Why are Chinese VCs drifting away from their U.S. peers?

China and the US are in different phases of the business cycle, and the focus of the capital market is therefore different.

A fundamentally new trend is emerging in China's venture capital (VC) industry. After more than two decades of following the footsteps of their American peers, Chinese VCs are increasingly diverging in terms of investment strategy and focus.

The following article is written by Mr. 李丰 Li Feng, founding partner of China-based venture capital fund 峰瑞资本 Frees Fund, which red_wallstreet thinks gave a well-rounded explanation of the underlying forces behind this trend.

In addition, the trend does not mean that people should be pessimistic when we say that China and the US are drifting apart in terms of their VC paths. China and the US have different economic structures, and the investments must conform to a country’s current economic structural adjustment.

The original title of the article is 中美VC为何渐行渐远?Why are Chinese VCs drifting away from their US peers?

This article is the second piece of the 2022 macro-economic analysis series. In this series, I’d like to discuss with everyone the changes and fluctuations, trends and opportunities of the capital market in recent years, as well as the reasons for the divergence in direction of VC in China and the US.

In the article Will 2022 be a Cold Winter for Capital? released last week, I discussed situations and development of Chinese and the U.S. capital markets in this year respectively, from three dimensions: short-term, medium-term and long-term.

We tend to think that though both the capital markets of China and the US have seen turbulence and fluctuations this year, they are not facing the same “winter”.

If we compare a country’s business cycle to the four seasons of a year, the US is at the stage of “late autumn when winter starts to set in” while what China is having is more like a 倒春寒 “early spring chill”. If you are interested in the opinion, please click the link above to read my first article.

In the second article of this series, I would like to discuss with everyone another topic that is closely bound up with venture capital investment——VC paths of China and that of the US.

“Has Web3.0 appeared in China yet?” is a topic frequently mentioned by people doing VC investment in China. Some feel that China is not ready for Web3.0, while others are convinced that Web3.0 is the future and an inevitable trend.

The heated discussion and disputes stirred up by Web3.0 actually reflect a trend—— in China and the US, the world’s two largest economies and also the two most favored destinations of international capital, there is a divergence in the direction of development.

We listed popular fields of investment in China and in the US as below, and we can see that there aren’t many overlapping fields. [Translated by GRR]

In this article, I will talk about the current characteristics of VC in China and that in the US, and what reasons caused their paths to diverge.

Here are my main points:

China and the US are in different phases of the business cycle, and the focus of the capital market is therefore different. China's VC is “diverting from the fictitious economy to the real economy” “脱虚向实” with the aim of serving the real economy. Meanwhile, the VC in the US is “going deeper into the fictitious economy” “脱虚向虚”, focusing mainly on the service industry and innovations of the non-real economy.

The two countries' different industrial structures somehow determine that even with the same technology, the two sides will take different routes in application.

And the different patterns of industrial development lead to their different business models.

The divergence of VC paths between China and the U.S. is the result of the combined impact of different industrial structures, different industrial development patterns, different capital market development conditions and different stages in the business cycle. It is not the case that one path is superior to the other, so investors and entrepreneurs should develop specific strategies based on the characteristics of the region they are in.

I hope that this article can provide some different perspectives.

[Certain promotional contents were redacted]

***

/ 01 /

Diverting from the fictitious economy to the real economy

V.S.

Going deeper into the fictitious economy

VC in China is “diverting from the fictitious economy to the real economy” while that of the US is “going deeper into the fictitious economy”. How did we reach this conclusion? Let’s look at the capital markets in both countries, which are highly related to the investment.

Under the guidance of current policies, China’s financial sector is generally “diverting from the fictitious economy to the real economy” [See a Xi Jinping's article on major theoretical, practical issues in China's development in the Qiushi Journal translated by GRR]. The central government has pointed out that “Finance is the pump of the real economy. Serving the real economy is in the financial sector’s nature, is the financial sector's purpose and also the fundamental approach to guard against financial risks”. It demonstrates that the purpose of China’s capital market is to serve the real economy.

In Will 2022 be a Cold Winter for Capital?, we mentioned that the total size of China’s capital market has approached 80 percent of our GDP in 2021, completely different from the situation seven or ten years ago. The capital market has gradually become a very important tool in China's economic development.

For this very reason, China’s investments go in sync with our economic structure, which means focusing on the real economy. Therefore, the investment trend in the capital market has gradually become "investing in projects related to the economic structure". Popular landing sites for investments such as industrial Internet and industrial digitization, are essentially serving the real economy with Internet modes and digital means.

For example, Hand Hitech 汉德科技, a firm Frees Fund 峰瑞投资 has invested, is promoting the digitalization of China’s huge logistics industry. YesBird 益鸟科技, also a firm Frees Fund invested, is specializing in the standardize and digitalize home maintenance. This is what we call “diverting from the fictitious economy to the real economy”.

Now Let’s turn to the US. As investors, we may find the directions of many early-stage investments and innovations quite intriguing, but we also keep an eye on the directions to see whether they are filled with bubbles from the final stage of the financial cycle.

In the first article of the macro series, we pointed out that the multiple rounds of super quantitative easing have generated huge bubbles in the American stock market in the final stage of the financial cycle. Adding to that, the Federal Reserve put these bubbles on the verge of bursting due to frequent interest rate rises and balance sheet reduction. At the final stage of a super long financial cycle, countries with their financial industries accounting for a high ratio of GDP, such as the US, would come up with financial innovations that do not rely on the real economy at all, such as NFT (Non-fungible token), Web3.0 and the blockchain.

In addition to the impact of bubbles in the tail period of the financial cycle, there’s also another reason for VC in the US to “go deeper into the fictitious economy”. That is its own business cycle.

Why not turn the clock back to the last century. Starting from the 1950s, high-tech firms started to emerge in the southern section of San Francisco Bay Area. These firms are mainly semiconductor firms engaging in the manufacturing of high-precision silicon and computer firms. The area is later known as “Silicon Valley”.

With numerous firms clustering in Silicon Valley, VC was born with the aim to help establish and expand firms. Then came Nasdaq. The emergence of VC and Nasdaq was meant to facilitate the development and expansion of the emerging industries in the real economy. The core of these industries is “silicon”, such as chips, wafers, manufacturing and computers. However, these industries have become less popular in the US compared to China today.

Back in those years, the US saw many companies in Silicon Valley making a large number of technological innovations, with the aim of serving the real economy. And and VC was following the same direction. But why is the US going deeper into the fictitious economy now?

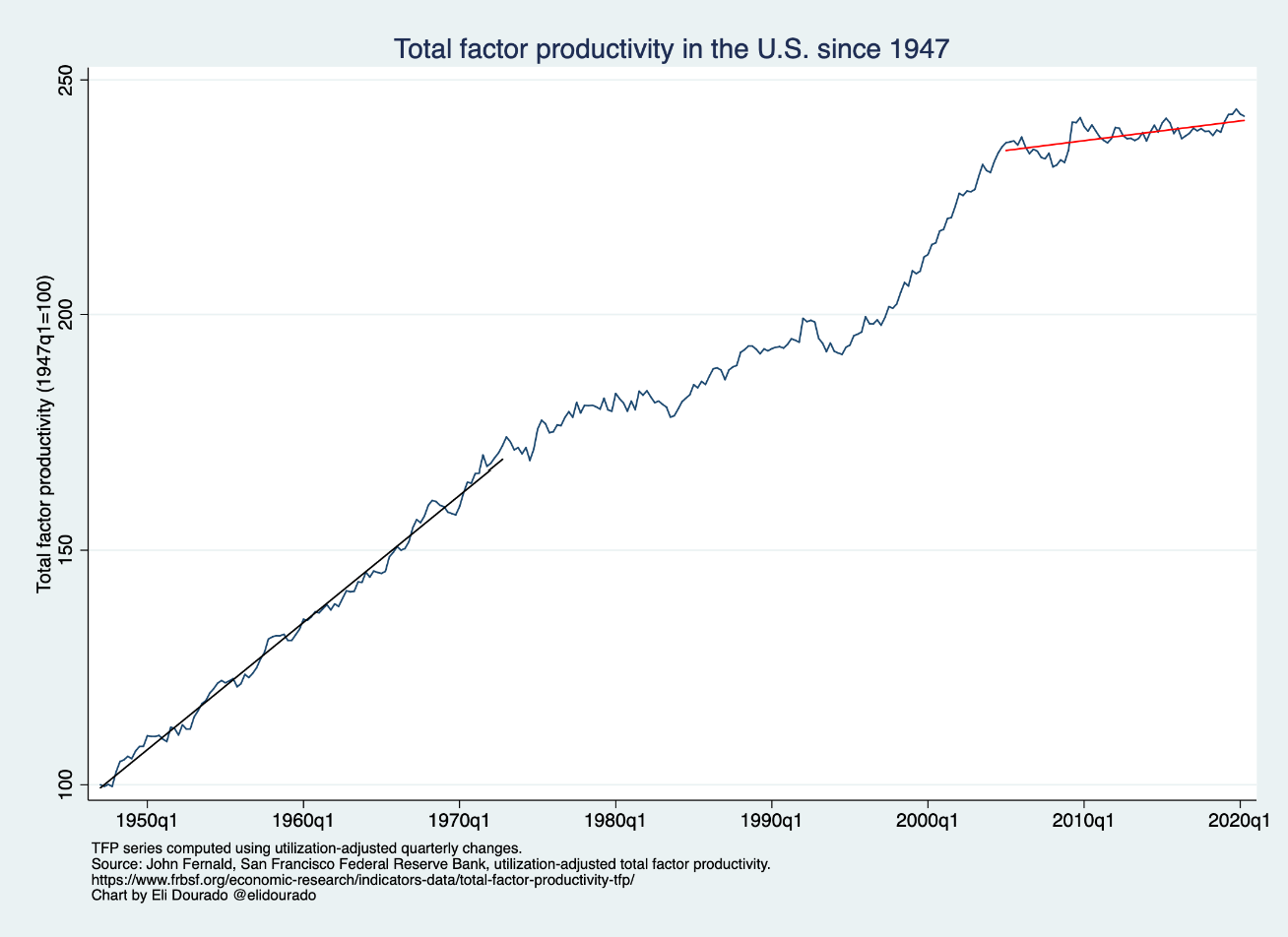

A concept is needed here: Total Factor Productivity (TFP) 全要素生产率, which refers to a system’s input-output ratio under the same input of capital, labor and resources. It is the best index for analyzing the potential impacts of innovations and technological changes on economic growth.

If we look at the TFP development, the U.S. had two phases of significant increases in TFP levels, both of which can be largely attributed to vigorous innovation and technological change.

However, in the past two decades, however, the TFP growth of the US practically stopped. One reason is that its scientific and technological innovations have reached the bottleneck. Moreover, the US has transferred its industries and manufacturing sectors to other places in the world during the boom of the Internet, and started to focus on the service industry and non-real industry such as the financial industry.

In comparison, China is applying technologies to the real economy and industries to seek higher growth, which can be called "lay a good foundation". While the US may need to push technologies forward a bit and bring more possibilities for the non-real economy and the service industry. This is called “going deeper into the fictitious economy”.

***

/ 02 /

Differences in industrial structures lead to divergence in thoughts

We have briefly discussed the current states of capital markets in China and in the US to demonstrate the different paths that the two countries’ financial industries took. Before we proceed, I’d like you all to think about this question: What is the essence of investment?

We can conclude the essence of investment roughly as providing resource allocation for economic development, which means keeping in line with the trend of economic development. Thus, investment is to inject capital and resources into fast-growing or highlighted industries and firms to help them grow better. So what would determine this development trend? The trend is related to a country's industrial structure.

In terms of the industrial structure, the focus of China’s industrial structure has gradually switched from the primary sector (agriculture) to the secondary sector (manufacturing industry) in the past 40 years of reform and opening-up, and it’s gradually switching to the tertiary sector (service industry).

The proportion of the primary sector in the US has been dropping year by year since World War II while that of the tertiary sector has been rising drastically. And the engine of US economic growth has gradually became the commercial service industry and social service industry.

In 2021, the proportions of China's primary, secondary and tertiary sectors in GDP were 7.26 percent, 39.42 percent and 53.30 percent, respectively. Although the tertiary sector is the mainstay of China's GDP, the contribution of the secondary sector remains significant.

In the US, however, the proportion of the tertiary sector has far exceeded that of the primary and the secondary sectors, accounting for over 80 percent of its GDP, while its secondary and primary sectors only account for 18.2 percent and 1.07 percent of its GDP.

Let’s analyze the two countries’ industrial structures from another perspective.

If we put China's GDP composition above and the value added to GDP by sectors together, we can see two phenomena: the tertiary sector is a strong engine of China’s economic growth, and the manufacturing industry also remains a powerful driver of our economic growth.

China achieved a GDP growth of 8.1 percent year-on-year in 2021. Out of this 8.1 percent growth, the secondary sector contributed the most with 32 percent of the total growth, followed by other industries, mainly the service industry, which made up 23 percent of the total number。

Therefore, we can see that many hot industries in China are related to the increase in manufacturing and industrial added value, such as NEVs (New Energy Vehicles), industrial Internet, etc.

Let’s look at the situation in the US. In 2021, The US achieved a year-on-year GDP growth of 5.7 percent. The contributions of different sectors to GDP were rather balanced. The total contribution to GDP by the tertiary sector including finance, insurance, professional and commercial services, education, medical care and social assistance was as high as 30 percent, followed by the manufacturing industry and government. But the total contribution of the secondary sector is rather low, so its driving effect on economic growth is not as strong as that of China.

How are the above-mentioned development trends of the industrial structures in China and the US reflected in the development paths of the capital market?

Taking synthetic biology, a very popular industry in the world of VC in the past six months, as an example. The industrial technologies of synthetic biology are mainly employed by biopharmaceutical companies such as Amyris, Precigen. While in China, the same technologies are used in chemicals and chemical-related industries by companies such as Cathay Biotech 凯赛生物, Huaheng Bio 华恒生物 and Bluepha 蓝晶微生物.

Why would there be such a difference in thoughts? From China's perspective, the output of China’s basic chemical industry accounts for about 40 percent of the total global output. According to a forecast issued by McKinsey, China will provide over half of the growth of the world’s chemical industry in the next decade.

The other factor is that, as China’s economic policies gradually shift from investment-driven growth to consumption-driven growth and the latter requires satifying the need of increasingly complicated products, so the demand for special chemicals will grow further. For example, the growth in a certain high-end personal care market may bring more complicated demand for special surfactants.

Meanwhile, China’s consumption trend will also offer new opportunities. For instance, the rapid growth in the demand for online shopping food may increase and stimulate new demands for packaging materials, and it may thus lead to a higher demand for innovative products such as biodegradable polymers.

From the perspective of the US, the scale of its chemical industry is far smaller than that of China, but the medical industry is a fairly large industry in the US. In 2020, the national medical expenditure in the US accounted for 19.7 percent of its GDP, reaching an all-time high. Its public and private medical expenditures far exceeded that of other developed countries and that of China.

In addition, the U.S.'s spending on new drug R&D is quite considerable, and the industry is several times larger than China's medical industry. Although China’s medical industry is quite developed, there is still a gap compared with the US. In 2020, China's total medical expenditure accounted for about 7 percent of our GDP and the proportion of new drug R&D in the total medical expenditure only accounted for less than 20 percent.

The world’s market for R&D of drugs is almost dominated by North America, especially the US. The prevalence rate of various chronic diseases in the US have been rising in recent years, and this is the main reason for pharmaceutical enterprises to engage in the R&D of new drugs.

According to data from the CDC, over 90 million people in the US suffer from at least one cardiovascular disease, and over half of the US population have at least one chronic disease, such as cancers, cardiovascular diseases, respiratory diseases and neurological diseases. It leads to a huge increase in the demand for new drugs and innovative drugs, and provides abundant medical-related application scenarios for the synthetic biology industry.

The result of this difference in industrial structure is that China uses synthetic biology mainly in the chemical industry, while the US uses synthetic biology mainly in the biopharmaceutical field.

The second example is the field of robots. At present, the US mainly focuses on the market of surgical robots while China concentrates on industrial robots.

However, industrial robots were actually born in the US. Around 1961, the US invented industrial robots first, but the market share was later taken by the four industry groups from Europe and Japan. The reasons are as follows:

▎The surge of unemployment rate after WWII in the US made hiring people more urgent than using robots. Therefore, the US government has no incentive to implement policies supporting the development of the robotics industry

▎As vanquished nations in World War II, Japan and Germany suffered a huge loss in their populations and were facing a severe domestic manpower shortage.

▎The rise of the automobile industry in Japan and Germany from the 1960s to the 1970s stimulated the demand for industrial robots.

With all these factors combined, the market share of industrial robots has been transferred from the US to Europe and Japan.

Currently, China has become the main market for industrial robots in the world. By 2021, China's industrial robot industry has been ranked the first in the world eight years in a row. China's assembly capacity in 2020 made up 44 percent of the world's total and the growth of our robot sales has always been higher than the world average level.

For one thing, China has been advocating that science and technologies shall serve the real economy, hence, our manufacturing industry has a vast demand which stimulates the prosperous development of industrial robots. Some policies favoring the development of the robot industry have been put forth in the 14th Five-Year Plan, promoting the robot industry to make qualitative changes.

For another, with the driving effect of demographic dividend on economic growth gradually wearing off, China’s industries are seeking to transform to smarter and more efficient to increase TFP. These factors have stimulated a high demand for robots.

The US, on the other hand, has emigrated its industrial system to other countries during the Internet boom and focused on the tertiary sector instead. Therefore, it doesn’t have a strong enough push in the development of industrial robots, compared with Japan and Germany.

However, the rapid development of the tertiary sector in the US, especially the medical industry, created opportunities for the development of medical robots. In 2020, the market size of surgical robots in the US reached 4.6 billion US dollars, accounting for 55.1 percent of the world's market, while that of China was 400 million US dollars, less than 10 percent of that of the US.

To sum up, the different development trends of industrial structures make China and US focus on different things when dealing with the same technology, and thus leading to the divergent investment ideas of VC.

***

/ 03 /

Differences in industrial development patterns lead to different catalysts

The perspective of industrial structures is rather macro. Now let’s go a bit deeper to industrial development patterns. When we talk about the different directions of entrepreneurship in China and the US, entrepreneurs need to consider one question inevitably: if they start their businesses in one country or both countries at the same time, what are the differences in their paths of entrepreneurship and innovation?

Generally speaking, industrial development patterns in China and the US are quite different.

Before the Internet was introduced to various industries in the US, many of its industries had fully undergone competition and had become mature. While in China, the Internet entered when many industries were rapidly developing or expanding, so the Internet grew with industries. This difference leads to different business models in China and in the US.

Let’s take SaaS which has been drawing widespread attention in recent years as an example. According to the report from ReportLinker, the global SaaS market will grow by a stunning 99.99 billion US dollars from 2021 to 2025. Many listed companies or industry unicorns in SaaS have already emerged in the US, including consumer-grade products and enterprises-grade products such as Google, Amazon and Salesforce.

In China many people mentioned that the "spring"of China’s SaaS was coming as early as 2011 and 2012, and such "spring" was brought up every one or two years.

In recent years, China's listed companies of SaaS have been developing quickly. For consumer-grade products, Tencent and Alibaba may compete with their US counterparts in market value. However, for enterprise-grade products, China still doesn’t have a top SaaS listed company with a market value of more than 30 billion US dollars (take Zoom and Salesforce as benchmarks). I talked to a SaaS entrepreneur earlier, and he said that it's more like China's SaaS industry celebrates the Spring Festival instead of the spring.

What caused such differences? We have mentioned above that the various industries in the US had established relatively complete industrial chains which had gone through relatively thorough competition before the Internet was brought in. When Internet technology was applied to various industries in the US in the 1970s, the country was experiencing "stagflation" when the upstream resource industries (extractive industry, agriculture, forestry, animal husbandry and fishery) and monopolized industries (petroleum and tobacco) had the best economic performance, followed by the financial industry and manufacturing industry, while consumer industry was at the bottom.

To increase their efficiency and get out of the difficulty, many enterprises started to bring in efficiency tools such as softwares when they had established mature industrial chains. The enterprises deployed application softwares on their servers to provide services to their customers. This is the foundation of SaaS development in the US. In the late 1970s, the high-tech industry in the US witnessed a strong wave of development.

When entering the modern Internet era, American enterprises experienced three phases: getting softwares online, getting online softwares to the mobile end (R&D of softwares on mobile ends) and smart mobiles (big data and AI applications). SaaS in the US normally have a rich and complete corporate service chain as the foundation, and each industrial upgrade brings more application demands, multiplying the number of service chains, and generating plenty of corporate service opportunities. Therefore, SaaS in the US is more like an efficient tool in mature industries.

Although China’s original Internet business model looks similar to that of the US, they are not the same. Taking Alibaba as an example. China's Total Retail Sales of Consumer Goods started to grow rapidly from 2001. Taobao was founded in 2003. It means that Taobao’s development is almost in perfect sync with China’s retail industry.

Compared with efficiency tools or information transmission mediums for industries, platforms such as Taobao are more like the industries themselves. Its division of labor, expansion and efficiency upgrading are all achieved on the Internet platform, instead of being transferred from offline to online after they become mature. This may help answer a question: Why China doesn’t have Shopify? Shopify’s service is to help merchants transfer their mature offline retail chains the customer resources online. In China, however, such chains and resources are generated during online development and expansion.

Besides retail, the Internet business model of other industries is similar. Financial innovations in the US are mainly about bringing offline business online and promoting efficiency while China’s financial innovations have become part of the industry after the introduction of the Internet, creating Internet finance such as mobile payment.

Another example is catering. The typical platform for customer reviews in the US is Yelp, while the typical takeout platform is Doordash. The former efficiently transfers the information of the offline catering online, and the latter focuses on takeout.

China’s Meituan has developed into a comprehensive platform with both customer reviews and takeout, and it has developed an industry supply chain supporting its takeout business. According to The Paper澎湃 [a Chinese digital newspaper], China’s online takeout in 2021 accounted for 21.4 percent of the total consumption in catering, which means that platforms like Meituan have made themselves [a huge] part of the catering industry [itself].

Therefore, the introduction of the Internet into China’s industries, be it retail, finance, catering, education, medical service and technology, was very early. It was brought in before the industries fully developed. These platforms not only serve as mediums or efficiency tools, but also become the industry, and gradually develop from a small part to the mainstream and even get to make the rules in industries.

Now we can better understand why no large company has emerged in China after China’s SaaS went through many "springs". The introduction of software, moving things online and the mobile and smart transformation of companies in many industries were squeezed into one cycle, which posed extremely high requirements for competition and iteration. Since companies have to meet high requirements for competition and iteration, their needs for corporate services are more general and more dynamic. Therefore, China’s SaaS industry is still fast-growing and shaping.

***

/ 04 /

China’s unique innovation cases

Last, I’d like to add one small point. We’ve mentioned that China’s entrepreneurship and innovation paths are jointly determined by the industrial structure, capital market and industrial development path. Our investment path today, be it in the primary market or the secondary market, must get closer to China’s economic structure itself and its adjustments in the structure. On this basis, China will generate many innovative models.

If the US is good at innovating in the mediums of information transmission, China also has information medium platform innovations such as Bilibili and TikTok. How were such innovations born?

For example, there were quite a lot of teams trying to make a Chinese version of "YouTube" 10 years ago. That's when I invested in Bilibili. But we all know that Bilibili became the only survivor.

Why Bilibili, instead of other Chinese imitators of YouTube, survive? Well, a very important condition was missing in other localized innovations of YouTube——the popularization of the hand-held home camcorders. Most people didn’t have portable devices (smartphones) to make videos with, not to mention creating their own videos and uploading them.

Bilibili adopted a similar strategy as online video websites such as Youku 优酷 and Tudou 土豆. It put digitized animes and videos on its platform. However, Bilibili added text information, the bullet screen 弹幕 on top of the videos. This feature creates new content for users. [Bullet screen is a feature that allows viewers send real-time comments and interact with each other when they watch videos, and the comments will fly across the screen, like bullets. Sometimes, the bullet screen can be more popular than original videos and attracts viewers to see it.]

The collision of text information and digitized information leads to the convergence of information. This is the feature and culture of Bilibili. It first helped Bilibili grow into a platform where fans of Japanese animes gather, and gradually found its audience in other groups. [Check a GRR post on a video of a story which went viral from Bilibli to other China's social media platforms two weeks ago]

Therefore, why would Douyin emerge in China's market, and later evolve into a world-famous product — TikTok? The main reason behind this is the widespread use of smartphones. From the second quarter of 2013, China has become the world’s largest consumption market of smartphones, and became the market with the highest smartphone penetration rate after 2015.

A high penetration rate leads to a growing base of the population who film videos with their smartphones, and rounds of popular content that iterates quickly. All these things train the market and the audience over and over again. That's why we had short video products such as Kwai 快手 and Douyin. In terms of short video filming, we’ve set an innovation trend in the world, and it is highly related to China's fast-developing industrial supply chain of smart mobile devices.

No matter Bilibili or Sunyur 商越, a SaaS service provider that came along later, or Douyin and TikTok, they are all innovations that combine the industrial structure with China's character, China's capital market environment, and other features.

In general, the size of China’s capital market, or the investment market is getting close to the GDP level. This is worth celebrating in the VC business. It means that subsequent investments will be more and more related to our national economic structure and become important tools for China’s economic development.

In addition, we’re not being pessimistic about any country when we say that China and the US are drifting apart in terms of their VC paths. China and the US have different economic structures, and our investments right now must conform to China’s current economic structural adjustment.

A similar cycle of economic structural adjustment also appeared in the US 50 or 60 years ago when the concepts of Silicon Valley, VC and Nasdaq were born. The US is probably at the final stage of a financial cycle where lots of conceptual innovations, financial and capital innovations will drive the US to go deeper into the fictitious economy. It's not that these innovations are unreasonable, although they may appear at the tail period of the economic bubble, they represent a typical phenomenon in the cycle.

From the angles above, we can see that China’s VC has somehow taken a different path from the US. This is the result of different industrial structures, different industrial development patterns, different capital market development states, and different phases of the financial cycle of two countries.

But what about the role of government? I know the CPC adheres to Marxist principles not allowing financialization. How does the CPC discourage non productive VC investment?