirms that many chip companies have passed the early stage when they needed a “helping hand”.

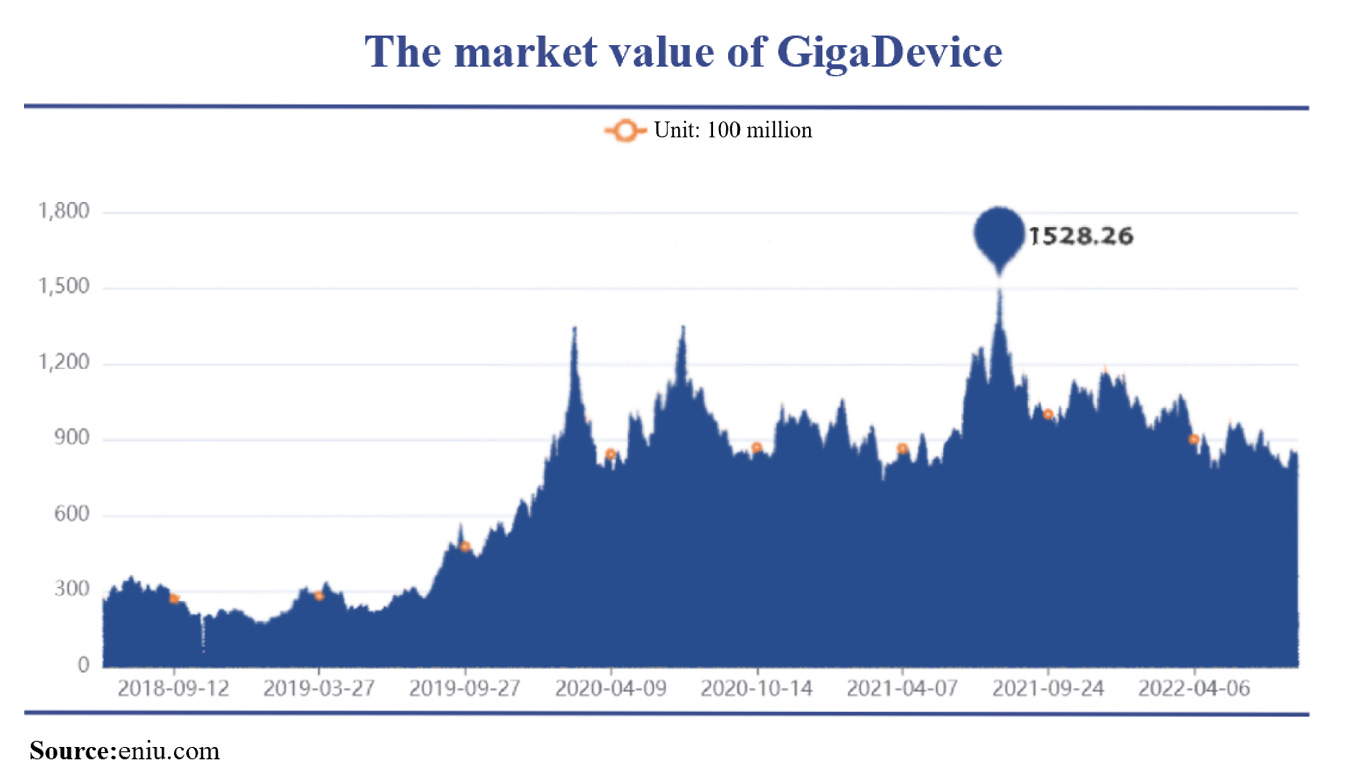

For example, GigaDevice 兆易创新 is now ranked as the third largest NorFlash enterprise in the world and dominates Hefei Changxin 合肥长鑫, the leader of DRAM (dynamic random access memory) manufacturing in China. GigaDevice earned a place in the mainstream market, and is no longer a marginal player.

Memory chip has always been a weak spot for China’s semiconductor industry. Yangtze Memory 长江存储 and Hefei Changxin 合肥长鑫 made the first step in making memory chips. At the end of 2020, Yangtze Memory became the world’s seventh largest NAND Flash maker. Moreover, according to the expansion plan, Yangtze Memory will raise its market share to six percent. Thus breaking the monopoly is just around the corner.

SMIC and Hua Hong are the fifth and sixth largest chip foundries in the world, respectively. Combined, the two companies take up nearly nine percent of the market share. While the semiconductor industry moved into a downward phase, the performance of SMIC was the best in its history. In the first half of 2022, SMIC achieved revenue of 3.745 US billion dollars, a year-on-year increase of 53 percent. Its net profit assigned to the parent company was 962 million US dollars, growing by 14 percent compared with a year earlier. In the second quarter, revenue from the Chinese mainland and Hong Kong accounted for nearly 70 percent of the total. Domestic substitution and the rise in the price made SMIC swim against the tide.

SMIC is the pillar of chipmaking in the Chinese mainland. The technology for producing 7-nanometer chips is already in place, the only piece missing is the Extreme Ultraviolet Lithography (EUV) machines. However, due to a lack of high-end lithography machines and EDA (electronic design automationsoftware), SMIC is limited to the 14 nm process or less.

Therefore, chipmaking in the Chinese mainland needs a breakthrough in domestic semiconductor equipment if any progress is to be made. Recently, Shanghai Micro Electronics Equipment 上海微电子 said that it has the hope of deliveribg domestic lithography machines for the 28nm process this year. Though still generations behind the 7nm process and the 5nm process, progress is visible.

Furthermore, the Big Fund has also invested in JCET Group 长电科技, the world’s third largest packaging and testing company, domestic equipment leaders NAURA Technology 北方华创, and AMEC 中微公司, two companies from which Yangtze Memory purchased etching, heat treatment, and other equipment.

After eight years of efforts, China’s chip industry chain has thrived. Domestic substitution is steadily underway, and great strides have been made in corporate competitiveness and performance. The Big Fund plays a significant role in these achievements.

Therefore, no one can deny its accomplishments despite drastic changes in the personnel of the Big Fund and chip manufacturers. The rise of China's chips will not be impeded. The future ahead is bumpy yet promising.

Meanwhile, we should be soberly aware that compared with the United States, Japan, South Korea, and the Taiwan region, the mainland's capability in the chip industry is still weak. The gap is still wide, especially for high-end chips.

But little steps will accumulate over time to build big things. At this moment, we must remain faithful, no matter what happens.

02

The indispensable Taiwan

The significance of chips produced in Taiwan Province can be seen from the import and export data.

In 2021, the Chinese mainland bought 1.6 trillion yuan worth of goods from Taiwan, of which chips accounted for 62 percent, reaching more than one trillion yuan.

Taiwan has always been the largest source of chips for the mainland. Last year, the mainland's integrated circuit imports reached 439.7 billion U.S. dollars, among which Taiwan is ranked first, accounting for more than one-third (about 36 percent) of the imports. South Korea is ranked second with one-fifth of the imports, followed by Malaysia, Japan, Vietnam, the US, and the Philippines.

The mainland may be geographically close to Taiwan Province, but they are poles apart in terms of their respective status in the global chip industry.

The global chip market is basically dominated by the US, Japan, South Korea and the Taiwan region. Taiwan's semiconductor output value is second only to that of the US. Taiwan is the undisputed number one in the world in terms of foundries, packaging and testing, the runner-up in IC design. Its prosperity in chips is attributed to the flourishing of the whole industrial chain. In particular, Taiwan Province is the absolute leader in the most difficult and most exquisite manufacturing process.

TSMC dominates the foundries, occupying 54 percent of the global chip manufacturing market share. Such a market share can almost be called a “monopoly” in any market-oriented industry.

In the field of advanced semiconductor device fabrication, TSMC is an absolute leader. Only TSMC and Samsung are capable of producing chips with transistors of 5 nanometers or less, and 92 percent of the world’s chips with a process of 10nm and below are provided by TSMC. TSMC chips are used in the products of tech giants such as Apple, AMD, Qualcomm, Nvidia, and Intel.

Morris Chang [the founder of TSMC] once “insinuated” that the mainland could never make high-end chips, and this is the key reason. SMIC, the most advanced chip manufacturer in the Chinese mainland, has been putting off the mass production of 7nm chips, while TSMC has began the adventure into 2nm process.

In addition to TSMC, Taiwan’s chip foundries include UMC 联电, Powerchip 力积电 and Vanguard International Semiconductor 世界先进, which rank 3rd, 7th and 8th in the world, respectively. Together, they account for 64 percent of the world’s market share.

As for IC design in the upstream, Taiwan is second only to the US, with MediaTek 联发科, Novatek 联咏 and Realtek 瑞昱 ranking fifth, seventh, and eighth in the world, respectively.

As for testing and packaging, half of the world's top ten companies come from Taiwan, including ASE Group 日月光 (including SPIL 矽品), Powertech 力成, King Yuan Electronics 京元电子, ChipMOS Technologies 南茂, and Gubang Technology 顾邦科技. Together, they occupy 41 percent of the world’s market share.

As we know, China is heavily dependent on chip imports, purchasing 60 percent of the chips produced globally every year. The Chinese mainland and Taiwan are naturally separated by a narrow strip of water. As the world’s largest semiconductor market, the mainland has a strong demand for the electronics industry, and needs a complete chip industry chain. And the economic development of Taiwan Province also needs the firm support from the mainland.

Last year, the food, fruits, and other goods imported by the mainland from Taiwan only accounted for 0.11 percent of the island's production. The tropical fruit imports and aquatic products suspension is rather symbolic, which will not affect the big picture. The key remains in chips.

The chip industrial chain in the mainland and Taiwan Province are so closely connected yet so far apart. Due to the US's attempt to curb China's technological progress, TSMC is unable to supply high-end chips to Huawei.

In the face of the brutal reality, China’s chip industry must be prepared for a long-term war, and must also adopt a wiser strategy to deal with the forces that try to keep China’s chip industry down.

03

The pressing “counter-encirclement”

Chip is the “nuclear weapon” the US have in hand to crackdown on China's technology. At present, the US begins to launch all-round encirclement, and plans to play “three cards”.

The first card is to block China from key areas that the US is good at. Three days after the signing of the chips bill, the US officially announced that it would impose export controls on EDA software designed for the development of integrated circuits with Gate-All-Around Field-Effect Transistor (GAAFET) structure, and the fourth-generation semiconductor materials including Gallium Oxide (Ga2O3) and diamonds.

As a successor to FinFET, GAAFET technology approaches are key to scaling to 3 nanometer and below technology nodes. For example, TSMC plans to introduce GAAFET technology to the 2nm process.

In other words, this move is intended to restrict China’s advances in the chips with transistors of 3 nanometers or less, and block China's fabless semiconductor companies efforts into conquering 3nm process.

On August 8, SMIC is rumored to have suspended its new 12-inch wafer CIM localization project because the contractor could not meet the demand of CIM software localization. The blockade of EDA software imposed by the US turns out to be a precisive strike.

The second card is to establish a chip alliance and batter China, as the chips bill only serves as an “appetizer”. The US attempts to build a so-called "Chip 4 Alliance" with Japan, South Korea and Taiwan, so that China will be isolated.

In her visit, Pelosi met with Mark Liu 刘德音, the Chairman of TSMC, aiming to nudge TSMC into the "chip alliance" with every means, and hinder China’s industrial upgrading from the source.

The third card is the “carrot and stick” policy that the US has always followed. In the CHIPS and Science Act, the US plans to invest 52.7 billion US dollars, of which 50 billion U.S. dollars will go to chip manufacturing over the next five years, coupled with tax credit for companies that invest in the semiconductor industry.

In addition to chips, the U.S. government will spend 200 billion U.S. dollars in the coming decade to promote scientific research on artificial intelligence, robotics, quantum computing, etc.

As for the "stick", the US resorts to various means to win over chip companies through its own “supremacy” in the political, capital, and scientific fields.

For example, the bill makes special mention of China. Subsidized companies must notify the secretary of commerce if they have substantial plans for the expansion of semiconductor capacity in China (exept for legacy semiconductors). Otherwise, the US will make a decision whether to withdraw any subsidies.

It is noteworthy that the act also plans to spend 200 million U.S. dollars on fostering talents, and it will broaden participation in microelectronics education for elementary school, middle school, high school, undergraduate, and graduate students. And the chip industry will lay a foundation for the work of the next generation in the US. As the Chinese saying goes, "It takes ten years to grow a tree and a hundred years to bring up a generation of capable people". The US is also well aware of the importance of “the development of semiconductors must start with the kids”.

According to Pat Gelsinger, CEO of Intel, the bill is perhaps the most important industrial policy introduced by the US since the end of World War II. Some even consider the bill as the modern version of Wassenaar Arrangement.

Looking back on history points out direction for the future. The global history of integrated circuits is an intricate economic war with ups and downs. Semiconductor technology was born in the United States. With the support from the US, Japan caught up, then it was overtook by South Korea and Taiwan. Thus, no country or company can remain invincible in this industry forever. The stories of ferocious competition are both striking and cruel.

In the face of the encirclement, it is pressing for Chinese chips to fight back. Independent research and development is the undoubted priority. Take Japan and South Korea as examples. They have pooled nationwide efforts to develop the chip industry. And huge investments were still made even when the industry was at a low ebb, which brings them the current success.

In 2021, 55 percent of the world's investment into the R&D of semiconductors came from the US, while merely 3.1 percent came from China. Therefore, strategic investments at the national level, mainly via the Big Fund, can only be strengthened, not contracted.

In the past decade, China has witnessed its chip industry heading onto the right track. If we continue with the industrial policy support, capital accumulation will become increasingly mature, and a sufficient number of talents will join the industry. Small changes will amount to a sea change eventually.

Second, we must rely on cross-border tech acquisition and international cooperation. Though the encirclement is hard to break, in Europe, Israel, and even Southeast Asia, there must be light in the cracks.

Despite endless meddling by the US, chip companies around the world don't want let go of China, which is the world's largest chip market. This is the basis for China to get an upper hand in the global chip battle.

For example, ASML was unable to export high-end EUV lithography machines to China, but the company was unwilling to ban the sale of DUVs in the field of mature process nodes. "They’re a very significant supplier of the global markets. So, we just have to be careful what we are doing," said Peter Wennink, CEO of ASML. Despite various obstructions, ASML delivered 21 DUVs to the Chinese mainland in the first quarter of 2022.

A notable matter is that when Pelosi visited South Korea not long ago, South Korean President went on a vacation to “avoid meeting her” It can be seen that not all chip powerhouses are willing to be pawns for the US. Therefore, great uncertainty hangs over the so-called “Chip 4 Alliance”.

04

Epilogue

"We might be benched for a decade." As a cutting-edge industry that requires the uttermost efforts of generations and the hard work of the whole nation, accomplishments can only be made if we let go of short-term interests and aim for the bigger picture.

Someone argued that in the 1960s, China went all out to develop "Two bombs, One satellite", and benefited tremendously from it. In the 1970s, no such effort was done in semiconductors, and it turned out to be a great loss.

When the “historical opportunity” was wasted in the 1970s, China missed the golden opportunity for development in the 1980s and 1990s under the wrong ideas of "buying beats manufacturing, and renting beats buying." As a result, China’s chip industry was merely a huge market and a source of profit for foreign investors over several decades.

The signing of the chips bill indicates to some extent that the future global chip industry landscape will shift from free market competition to an arms race, from a global division of labor to domestic circulation.

The encirclement around China's chip industry is increasingly tightening. To succeed in "counter-encirclement", the country must pull together and work hard.