Where does China’s growth potential lie? -- views from Weijian Shan

A mid-year reflection on China’s economy

Good evening. China’s gross domestic product (GDP) expanded by 5.3 percent year-on-year in the first half of 2025, according to data released Tuesday by the National Bureau of Statistics (NBS).

As we reassess China’s economy past the midway point of 2025, key questions remain: Where does China’s growth potential lie? How can the country reduce its reliance on exports and low-cost labor? And what will it take to pivot toward a more sustainable, consumption-driven model?

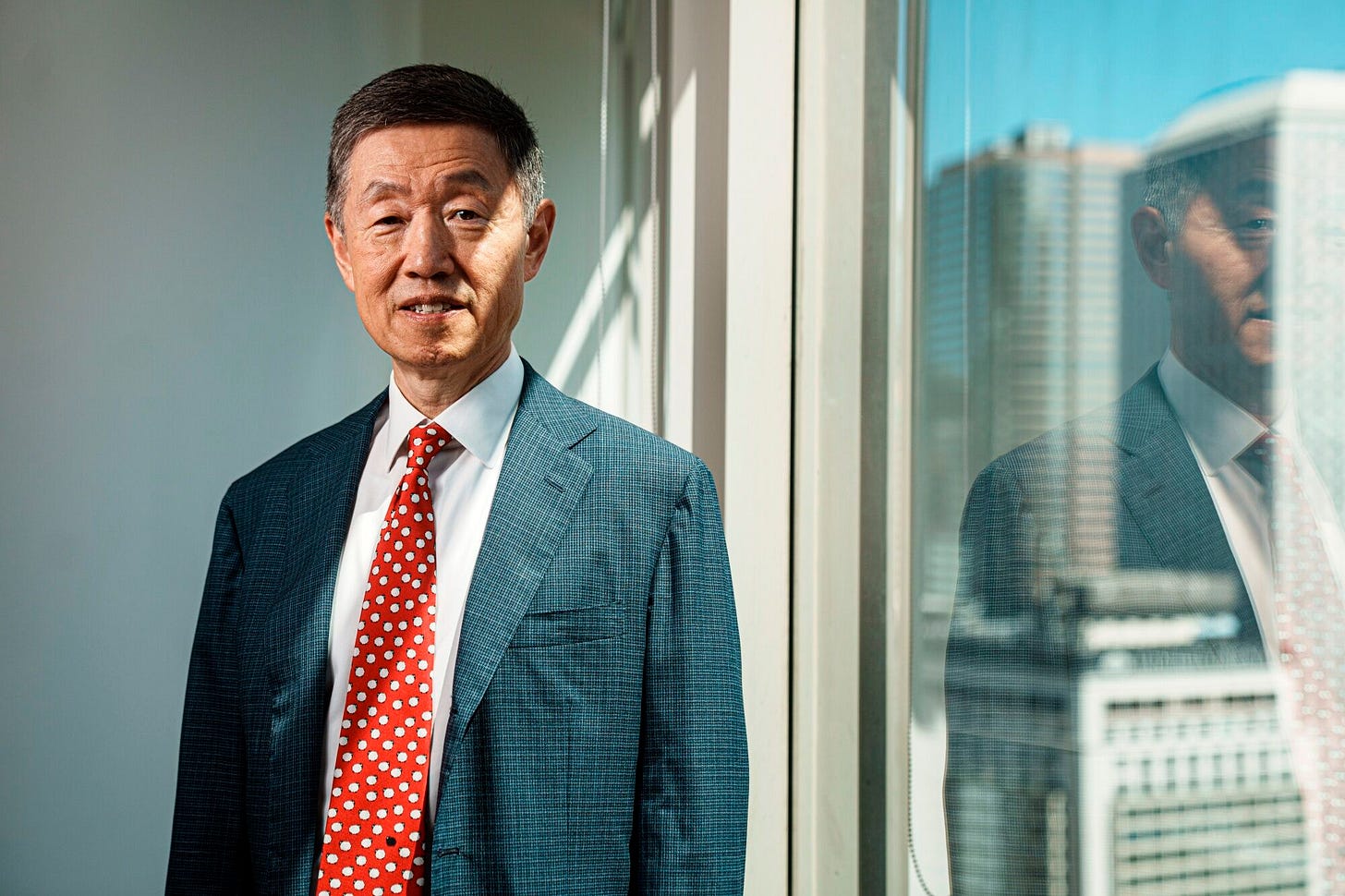

To explore these questions, 财经 Caijing, a Chinese financial media outlet, recently did an in-depth interview with Weijian Shan, the executive chairman of PAG, a leading Asia-focused private equity firm.

As an investor who has lived and worked across the Chinese and American systems, Shan brings a unique lens to China’s ongoing economic transition. Over the past few years, I’ve shared several of Shan’s insights on China’s economy—some of the most widely read and discussed pieces I’ve ever published.

Today’s newsletter features my translation of the sections from Caijing’s latest interview which was published on July 9 that focus on China’s economic challenges and opportunities. The translation is published with Mr. Shan’s kind permission.

Caijing: The issue of expanding domestic demand was actually raised quite prominently at the Central Economic Work Conference in December 2000, when Zhu Rongji was China's premier, who said that "expanding domestic demand is the long-term and fundamental foothold for China's economic development." Twenty-four or twenty-five years have passed since then. More recently, starting from when you wrote that article for Foreign Affairs, China's household consumption as a percentage of GDP was 39.25% in 2019 and 39.13% in 2023. Last year's data hasn't been released yet, but the trade surplus hit a record high last year, so the consumption rate should have declined. Why is expanding domestic demand so difficult?

Shan Weijian: China's exports as a percentage of GDP peaked at 36% in 2006. By 2018, this ratio had dropped to 18%, halving China's export dependence over 12 years. However, since 2019, this ratio has stopped declining, with exports accounting for approximately 18.4% of GDP last year.

I think the 2023 growth pattern was quite ideal: economic growth reached 5.2%, with 82.5% driven by consumption and net export negatively contributed to the growth rate by 11.4%. This shows that China can achieve economic growth by relying on domestic demand and consumption rather than exports. Following this pattern, China's economic growth would be sustainable and the growth rate could increase substantially. But in 2024, the momentum reversed—30.3% of economic growth was driven by net exports, while consumption’s contribution to growth dropped to 45%. Is there potential for consumption? I believe there's tremendous potential. As I mentioned earlier, household deposits total 160 trillion yuan (about 22.29 trillion U.S. dollars). If just 10% of that went to consumption, that would be 16 trillion yuan or $2.2 trillion. What kind of stimulus policy could compare to that?

Caijing: Even with the 2023 data, if we look at household consumption as a percentage of GDP, it's still below 40%.

Shan: But total consumption (household consumption plus government consumption) contributed 82.5% to economic growth. I completely agree that China's household consumption as a percentage of GDP is too low. My point is that household consumption has great potential for improvement. Take Japan, for example—it's difficult to increase consumption there, but China has tremendous potential because people have the purchasing power. So why has consumption been relatively sluggish over the past three years? Looking at household disposable income, from 2015 to 2019, it grew an average of 8.8% annually, while household deposits grew 10.2% annually. From 2020 to 2024, household income grew an average of 5.9% annually—a significant decline—yet the average annual growth rate of household bank deposits reached 13.4%, double the income growth rate. People's income growth has declined, but their propensity to save has increased.

Why is this happening? Mainly because household balance sheets have shrunk, especially after 2021—people feel poorer. According to the People's Bank of China's 2019 statistics, household balance sheets consist of two main components: real estate, accounting for about 59% of household wealth, and financial assets, mainly the stock market, accounting for about 19% of household wealth. In the three years after 2021, both markets continually contracted, making people feel poorer and reluctant to spend. Now the real estate market has basically stabilized, and the stock market is also relatively stable, so household balance sheets have essentially stabilized as well.

Look at Japan's 30-year recession—it was caused by the collapse of the stock and real estate markets, which led to massive household balance sheet contraction and sluggish consumption. China's conditions are much better than Japan's. China’s household balance sheet has basically stabilized now, the economy continues to grow, and with such substantial household deposits, there's a foundation for shifting toward consumption. The fundamentals can support this transition.

Caijing: This has been your view for many years—that China should transition from an investment and export-driven economy to a consumption-driven economy. You just mentioned that household balance sheets are improving, and neither the housing nor stock markets are continuing to contract. But not continuing to contract doesn't mean returning to previous growth states. Why would we think that just because household wealth has stopped shrinking, people will be willing to spend?

Shan: People won't automatically be willing to spend. What most affects consumer spending is expectations and confidence. How can we boost expectations and confidence? Government policy is crucial. For example, on September 24 last year, the government introduced a series of accommodative monetary policies, and the stock market immediately rallied. When the government introduces policies that can influence expectations and confidence, investment willingness suddenly increases. The same applies to consumption.

For instance, on March 5, the Chinese government announced this year's growth target as 5%. I think 6% would be more appropriate because if the government shows confidence in achieving a higher target, it would boost overall market expectations. Last year was 5%, this year is still 5%, so expectations won't change much. The most important thing is to influence expectations so that people are willing to spend. Here's an example: in the first four months of this year, offline retail grew faster than online retail. This hasn't been the case for the past decade or two—online growth always exceeded offline growth, and many physical stores couldn't survive. But why is offline growth higher than online growth this year? It's because of government consumption subsidy policies. These subsidies aren't issued by the central government but by local governments, which must distribute them to local merchants. Online sales are nationwide, which doesn't concern local governments much, so offline growth has been faster than online this year. This shows that government policies can have a leveraging effect and can change expectations.

Caijing: But consumption subsidies are one-time measures. Expectations about income growth have a greater impact on people's confidence. Consumption is the effect; income is the cause. Only when income increases, or when income expectations improve, can consumption be boosted.

Shan: Yes, we need to change these expectations. The pace of income growth and the stability of household balance sheets all affect consumer decisions.

Caijing: You mentioned earlier that China's fiscal policy is conservative. If fiscal policy became more proactive, besides raising the budget deficit to GDP ratio, what other measures could be taken? After the stimulus policies came out last September, many commentators said the policy intensity should be greater.

Shan: I also believe there should be stronger stimulus policies. China has significant room for both monetary and fiscal policy, which is an advantage that other major economies don't have—they either have high inflation or high debt ratios. China's central government debt is only about 21% of GDP, probably the lowest among major economies. Japan's is 260%, and the United States' is around 130%. China's local government debt, including financing platforms, totals only about 80-90% of GDP. Combined central and local government debt is around 110% of GDP.

Moreover, this only looks at the liability side of the balance sheet, not the asset side. What assets does the U.S. government have? The U.S. Postal Service, which loses money year after year, and the rail system, which also runs chronic losses—the U.S. government basically has no assets. The net asset value of China's state-owned enterprises approximately 145 trillion yuan, compared to GDP of 135 trillion yuan or $19 trillion. The market value should be higher than net asset value, exceeding liabilities, so if you look at net debt, the Chinese government's net debt is actually negative.

In fact, China’s fiscal policy is very conservative. Being conservative certainly has its merits, but the country has significant capacity to raise funds in international markets, especially by issuing offshore RMB (CNH) bonds. Without such products, there is a limited scope to invest CNH, restricting its holding. From China's perspective, the best approach is to issue CNH-denominated foreign debt, which has no credit risk (because the currency is issued by the central bank) and can increase the variety of CNH products, making it beneficial for other countries to hold offshore RMB as part of their foreign exchange reserves. With such low net government debt, appropriately increasing debt to raise capital for economic development gives fiscal policy considerable room to maneuver.

Actually, looking carefully at various stimulus policies, the amount truly used for consumption is almost a drop in the bucket. China has too many areas that need investment. As I mentioned, if household income levels don't increase, consumption will remain subdued. But it's not just income that affects consumption—there's also social security, which removes concerns about rainy days. The national social security fund has a balance of less than 10 trillion yuan, which is far from sufficient for a rapidly aging country of 1.4 billion people.

So the Chinese government should borrow more for domestic investment, especially foreign debt. China's foreign debt is too low. The central government's foreign currency-denominated foreign debt is probably less than 50 billion U.S. dollars. My firm manages 55 billion U.S. dollars. Think about it—China, a major country with a 19 trillion U.S. dollars GDP, has such minimal foreign-currency denominated debt.

Caijing: You just mentioned that income expectations affect consumption. What are your thoughts on increasing household income?

Shan: Current average wage levels in China, calculated in dollars, are about one-sixth of those in the United States, but China's manufacturing labor productivity is higher than America's measured by physical output per worker. This reminds me of Singapore's experience during its development history. Singapore faced the same problem and gradually raised minimum wage levels, forcing companies to shift toward higher value-added activities, which helped raise wage levels.

Caijing: Looking just at manufacturing, you mentioned that China's manufacturing labor productivity exceeds that of the United States, yet wages are only one-sixth of American levels. This means China's wage levels have enormous room for improvement, but why can't this be achieved in reality? Isn't it absurd that China's highly efficient workers receive low wages that essentially subsidize American consumers?

Shan: Yes, that's why we need to think about this issue. I don't have answers to all questions, but I can identify where the problems lie, and this is one of them. Again, Singapore took this path, using minimum wage increases to gradually break away from the path dependence of economic development based on cheap labor. China is also moving in this direction, just moving relatively more slowly.

Caijing: Wage growth exceeding productivity growth is harmful. Some Latin American countries have experienced this, where populist governments raised wages and benefits too high, damaging economic growth and ultimately harming the people.

Shan: China's situation is exactly the opposite. China's current problem is over-competition. Because China's production costs are relatively low, market players can push prices extremely low, with everyone competing to cut prices. For example, China has over 100 electric vehicle companies, but only two or three are profitable—nobody's making money. The same situation exists in batteries and solar panels. But raising wage levels helps prevent destructive competition among companies because they can no longer compete on low costs alone. Moreover, stopping just one company from engaging in destructive competition is ineffective—the entire industry must be prevented from doing so, which would push prices up. Take rare earth exports, for example. After the government regulated rare earth exports, prices tripled. In value-added terms, the rare earth industry's productivity suddenly tripled. So I think the issue of low wages deserves study—China can't always remain in the low-cost territory.

Caijing: Some believe China still has a long way to go in industrial upgrading and many "chokepoint" technologies to overcome, so it's premature to talk about replacing production-driven growth with consumption-driven growth. Is this argument valid?

Shan: These two things aren't in conflict. It's not that you need to become globally number one in all fields before consuming, or wait until you've produced domestic 2-nanometer chips and domestic commercial aircraft engines before consuming. There's no such logic—these two things have no necessary relationship.

Caijing: One final question. Having lived and worked extensively in both China and the United States, what do you think are the strengths of each country?

Shan: That's too big a question. But I can say that Chinese people are the most hardworking—Chinese average working hours exceed those in America.

Caijing: Americans are already considered hardworking in the Western world.

Shan: Yes, Chinese working hours are much higher compared to Europe. Where is America strong? In attracting global talent to high-tech industries. To become a global high-technology innovation center requires five conditions: first, concentration of talent; second, concentration of top-notch higher learning and research institutions; third, availability of venture capital; fourth, deep manufacturing capabilities; and fifth, a massive single domestic market.

In the 1980s and 1990s, the United States was the only country in the world that possessed all five conditions. Today, America no longer has deep manufacturing capabilities—American manufacturing has declined—but it can obtain these capabilities externally, such as through TSMC and ASML. So America's advantage today remains in high technology innovations.

On the other hand, China has now single-handedly achieved all five conditions. These five necessary conditions constitute sufficient conditions, which is why I'm very confident about China's long-term economic development.

Caijing: Is it possible for China and the United States to establish a relationship based on mutual recognition of rules and shared interests?

Shan: Yes, but there's a prerequisite: China's nominal GDP in dollar terms must exceed that of the United States. In terms of purchasing power parity, China’s GDP is now about 30% bigger than that of the U.S. Today we're at a critical juncture—China is about to surpass but hasn't yet surpassed the U.S. in nominal GDP, so America is using every means at its disposal to suppress China’s growth, whether through trade wars, technology wars, or sanctions, all to prevent China from replacing America’s as the largest economy in the world. But if China one day becomes the largest economy, American containment policy would become meaningless. Only then can bilateral relations fundamentally improve. When you're about to surpass but haven't yet surpassed them, that's when bilateral relations are most tense.

Weijian Shan

Executive Chairman and Co-Founder, PAG, Author: Out of the Gobi, Money Games, and Money Machine

Just before China holds the third Supply Chain Expo, Yang Liu sat down with Mr. Yu Jianlong, vice chairman of the China Council for the Promotion of International Trade (CCPIT), the organizer of the expo. He explained what the expo is and why it matters in the time of havoc for global supply chains. You can check the latest Got China show on YouTube or Substack. I had to miss recording this episode because of my foot surgery.

I believe that the way China is automating and embedding AI in all aspects of life will lead to such high demand for all sectors to catch h up leading to a lot of retooling and trainings that will be so ahead of the rest of the world. But the time the rest of the world catches up China will be ready to export such excess knowledge