Can Chinese batteries rise to power European EV?

The latest adventure of CATL into Europe is the epitome of an “Era of Voyage” started by Chinese EV battery enterprises.

There is little doubt that electric vehicles (EVs) will transform the automotive industry and help decarbonize the planet.

The European Union (EU) announced plans earlier this year to only allow zero-emission new vehicles to be registered from 2035, though the proposals need approval by lawmakers in the EU Parliament and the EU Council before they come into effect.

The island of Hainan in southern China also plans to ban the sale of fossil fuel-powered vehicles by 2030, and more provinces are likely to follow suit.

In addition, A previous GRR piece on Huawei's master plan for electric vehicles has illustrated the very delicate line that Huawei treaded between being a "Tier-0.5" supplier and a full-fledged automaker.

As high-voltage batteries make up more than 40 percent of the cost of new-energy cars, it has increasingly become a consensus that building supply chains centered on car batteries and expanding the related market represent a new height of profit.

Against such a backdrop, China’s Contemporary Amperex Technology Co., Ltd. (CATL) 宁德时代, the world’s largest car battery manufacturer, grabbed the limelight earlier this month when it announced a largest-ever investment in Hungary, by building a battery plant in Debrecen in the eastern part of the country.

Today’s GRR newsletter is composed of two parts.

In the first part, GRR presents an analysis by Guancha.cn's Chen Jishen 陈济深 posted on WeChat on August 15, which explained the factors behind CATL’s investment as well as its impact on the European EV market. The original title of the article is 宁德对决LG,中国如何再赢一次?CATL vs LG, how can China triumph once more?

The optimism, however, is not shared by all. In the second part of this newsletter, GRR offers a note of barriers, such as growing protectionism in Europe as well as in America, that Chinese battery companies must overcome in order to succeed beyond their home court, excerpted from an analysis by Zhang Zhidong 张之栋 posted on the Wechat account of iautodaily on August 16. The original title of the article is 全球动力电池:欧美期待本土“宁王”的出现 Global automotive batteries: Europe, U.S. look forward to their own CATLs.

Some key takeaways:

* Europe is the world’s second largest new-energy vehicle market, only behind China in market size.

* The supporting industrial chain for the burgeoning new-energy vehicle sector is, however, not as prepared as it should be in Europe.

* There are increasing signs of overproduction of EV batteries in China

* LG constitute a real competition of CATL in Europe.

* Compared with LGES, CATL has deployed throughout the battery industrial chain.

* CATL is on par with LG in terms of ternary lithium batteries, but it leads significantly in LFP batteries, high-nickel batteries and sodium-ion batteries.

* Growing protectionism is headwind for Chinese battery firms to go globally.

Part I CATL vs LG, How can China triumph once more?

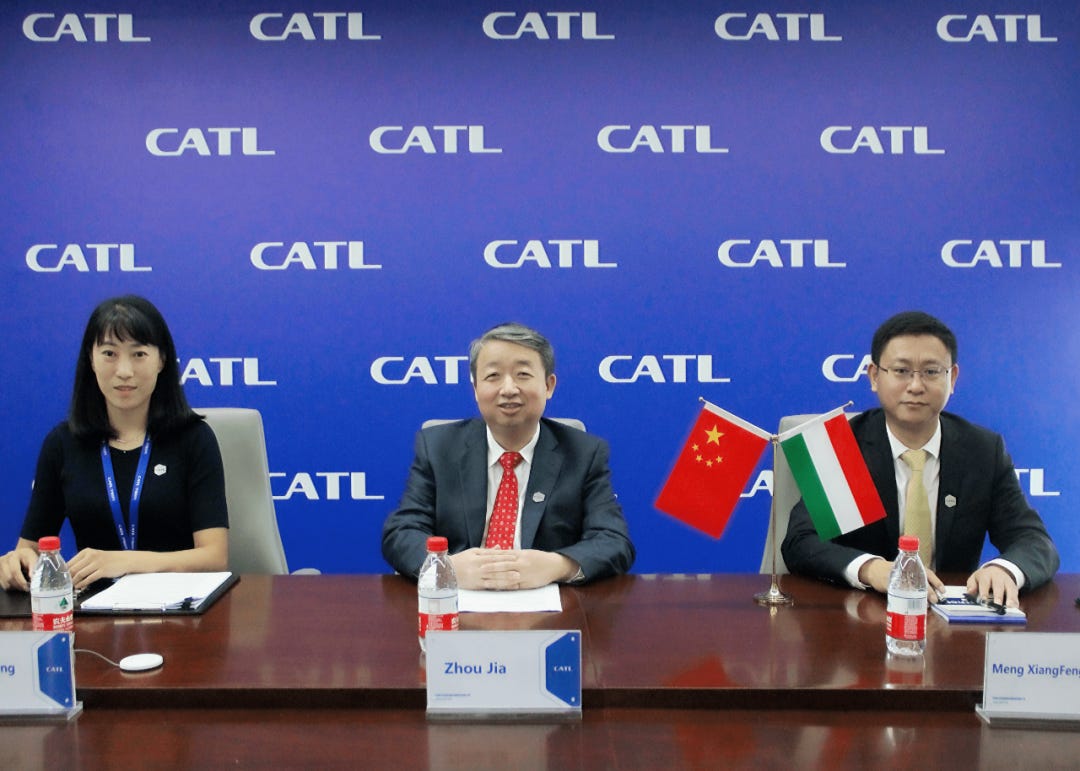

On August 12, Peter Szijjarto, Hungarian Minister of Foreign Affairs and Trade announced that China’s Contemporary Amperex Technology Co., Ltd. (CATL) will build a battery plant in Debrecen of east Hungary.

“We are proud of it,” said Szijjarto on his social media account.

CATL released a statement on the same day, confirming its plan for the Debrecen battery plant, with a total investment of up to 7.34 billion euros (around 50.86 billion yuan).

As the world’s largest automotive battery producer, CATL’ move has put itself under the spotlight. Why is the company focusing on Europe this time?

European vehicles need Chinese batteries

Europe, once a major manufacturing base of fossil fuel cars, is barreling into a new energy era. Sales of new-energy vehicles increased by nearly 11 percent to 1.0898 million units in the first half of 2022. It is undeniably the world's second largest new-energy vehicle market, trailing only China in terms of market size.

The supporting industrial chain for such a burgeoning sector, however, is not as prepared as it should be in Europe.

According to market forecasts, global automotive battery capacity is expected to exceed 1,000 GWh in 2025, with the European market accounting for 462 GWh of the total.

While conventional fossil fuel vehicles have a fully mature industrial chain a century after their inception, new-energy vehicles are a different story in Europe. Local battery enterprises do exist, such as Northvolt in Sweden, Verkor and ACC in France, InoBat Auto in Slovakia, Britishvolt in Britain, Freyr and Marrow in Norway, Itavolt in Italy, and ElevenEs in Serbia. However, they are unable to meet the continent's high demand for automotive batteries. A significant market gap must be filled.

If Chinese enterprises do not try to occupy the European market, they will leave this market to other players. Take Hungary as an example. South Korean electric vehicle (EV) battery maker SK began building plants in the country in 2018. Three SK facilities have helped Hungary rise to the world’s fifth-largest producer of car batteries and establish itself as the primary battery supplier of European automakers.

If one checks the global leaderboard for installed EV battery capacities, one will find that Chinese and South Korean companies dominate the top ten positions. In particular, China’s CATL has held the top spot for the past five consecutive years. [GRR: According to SNE Research, 15 Chinese companies ranked among the top 20 battery corporations in terms of installed capacity in the first half of 2022, with a combined market share of 61.88 percent. Among the 12 firms that grew more than 100 percent throughout the time, 11 are from China. ]

Thus in terms of production capacity and battery quality, South Korea's SK and medium- and small-sized European battery companies all lag far behind the main battery producers led by CATL.

Expansion into Europe has become a must for CATL, and a must for the further development of all Chinese EV battery firms.

Chinese firms also need Europe

Following leapfrog development over the past few years, there are increasing signs of overproduction of EV batteries in China. Venturing overseas is the only option for enterprises to release their congested capacity. Europe is believed a crucial market for their further growth.

[GRR: According to Shanghai Auto News, if the top five domestic battery manufacturers can successfully raise funds as what they have planned, they would have a combined capacity of over 2,450 GWh by 2025, more than 20 times what it is now (125 GWh), or eight times the lithium-Ion battery market (324 GWh) in 2021.

If 1 GWh can power 20,000 electric vehicles, 2,450 GWh could be translated into an installed capacity for 49 million electric vehicles. However, according to BloombergNE, global EV sales (including BEV and PHEV) are estimated to reach 20.6 million units by 2025. The figure was 6.6 million in 2021. Therefore, the installed capacity planned by Chinese battery firms would be enough to power 2.5 times of the projected EV sales in 2025.]

Whoever expands internationally first and successfully seizes the European market will gain the upper hand in future competitions and rework the high-speed growth miracle of Chinese EV batteries.

The pivotal moment is now. Following a peak in order placement between 2017 and 2020, earlier models of major automakers have entered the scale production phase. We are now at a critical juncture for another round of signing of fixed-term contracts from the auto sector. Whoever locks in new contracts is able to shape in the market landscape for the next five years.

To obtain such contracts from global car makers, especially from the European markets, Chinese companies must change course. They must pursue quality development, engage in the competition of quality, and shun the rate race that results from the competition of price.

Exploring the European market therefore involves more than just contests of technology, scale production, and industrial chains. Whoever can achieve better localization and low-carbon emissions will be able to gain the upper hand in this competition. This also puts forward a new requirement for Chinese EV battery companies to continue leading the world, i.e., globalization.

Recent CATL moves in Europe are an epitome of how the Chinese EV battery giant’s accelerated globalization drive.

In April, CATL said that its first overseas plant at Thuringia, Germany, was officially licensed to produce 8GWh battery cells. The factory is less than 300 km away from Tesla’s Gigafactory.

The Debrecen plant, CATL’s second Europe-based plant, is located at an industrial ark in the southern part of the city, covering an area of 221 hectares in the heart of Europe, right next to the vehicle plants of Mercedes-Benz, BMW, Stellanti and Volkswagen - all are CALT’s clients. Once completed, the Debrecen plant is expected to supply battery cells and module products for European carmakers.

In the first half of 2022, CATL's installed EV battery capacity neared 16.5 GWh outside the Chinese market. This figure more than doubled from the same period last year, putting the company third in the leaderboard for overseas installed capacity, trailing LG Energy Solution (25.6 GWh) and Panasonic (19.9 GWh). CATL's international business has clearly picked up speed.

CATL keeps up the offensive

For CATL, the true rival in its latest market expansion in Hungary is not SK, though the latter also had factories in the same country. LG, which is actively expanding in Poland, is the real competition.

According to SNE Research, global installed EV battery capacity totaled 296.8 GWh in 2021. CATL ranked the first with an installed capacity of 96.7 GWh, or 32.6 percent of the market share. LG ranked the second, with an installed capacity of 60.2 GWh, and 20.3 percent of the market share.

Latest data shows that in the first half of 2022, CATL had a larger global market share than the top three Korean battery suppliers put together.

Among them, LG took 14 percent of global market share, a decrease from 24 percent during the same period in 2021. Samsung SDI's market share dipped from 6 percent to 5 percent, while SK ON's rose from 5 percent to 7 percent, making it the world's fifth-largest manufacturer of EV batteries.

Top three Korean battery manufacturers, including LG Energy Solution, had a combined market share of 26 percent in the first half of 2022. This was still 8 percentage points lower than CALT’s alone.

But for CATL, being No. 1 of the industry has never been an honor that indicates that it is able to win in a breeze. Instead, it means facing constant pressure and challenges from rivals.

Early this year, LG spun off its battery subsidiary LGES and raised 10.7 billion U.S. dollars, setting off a fresh round of seething undercurrents of turmoil in the global EV battery market.

LGES' prospectus indicated that the company got its largest chunk of revenue from European and American clients. In the first three quarters between 2018 and 2021, its European operation brought it an revenue of 39.9 billion yuan, 50.6 billion yuan, 68.8 billion yuan, and 73.8 billion yuan, representing 24 percent, 37 percent, 42 percent, and 49 percent of its annual revenues.

Like CATL, LG and SK are also astute enough to realize the opportunities in the European market, and they have taken Europe as their main arena in the new era.

In July, LG Energy Solution announced to double its production capacity in Poland. This has started a new round of competition in the European EV battery market.

Will CARL follow suit? For the world’s largest automobile battery manufacturer, this has never been a real question.

Offensive defense is the best defense. In response to LG’s strategic pivot, CATL decided to take the initiative, venturing deeper into Europe and triggering another round of market reshuffle.

CATL still has enough cards to play even without its home court advantages when competing outside China.

Its client roster included not only Volkswagen, BMW, Mercedes-Benz, Renault and Volvo, automakers that are in cooperation with LG, but also Jaguar Land Rover, PSA Peugeot Citroen, Nissan, Honda and Toyota. It is safe to say that CATL has its sales ensured by virtue of such a large group of clients.

While LG looks to secure its upstream resources through strategic partnership and long-term agreements, CATL has made a wider range of deployments in this regard, covering from the upstream production of nickel, cobalt and lithium, to the production of four key components of batteries (anodes, cathodes, separators, and electrolyte) and lithium battery equipment, and to the manufacturing of EV batteries, charging infrastructure, vehicles, and automotive control units in the mid- and downstream of the industry. The Chinese company is working to further integrate its industrial chain to maintain its competitive edge even when lithium is in short supply globally.

In addition to building a leading edge in resources, CATL has juxtaposed multiple battery technologies, which provides carmakers with more options when compared with LG which concentrates solely on ternary lithium batteries.

Currently, CATL is on par with LG in terms of ternary lithium battery capacity. But it leads significantly in the fields of LFP batteries, high-nickel batteries and sodium-ion batteries. [GRR: LG's first LFP battery line is expected to go into production in LG's China factory as early as next year.]

According to CITIC Securities, CATL's production capacity is estimated to reach 800 GWh by 2025, way ahead of the 450-GWh capacity of LGES. The sheer advantage in his regard is likely to have an even larger scale effect.

As CATL’s plans gradually turn into reality in Europe, South Korean businesses would lose their first-mover advantage to their Chinese rivals. The European EV battery market may undergo another wave of restructuring.

Can Chinese firms win again?

It is fair to say that CATL had managed to become the world champion of EV batteries thanks to the resonance between historical opportunities and enterprise characters. But how to retain that title and continue with high-quality growth in the future’s commercial competition, is a question that put the wisdom of CATL, as well as that of other Chinese battery companies, to test.

Signs of an industrial revolution to usher in an “EV era” have been increasingly clear. Victory and defeat have been determined in the Chinese arena, but the situation is far from clear in the global industrial chain - the outcome of the EV battery sector will be determined by competition in the European arena.

Whoever dominates the European market first would be able to continue leading the industry. More importantly, it will be well-positioned to reap the industrial benefits produced by the restructuring of the energy and traffic systems.

At present, six of the world’s top 10 EV battery manufacturers by installed capacity are Chinese. However, all of the remaining four - Panasonic, Samsung, SK, and LG - have already begun expansion in Europe.

These erstwhile moguls have been knocked out of the top position in the EV battery leaderboard, but they have never stopped growing. They are biding their time for a comeback on the strength of the European market.

Fortunately, Chinese enterprises have a clear understanding of this: if you want to grasp the future, you cannot afford to rest on your past laurels.

The latest adventure of CATL into Europe is also the epitome of an “Era of Voyage” started by Chinese EV battery enterprises.

Looking back on the evolution of the Chinese EV battery market, we can see how Chinese enterprises led by CATL gradually closed the gap with their Japanese and Korean counterparts, eventually dethroning them.

Fortunately, the Chinese industry is not falling behind this time. Rather, they are in a leading position.

Chinese enterprises are able to chalk up another victory in the European market. Period.

***

Part II Guancha.cn’s optimism, however, is not shared by all.

Below is an excerpt from an analysis titled “Global automotive batteries: Europe, U.S. look forward to their own CATLs” carried by iautodaily, a Shanghai-based WeChat account on August 16.

The piece offers a note of barriers, such as growing protectionism in Europe as well as in America, that Chinese battery companies must overcome in order to succeed beyond their home court.

Rising trends of “protectionism” in the European and US markets are bringing new variables to the global EV battery landscape.

Data shows that enterprises from China, Japan and South Korea have a combined market share of more than 80 percent, painting a landscape that the article has described earlier as a tripartite split of the global market. But governments across the globe have begun to employ macro-control means to construct a cover to shield their own battery industrial chains.

At the forefront of this trend are none other but the European and North American markets, who have always trumpeted liberal economy.

The European market adopted a regulation concerning batteries and waste batteries in March to beef up local industrial chains. As of July 1, 2024, only EV batteries and rechargeable industrial batteries with a carbon footprint declaration are allowed to be placed on the Union market. All battery imports into EU, including those produced locally, are required to obey the new regulation.

Simply put, Europe has set a higher threshold for foreign EV battery enterprises. Despite citing so-called "carbon neutrality" as their justification, their ultimate goal is to maintain control over the entire battery manufacturing process.

The United States, for its part, is more straightforward. According to the Inflation Reduction Act that passed the Senate on August 7, new-energy vehicles must have their final assembly made in North America to enjoy a subsidy of up to 7,500 U.S. dollars. Meanwhile, their battery materials and “crucial minerals” must come from the United States or countries with which the United States has a free trade agreement.

Moreover, the Act made it rather plain that a new-energy vehicle will not qualify for subsidies if its battery is sourced from other countries. So who does the Act target? It is something self-evident.

CATL postponed an announcement on a factory in North America. Market rumors attributed the postponement to strained Sino-U.S. relations as a result of Nancy Pelosi's trip to Taiwan on the one hand, and uncertainties brought about by the Act on the other hand.

It is not difficult to see that the United State enacted the Act for the same purpose with the EU - to support local industrial chains of EV batteries, at least enterprises that invest in and build plants on its own soil.

To help make Ginger River Review sustainable, please consider buy me a coffee or pay me via Paypal. Thank you for your support!