Good evening. Today's newsletter focuses on the recent debate of China's new energy sector and the rise of China's electric vehicle. I had planned to attend the Beijing auto show recently, but my work schedule was overwhelming, and I heard the event was extremely crowded. Nevertheless, when recounting some of this year's major developments in China at the end of 2024, the emergence of new energy vehicles will undoubtedly stand out.

Today, I want to share an article from a WeChat blog. The piece is by 宁南山 Ningnanshan, a WeChat blogger writing about China's industrial structure and related topics. I've shared some of his articles previously due to his perspectives that starkly contrast with Western views on China, often leading to heated debates. Moreover, some have even claimed that Ningnanshan’s blog was widely read in China’s policy circle.

The original article titled “产能过剩”与中国的使命 "Overcapacity" and China's mission", which received more than 100,000 clicks (“10万+”) from readers online in China, is quite lengthy, so we have translated only the first half, which focuses more on electric vehicles.

In early April, during a visit to China by U.S. Treasury Secretary Janet Yellen, "overcapacity" became a hot topic on social media after she raised concerns over the so-called "overcapacity" in China's green industries, particularly electric vehicles (EVs), solar panels, and lithium batteries.

To get a better understanding, I reviewed the Chinese and English versions of Yellen's talk in China. To be honest, my first impression was that the U.S. is once again trying to set China's development direction.

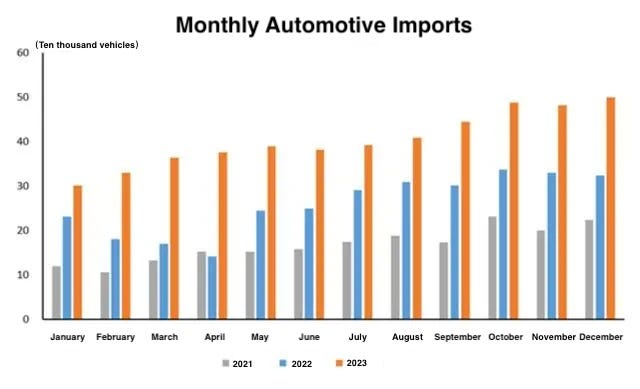

Let’s talk about the auto sector. In 2023, China surpassed all other countries in automobile exports. However, most of the vehicles exported from China were fossil fuel-powered vehicles.

According to data from the China Association of Automobile Manufacturers (CAAM), China's auto exports surged 57.9 percent year on year to a record high of 4.91 million vehicles in 2023.

Out of these, traditional fossil fuel vehicles made up 3.707 million units, growing by 52.4 percent and accounting for 75.5 percent of the total. New energy vehicles (NEVs) reached 1.203 million units, growing by 77.6 percent, constituting 24.5 percent of the total.

Obviously, China saw massive growth in the exports of traditional fossil fuel vehicles and NEVs, with majority still being traditional fossil fuel vehicles.

Yet Yellen emphasized Chinese overcapacity in NEV sector.

In fact, China’s exports of traditional fossil fuel vehicles also grew rapidly, with their growth rate even exceeding that of NEVs last December. The exports of traditional fossil fuel vehicles and NEVs for December 2023 increased 60.3 percent and 36.5 percent year on year to 388,000 units and 111,000 units, respectively.

China's automobile industry is still primarily focused on traditional fossil fuel vehicles. CAAM data showed that China produced 30.261 million vehicles in 2023, including 9.587 million units NEVs.

To give some perspective, Japanese auto giant Toyota sold 11.233 million vehicles in 2023, while Volkswagen, Germany’s biggest car manufacturer, sold 9.24 million vehicles.

In other words, China's NEVs output in 2023 is equivalent to just a leading car manufacturer in Germany or Japan, and it is much less than the output of traditional fossil fuel vehicles in China.

The U.S. seems to ignore the overcapacity of traditional fossil fuel vehicles, focusing instead on China's NEV sector. The fundamental reason lies in the much stronger competitiveness of China in new energey industries.

Different from its position in the market of traditional fossil fuel vehicles, China is much more competitive in the NEV sector. Chinese manufacturers have significant strength in key components, including electric power systems (power battery, electric motor, and electronic control system), in-vehicle system, and autonomous driving.

In 2023, China's battery giant Contemporary Amperex Technology Co., Ltd. (CATL) generated revenue of more than 400 billion yuan ( about 55 billion U.S. dollars),marking a 22.01 percent increase. The company's net profit attributable to shareholders topped 40 billion yuan (around 5.5 billion U.S. dollars), representing a 43.58 percent growth.

In contrast, it would be much more challenging for China to have parts suppliers in the traditonal fossil fuel vehicle sector that can compete with companies like Continental AG, ZF Friedrichshafen AG, Denso Corporation, Aisin Seiki Co., Ltd., and Robert Bosch GmbH. China relies heavily on foreign products in core auto parts and components.

Moreover, Chinese brands also have a much weaker brand power.

Additionally, the emergence of EVs has also brought a reshuffling of auto brands.

Leading brands in the fuel vehicle sector, whether foreign or domestic, hold a much smaller brand advantage in the EV sector as it is a brand new playing field.

So today we rarely hear names like Toyota, Honda, General Motors, Ford, Mercedes-Benz, and BMW in news stories about NEVs. Instead, Tesla, BYD, NIO, Li Auto, and AITO are main players making headlines in the EV industry.

China's EVs are getting increasingly attention from internationally renowned automotive media outles. The UK-based "Carwow", for example, which resembles domestic automotive websites, has 9.15 million followers on Youtube. In February 2024, they published a video comparing the Tesla Model 3 with the BYD Seal, which garnered over 3 million views.

We can see that the prices of Tesla Model 3 and BYD Seal in the UK are almost the same.

Tesla, the world's largest EV manufacturer outside China, produced half of all its EVs in 2023 at its factory in Shanghai. Of the 1,845,985 cars at all Tesla factories in 2023, 957,700 came from its Shanghai plant, accounting for 51.88 percent. Another key metric, delivery volume, shows a similar pattern, with more than half of Tesla's global deliveries coming from the Shanghai factory.

Of the Tesla's Shanghai-made vehicles produced in China, over 90 percent of the parts and components are sourced locally. Though this is by quantity, not by value; key components like chips and certain software still come from outside China.

It is clear that the U.S. is aware of China's strong competitive position in NEV sector, so they pointed out that China faces overcapacity in NEVs.

I think the U.S. has actually served as a "lighthouse" to guide China in recent years, often targeting its best-performing industries. In the past, domestic opinions were divided on the future development of new industries in China, but the U.S. has highlighted the direction, through tech wars and public opinion warfare, leading to unprecedented consensus across the country.

I have always believed that choice is more important than effort. Over the past several thousand years, the Chinese nation has been very diligent and hard-working. But why did the Chinese nation suffer periodic collapses in history? During the Jin Dynasty (266-420), China experienced a decline in its strength; the Southern and Northern Dynasties (420-589) were a period of continuous division and turmoil; starting from the Song Dynasty (960-1127), the Chinese empire was continuously invaded by nomadic tribes; in the late Qing Dynasty (1644-1911), the Chinese civilization was defeated by foreign powers for the first time due to technological backwardness. The root cause was that the ruling groups at those times failed to guide such a large country and nation in the right direction.

The truth is, the Chinese nation has had an overwhelming demographic advantage on a global scale since the unification of Chinese nation over 2,000 years ago. Throughout human history, no other nation has had maintained the world's largest population for such a long period, around 2,000 years. Other empires, such as the Roman Empire and the British Empire had ruled over large populations, yet neither had a single dominant ethnic group. As a result, these empires lost the possibility of reuniting once they disintegrated. What makes the Chinese nation unique is not only its demographic advantage, but also its hard work ethic and emphasis on education.

So the Chinese nation is bound to be powerful as long as it moves in the right direction.

In recent years, the U.S. has helped China pointing the way forward in a unique way. After the U.S. lauched a trade war against China in 2018, it also began targeting Chinese telecom equipment maker ZTE with extreme sanctions using chips as a weapon. This ultimately led to massive advances in China’s semiconductor industry over the following six years, driven by external pressure.

For the average Chinese people, the production of more high-tech products in China is the only way they can have a better life. Taking China’s NEV sector for example, salaries are generally high in the industry, and the leading companies are quite profitable. It is also natural for the lagging businesses to be knocked out of the market by competition.

In the past few years, EV makers like NIO, Li Auto and Xpeng Motor pay much higher salaries than their conventional counterparts. The regional economy has also benefited from the development of EV manufacturers. Last year, CATL saw its net profit exceed 40 billion yuan (about 5.5 million U.S. dollars). With two of its plants in Ningde, east China’s Fujian Province, and Yibin, southwest China’s Sichuan Province, the two cities have each become a big contributor to local economy.

Since the EV boom, BYD reaches its highest net profit since its establishment, with 30.041 billion yuan in 2023, far surpassing the figure in the era of fossil fuel vehicles. When fossil fuel vehicles dominated its sales, BYD reported the highest net profit in 2016, at 5.05 billion yuan. Today the new profit level represents a sixfold increase.

In 2023, BYD recruited 31,800 fresh graduates, with 60 percent of them holding at least a master's degree. This has significantly alleviated the employment pressure at that time when the national economy was impacted by the pandemic, causing numerous businesses to scale down their recruitment.

Sungrow Power Supply, a Chinese renewable energy company that specializing in solar inverters and energy storage systems, according to its earnings preannouncement, is expected to generate a revenue of 71 to 76 billion yuan in 2023, representing a year on year increase of 76 percent to 89 percent. The expected net profit is between 9.3 billion and 10.3 billion yuan, representing a year on year increase of 159 percent to 187percent.

Earlier I wrote articles about the Fortune Global 500. There aren't many companies worldwide whose net profit can surpass 1 billion U.S. dollars. Of the 500 largest companies in the 2023, only 355 reached that mark.

To be eligible for the Fortune Global 500, a company must earn more than 30 billion U.S. dollars in operating revenue.

In U.S. dollar terms, BYD's net profit last year exceeded 4 billion U.S. dollars, CALT's exceeded 5 billion U.S. dollars, and Sungrow's topped 1.3 billion U.S. dollars. In recent years, the popular photovoltaic maker Tongwei saw its net profit increase from a few billion yuan to over 10 billion yuan as illustrated in the chart below.

Companies like BYD, CATL, Sungrow, Nio, Xpeng and Li Auto, the jobs they offer are popular among Chinese college graduates.

Below is my understanding of the new energy industry:

1. In general, the new energy industry is advanced, emerging, and high-paying. Making it a priority to continually develop this sector should be a steadfast mid- and long-term goal for China.

2. In the long run, demand for new energy is on the rise, both globally and in China, which means our production capcatiy in this field must grow substantially to satisfy the long-term needs at home and abroad.

In an earlier article, I mentioned China's energy demand will undoubtedly increase significantly when its per capita gross domestic product (GDP) reaches 40,000 U.S. dollars. The figure was just around 13,000 U.S. dollars in 2023.

Even in China, where EVs are highly advance, the NEV penetration rate (the proportion of NEVs in all car sales) was just slightly higher than 30 percent in 2023.

In the U.S., the world's second-largest automotive market, the figure was merely 9.3 percent in 2023. If only the U.S. would open its market more to Chinese NEVs, it would be a boon. It's not reasonable to ban Chinese NEVs from entering the U.S. market while claiming that China has an overcapacity issue in the EV sector.

3. The development of new energy is a process when structural overcapacity will occur during some periods, though that's not necessarily a bad thing. Then what should China do? Maintain the normal competition order in the market, without subsidizing and supporting tail-end companies that are phased out in normal market competition. Only when supply exceeds demand in the market will there be a chance to force out lagging capacity.

We could imagine a market where demand always exceed supply with no surplus and all companies making a profit. Then the worst performing firms could still survive even if they do not actively seek improvements, make low-quality products with low competitiveness, and pay employees low salaries. When sold domestically, their products would bring poor consumer experiences and even threaten consumer safety; if sold overseas, they would only harm the reputation of Made-in-China.

This reminds me of a middle-aged woman who sells fruits from a stall in the neighborhood of my hometown county. She always cheats buyers by giving short weight; when the buyers find out, she would even abuse them, yet the woman has not been eliminated from the market even after so many years. During the Spring Festival holiday this year, I found she was still selling fruits there, which means that the county's consumers continue to suffer.

Amid increasing demand for new energy in the long term, Chinese manufacturing will advance to a higher level after outdated capacity gets knocked out following a periodical excess. By then, the market share and profit of high-quality companies will increase.

Consumers are discerning. That holds true even for big brands. AITO backed by Huawei technologies is a good example. In March this year, AITO sold 31,727 vehicles with the M9 accounting for 6,243 units, the new M7 for 24,598 units, while the M5 only a few hundred. Even though the AITO M5, first unveiled by Huawei in December 2021 as the first vehicle under its brand, was once a major seller. This fully demonstrates that products with poor competitiveness would only be squeezed out of the market.

4. Tesla offers a prime example. At the end of 2019, Tesla with leading advantages in brand power and product competitiveness started mass production in China as the Shanghai Gigafactory began operations. The Shanghai plant has contributed to an increase in China's NEV production capacity and Tesla's output in China has rocketed in the past two years. Instead of leading to overcapacity, it stimulated the local NEV makers to bolster their competitiveness, producing a catfish effect.

Huawei has had a similar effect through its entry into the EV sector in the past two years. AITO is emerging as a powerful rival, pushing China's EV startups to innovate and unveil new features. Enditem

Some of you might notice that a think tank report titled "China-EU Cooperation on Environment and Climate: Progress and Prospects" was released globally on Friday. The timing of this report, released before Xi Jinping's visit to Europe, I believe is not coincidental, and it also echoes some of the content in Ningnanshan's article.

This is really interesting - and a perfect example of how people’s decreasing attention span makes them vulnerable to the kind of manipulation Yellen is doing. If a person only consumes tiny headlines, without looking at the depth of any issue, they can be wildly wrong in their views of the world.

Ha ha, the only “over capacity” that exists today is the US military, which has an excessive defence budget. 🧐. Just being facetious!🤣