Why is it more urgent for China to have a reliable operating system than chips in the automotive industry?

"The time window for China is about three years, or five years at most. " -- Miao Wei, former head of the Ministry of Industry and Information Technology

Semiconductors and intelligent vehicles are two beloved topics for the tech community as well as investors interested in China. In previous posts, Ginger River Review has offered you three stories including Huawei's Master Plan for electric vehicles, CATL's adventure in the European EV market, and the future of China's chipmaking. All three of them were well received by our readers. GRR thus wants to bring you a fourth piece into the collection so that the discussion will be more well-rounded.

Co-hosted by China EV100 中国电动汽车百人会 and the government of Jiangning District in Nanjing, the capital of east China's Jiangsu Province, the "2022 Conference on Innovated Global Supply Chain of NEV and ICV " kicked off on September 6.

Miao Wei 苗圩, the deputy director of Economic Affairs Committee of the Chinese People's Political Consultative Conferencee (CPPCC) and former head of Ministry of Industry and Information Technology addressed the event.

Today's piece is a translation of Miao's speech at the conference.

In the speech, Miao expressed his concern over the operating system (OS), calling it "a more urgent and fatal issue than chips, and it is the key to success for intelligent vehicles and Vehicle-to-Everything(V2X)," adding that though the landscape of global intelligent vehicles is still up in the air, the window left for China is about three years, five years at most.

Miao also elaborated on the relationships between chips and OS, and talked about how progress made in OS may help China out of the current semiconductor predicament.

Beware that the following speech was notes taken by guancha.cn, a Chinese news site, at the event, and the content and GRR’s translation have not been reviewed by the speaker.

The topic of my speech today is "on Key Issues Facing the Automobile Supply Chain."

Due to the impact of COVID-19 and geopolitics, the supply chain of NEVs and intelligent connected vehicles (ICVs) has undergone a sea change in recent years. The change will deepen further, as shortening the supply chain and suppliers participating through block chain will be the future. The supply chain is no longer an economic issue. It is under the influence of multiple political factors. However, whatever the changes, the supply chain will remain close to the market and close to factories.

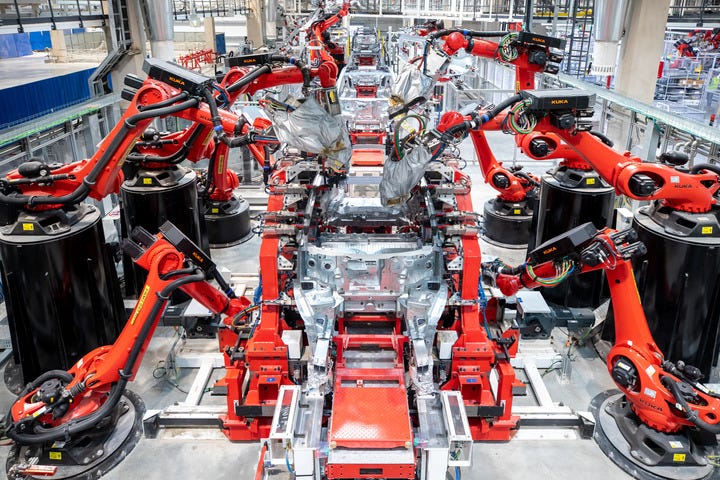

China is the largest automobile market, with annual production and sales accounting for about one-third of the global total. And for years, more than half of the total NEVs are produced and sold in China. Therefore, we are fairly confident in building the supply chain of NEVs and ICVs in the country. This landscape will not bend to the will of certain politicians. After all, the law of economics is the deciding factor here. In terms of NEVs, China's production and sales both exceeded 3.5 million from January to June, about 1.6 times higher than that of last year. We thus predict that the figure will reach 5.5 million at the end of 2022, up 56 percent year on year. Previously, our mid- and long-term goal for the industry was to reach a penetration of 20 percent by 2025. Now, it seems that this target will be achieved this year, three years in advance. Meanwhile, the automobile industry is experiencing the biggest change ever since its birth a century ago. In fact, the industry is nearly 140 years old.

How will the change take place?

As for vehicles, I personally think the main direction lies in the transition to electric vehicles and intelligent vehicles. Why the V2X is left out? Because for NEVs and intelligent vehicles, V2X is a tool to empower the products and to promote the transition, and China will catch up with Western developed countries if we set a common goal and work towards it. For example, we got advanced 5G services for ICVs, and the biggest setting for 5G services is for Business (B2B) rather than for consumers (B2C). As for B2B, the largest market is the Internet of Vehicles (IoV). So we should make full use of our advantages in this respect.

As for smart cars, other countries don't have [favorable] conditions and all the problems must be solved by car makers themselves. Equipping all vehicles with cameras so that at every crossroad the cars monitor the surroundings is neither economic nor efficient. If we build Road Side Unit (RSU) at a crossroad, it will be more effective and reduce the cost of application for the whole society. Indeed, we have to face investment in the early stages. But our strength lies in the V2X, as China is able to cooperate roads with vehicles. Local governments and companies from different industries may gather around to solve problems in the transition to intelligent vehicles, instead of tossing everything to car makers like some western countries do.

In promoting NEVs, the construction of public charging piles help us solve the difficulties of charging, and local governments at all level played a vital role. If it weren't for their efforts, we couldn't have built over 2.6 million charging piles, especially over 1 million public charging piles, in such a short time. Of course, this is not enough. We must keep exploring this path, a path proved by past practice that it is to our institutional advantage. So we must carry it forward in future development.

For the supply chain of NEVs, let's pay attention to chips first.

Regarding the development of chips, chips for consumers hold high standards and the biggest demand for advanced chips, with chips used in smart phones as an example. However, smart cars are equipped with chips only secondary to ones for military use. They must operate in a worse environment compared with chips for consumers and chips for industrial use, and must have a longer lifespan. Moreover, in addition to the general standards, automotive chips must adapt to a series of automobile standards. For example, to test the reliability of chips, we usually use the AEC-Q100 standard, which is generally used in North America. To control the failure rate, we must establish a quality control system for chip makers, in other words, the IATF-16949 standard. This is a standard that automotive chips must meet as we are in line with the international standard now. For functional safety, ISO 26262 is another standard needed for certification. Therefore, there are more requirements for automotive chips, and the time needed for certification is longer.

In addition to chips, I would like to talk about software. In the era of computers, the Wintel alliance dominated the industry. Most PCs around the world operated on the Windows operating system. In the transition from traditional phones to smart phones, Apple Inc. created a closed-source operating system called iOS. In response, Google Android, an open-source operating system free of charge. Thus, in the era of smart phones, Apple occupies 10 to 20 percent of the market share, while the rest of the world's mobile phone companies go with the Android system.

In the past, I saw no problem in using an open-source operating system. However, the US began to clamp down on Huawei two years ago. Besides ceasing the chip supply, it also restricted the use of Android operating system. Instead of restricting Huawei's access to the Android OS, the US limited Huawei's use of apps that are operating on Android OS. As a result, Huawei had to equip smartphones with its HarmonyOS, an operating system originally for industrial use. In this way, Huawei managed to continue the service for customers. Otherwise, it couldn't maintain its customers even in China. But Huawei still lost huge swathes of the overseas market.

From the lack of OS for mobile phones, we are keenly aware that in the transition to intelligent products, without [reliable] OS, no matter how advanced the chips or automobiles are, the gains would be like a mirage. But if we don't overcome the challenge of chipmaking and building an independent OS, we cannot go fast or far.

For the second part, I'd like to share my views on the development of the automotive chip supply chain.

Let me briefly introduce China's chip development in recent years. In terms of design, manufacturing, packaging and testing, chip design companies have made the fastest progress these years with the development of smart phones. Hisilicon 海思 of Huawei has made it to the world's top ten fabless integrated circuit companies. As I remember, it ranked fifth in its best record. Spreadtrum Communications 展讯 and RDA Microelectronics 锐迪科 also ranked among the world's top ten at one time. [GRR: It is Unigroup that made it to the top 10 in 2017. But Unigroup acquired Spreadtrum and RDA in 2013 and 2014 respectively.] Unfortunately, after the US began to suppress Huawei, Huawei cannot make it to the top 10. Even if chips can be designed, no company provides tape-out and manufactures the chips for Huawei. Nevertheless, it's an indisputable fact that we have made fast progress in design capabilities.

In terms of countries, the US ranks first in chip design, with a market share of 68 percent, according to last year's statistics. Ranking second and third are China's Taiwan region and the Chinese mainland, with market shares of 16 percent and 13 percent, respectively.

As for packaging and testing, China has a strength, and the smallest gap with the world's leading level. Of the world's top ten packaging companies, five are located in Taiwan, and three in the Chinese mainland. The three companies are JCET Group 长电科技, TongFu Microelectronics 通富微电 and Tianshui Huatian Technology 华天科技. The other two are located in the United States and Singapore.

We have met resistance in the tape-out of advanced chips. A solution is to package different types of chips together, which would address our weaknesses in advanced chips to some extent. This is also the mainstream of the international chip industry.

Tape-out is the process that we are left far behind. The best we can manufacture is 14 nm process chips. And because the US ordered the Dutch company not to export EUV lithography machines to China, we are hampered in making more advanced chips. Although advanced chips are important, its current market share is still small in the global market distribution. The chip shortage that we suffered in recent years are mainly chips with 28 nm process and above, ranging from digital electronics, analog electronics, power semiconductor devices to sensor chips. Therefore, we must consolidate existing advantages first. Since we are not only curbed in the development of advanced chips, the insufficient production capacity for 28 nm chips and above is also a problem. Therefore, we are investing heavily to scale up the production of 28nm and more mature processes

Regarding automotive chips, a small number of AI chips are need in CPU and GPU. It's best to have advanced chips. But if not, there remain other solutions. In terms of the total amount, only a small proportion of automotive chips are advanced chips, and the majority is chips manufactured at mature nodes.

For vehicles, with the development of NEVs, the electrical/electronic (E/E) architecture shifts from decentralized ECU control to a newly designed platform that has centralized domain controller. Looking ahead, we will move towards building Central Vehicle Controller (CVC) on the basis of domain controllers. And every step towards centralization will promote the efficiency of automotive chips. Many chips cannot give full play to the on-board computing efficiency due to decentralized control and domain controller. Therefore, the future of vehicles is about marching towards the centralized computing architecture from domain controller. The trend has already been brought up a few years ago, and it's an upward slope.

On this basis, China must make forward-looking overall planning for cloud control platform. Many chip companies participated in the discussions this morning. I said that we all pay attention to the automotive chips used on automobiles. Recently, the U.S. Department of Commerce imposed restrictions on Nvidia's export of GPU chips to China. Why GPU chips but not Nvidia's Orin chips? Yu Kai [the founder and CEO of Horizon Robotics] later told me that Nvidia's GPU chip is vital for training AI systems, so the US is targeting the vitals. What I'm trying to advocate is that other than focusing on automotive-grade AI chips, we also need to draw attention to training AI chips in the cloud.

Regarding the coordinated development of car companies and automotive chips, I think that car makers should shoulder the responsibility of the "chain leader". This morning, a speaker mentioned this issue. Car manufacturers basically didn't care about chips in the past. And the chip selection and matching were accomplished by first tier and second tier suppliers. The matching of system-level chip used in our power system is also finished by world-renowned parts suppliers according to the system. Therefore, a car company is basically a user. Nowadays, a car company does not necessarily have to make chips, but it must understand chips. Car companies must have overall thinking on cross-industry alliance and cooperation for companies' development and chips' future. Only in this way can we build a healthy environment for the industry.

Above is some thoughts on automotive chips I'd like to share with you.

Third, I would share my views on the development trend of automotive OS.

As mentioned earlier, the electrical/electronic (E/E) architecture of the vehicle witnessed a change from distributed architecture to a centralized one. The software on cars has also evolved from the embedded software to the full-stack software development. The OS links the internal management and external interaction.

The development trend of the full-stack OS is crystal clear. Some car makers are dedicated to creating their own full-stack OS. I think it is all right for some capable car manufacturers.

However, I'll use the smartphone example again. Back then, Samsung had its smart phone OS, and Nokia had Symbian too. However, almost all mobile phone manufacturers in the world choose the open-source and free Android OS except for Apple. Now, Android is marching into the vehicle system of smart cars. Next, it will further penetrate into the operating system and the chassis system. I'm worried that the smart phone industry's today will be the tomorrow of the automobile industry in several years to come. Smart cars all over the world will be equipped with an open-source, and free OS. Once the ecosystem is in shape, the industry will operate under the Law of the jungle where the winner takes all. As in the mobile phone industry, there will be the number one and number two operating systems and no others. Tesla has decided to ditch AutoSar. It writes its own codes to build a closed-source OS, as Apple did years ago. Apart from Tesla, there will be one to two companies at most. Without the producing and selling millions of vehicles, neither autonomous driving software nor apps for customers will adapt to your niche OS. Companies will prefer large OS with the largest number of users. That's how things work and there is no other way around. Google is not offering pro bono services. Though it does not charge users directly, all apps operating on the system must be certified by Android and pay some fees. This is the logic of the Internet.

Nothing comes for free. Therefore, building OS is more urgent than making chips for the automobile supply chain.

Chinese car companies are fully aware of the serious impact of chip shortage on development, but few realize that the lack of OS will be fatal too. But the bright side is that we may achieve the decoupling of hardware and software through OS. An OS can adapt to several heterogeneous chips, not to mention homogeneous chips. It can adapt to the same type of chips produced by different manufacturers. This decoupling at the underlying layer of OS won't be a problem. As multiple devices can be plugged into computers, the future is the same for chips. Therefore, developing OS may help us with the predicament of advanced chips to some degree. Fortunately, the global landscape of intelligent vehicles is not settled yet. The time window for China is about three years, or five years at most. If we fully understand the importance here and put in three years of efforts to build an independent OS, an open-source and preferably free system controlled by us, China will form its own industrial ecosystem. After all, China accounts for one third of the world's NEV production. If we expand that figure to more than half of the world's total, then every move from China will have a global influence on industry. Let's dream big, China may have the opportunity to lead the global automotive OS, as we did with 5G.

There is another important issue when it comes to OS and chips. For a long time, there is a lack of coordination between software and hardware in the development of electronic information, chips and software. People focusing on hardware and those on software never really communicate with each other. When a problem arises, each side points a finger of blame at the other. Let’s take a look at the international development trend. In the age of computers, there was the "Wintel alliance." In the age of smartphones, there were Android and ARM Alliance. Thus, in the age of automobiles, we must address the problem that has been long ignored, which is the coordination between software and hardware from the outset. Two sides complementing each other will bring us to a win-win situation.

Finally, under the premise of opening up, we should not seek 100 percent independence, as it is unscientific, uneconomical, and impossible. We must step up in opening up to the outside world, and welcome foreign OEMs (Original Equipment Manufacturer), chip companies, and software companies to invest in China.

We shall work together to share the dividends of China's automobile development. Indeed, we cannot carry on the previous practice of voluntarily integrating into the global development, and participating in the international division of labor after we joined the WTO, as the US won't stop curbing and suppressing China. So we must have a plan B. We do not pursue 100 percent "made in China", but we must prevent a lethal blow against our fastest growing industries and most promising enterprises at critical moments. So we must take precautions in building an independent OS, and pursue a development model that combines both hardware and software. Moreover, car companies should take the lead in the process.

That's all for my speech today. Thank you!

To help make Ginger River Review sustainable, please consider buy me a coffee or pay me via Paypal. Thank you for your support!